Get and Keep Ideal Clients

Earning Trust in a Robo-World

In the Future…

How will financial advisors get and keep ideal clients?

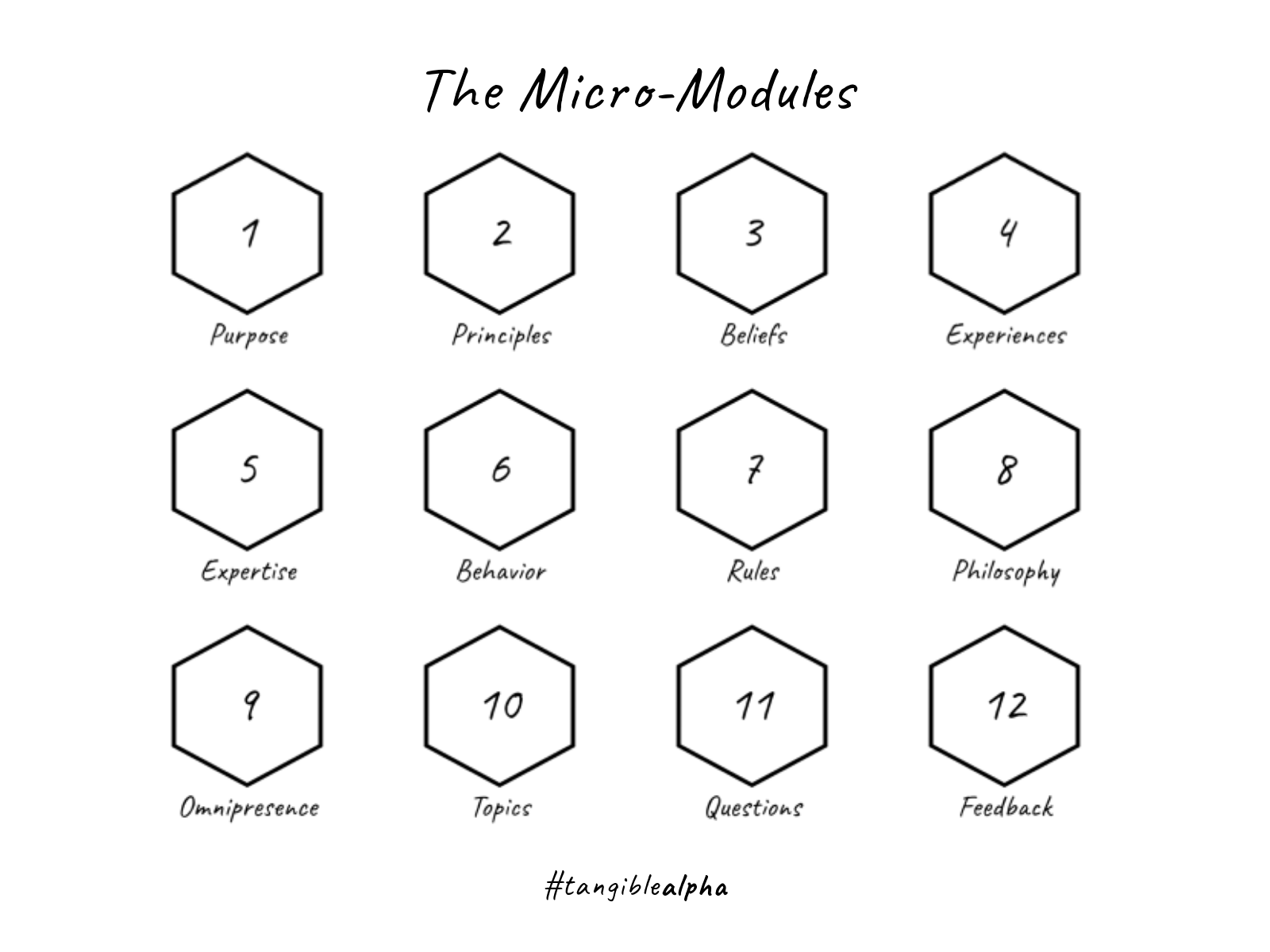

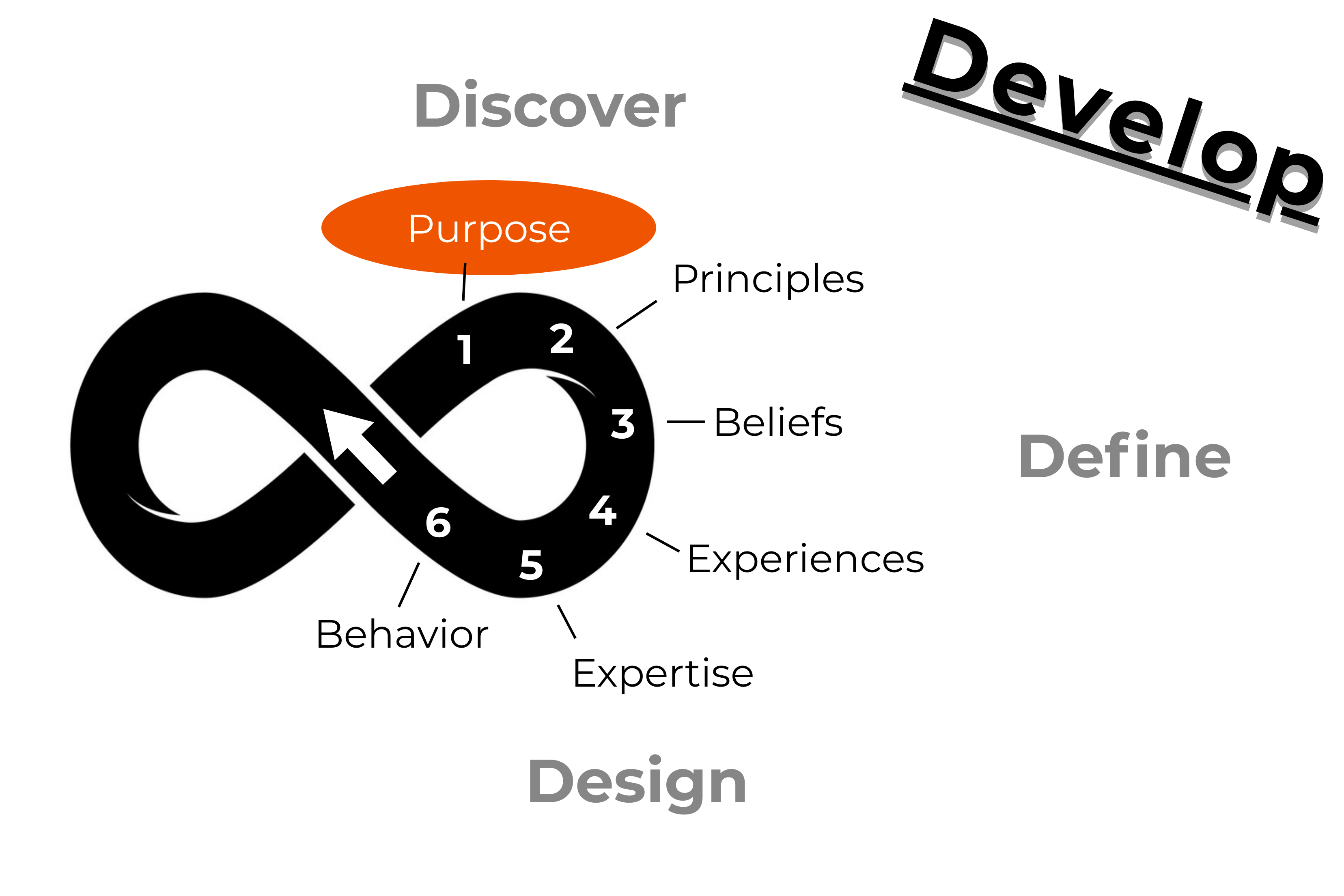

This is a walk-through for the first six micro-learning modules of Infinite Advisor Alpha

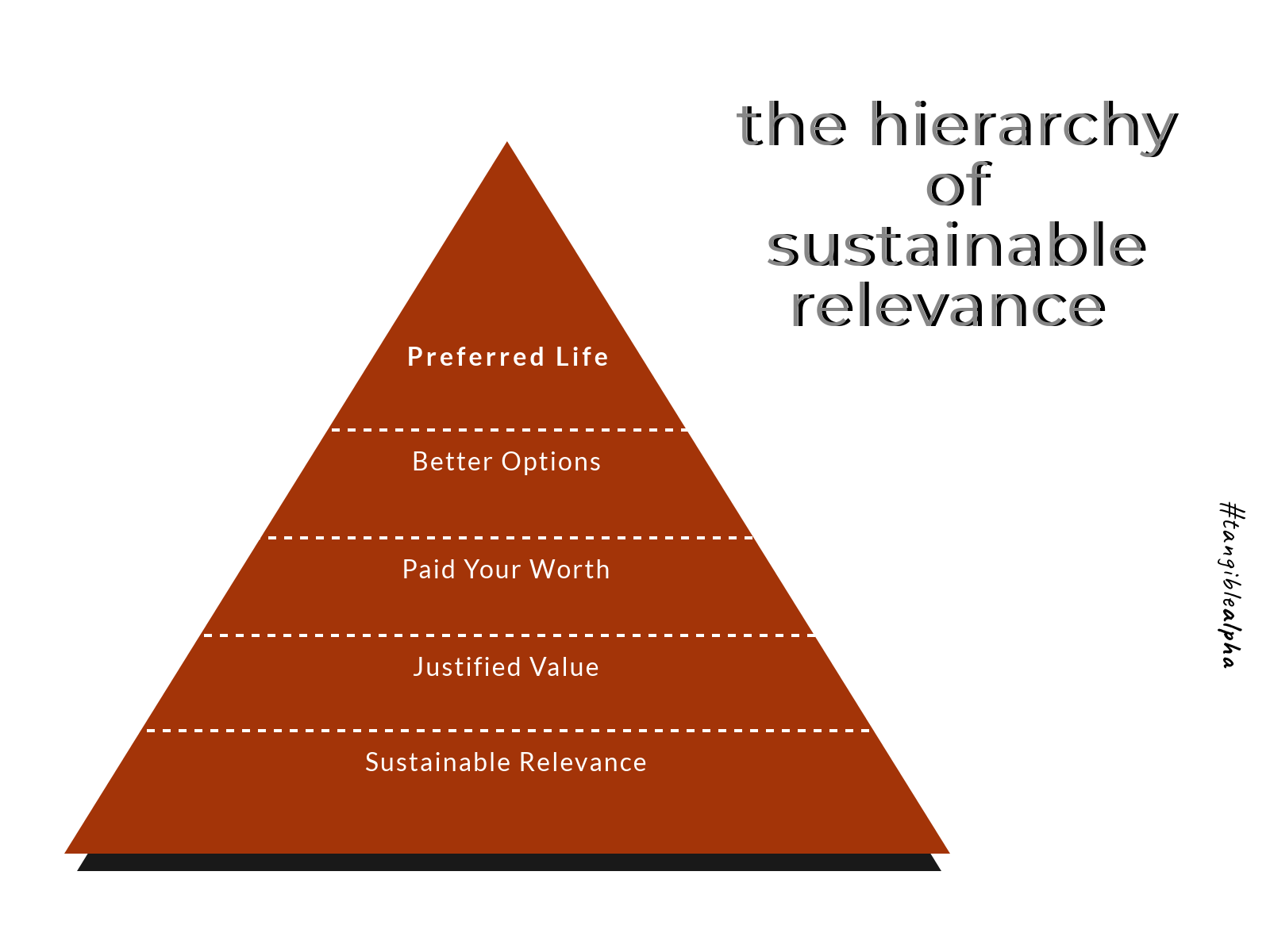

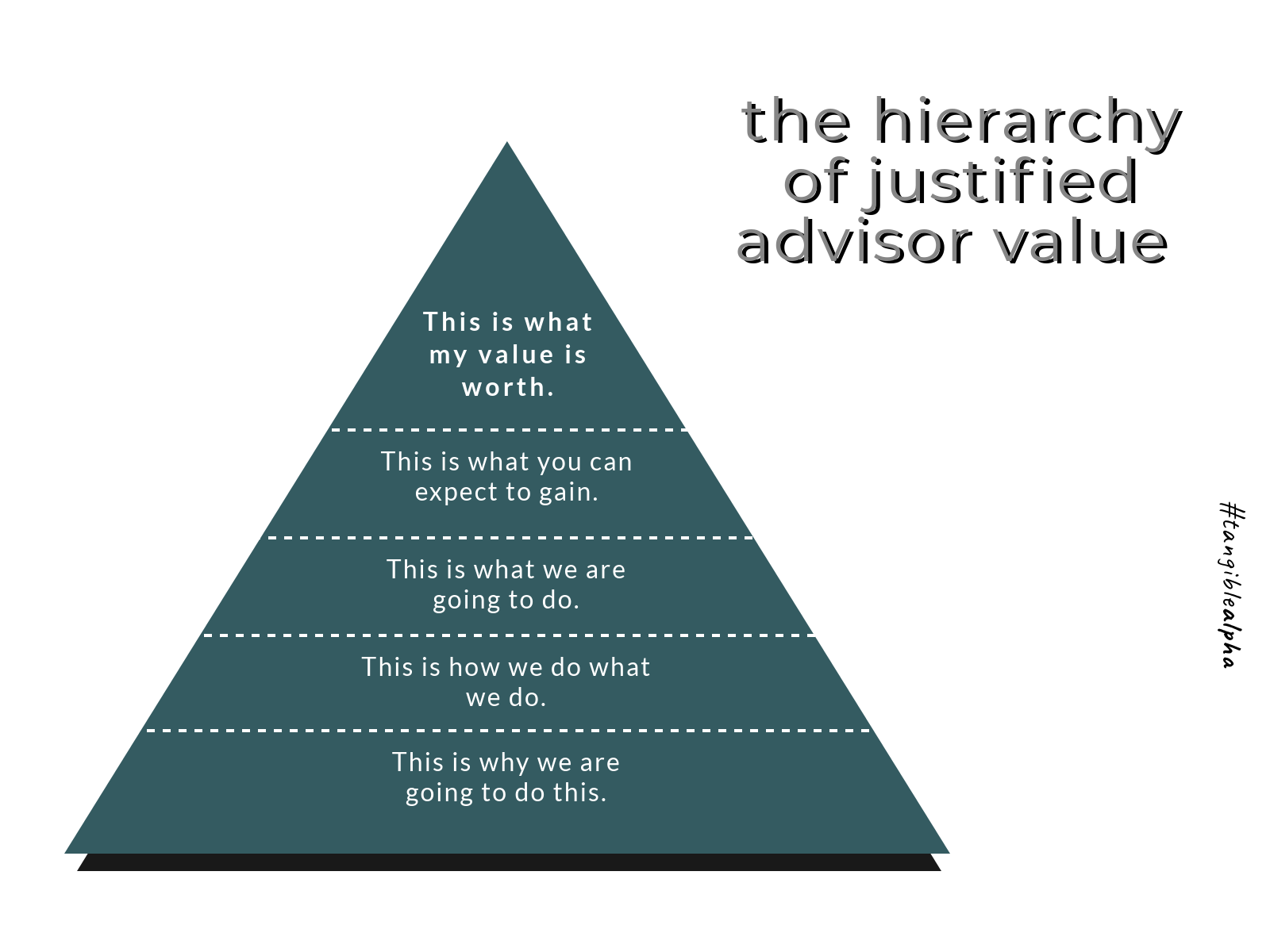

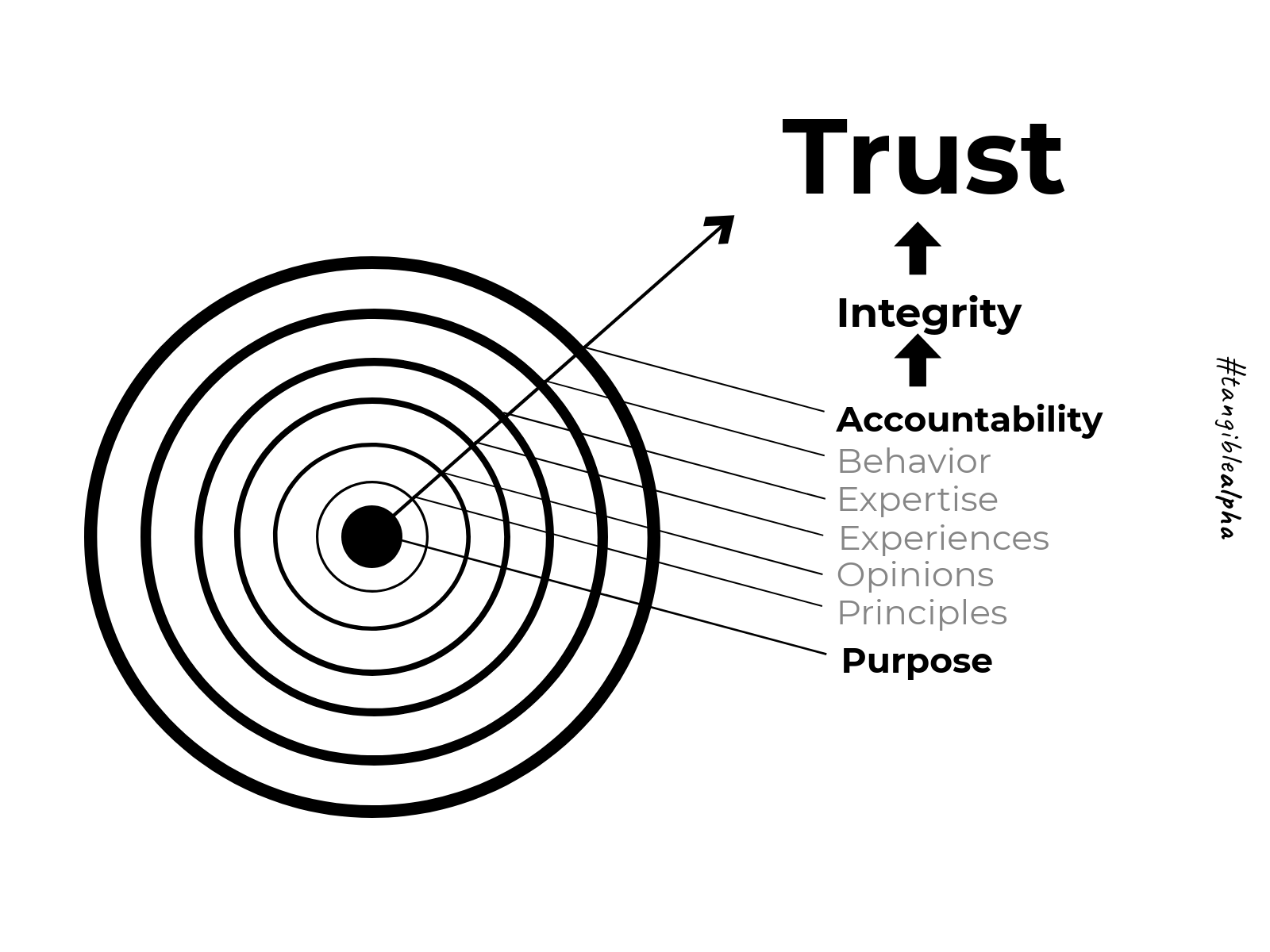

- Purpose You must lead with a client centered purpose to remain relevant in the digital age.

- Principles Your principles must be documented to create tangible accountability in a robo-world.

- Opinions You must distinguish your authority as a trusted source of wisdom.

- Experiences Creating tangible touch-points, that your clients and ideal prospects can associate with, is imperative for your survival.

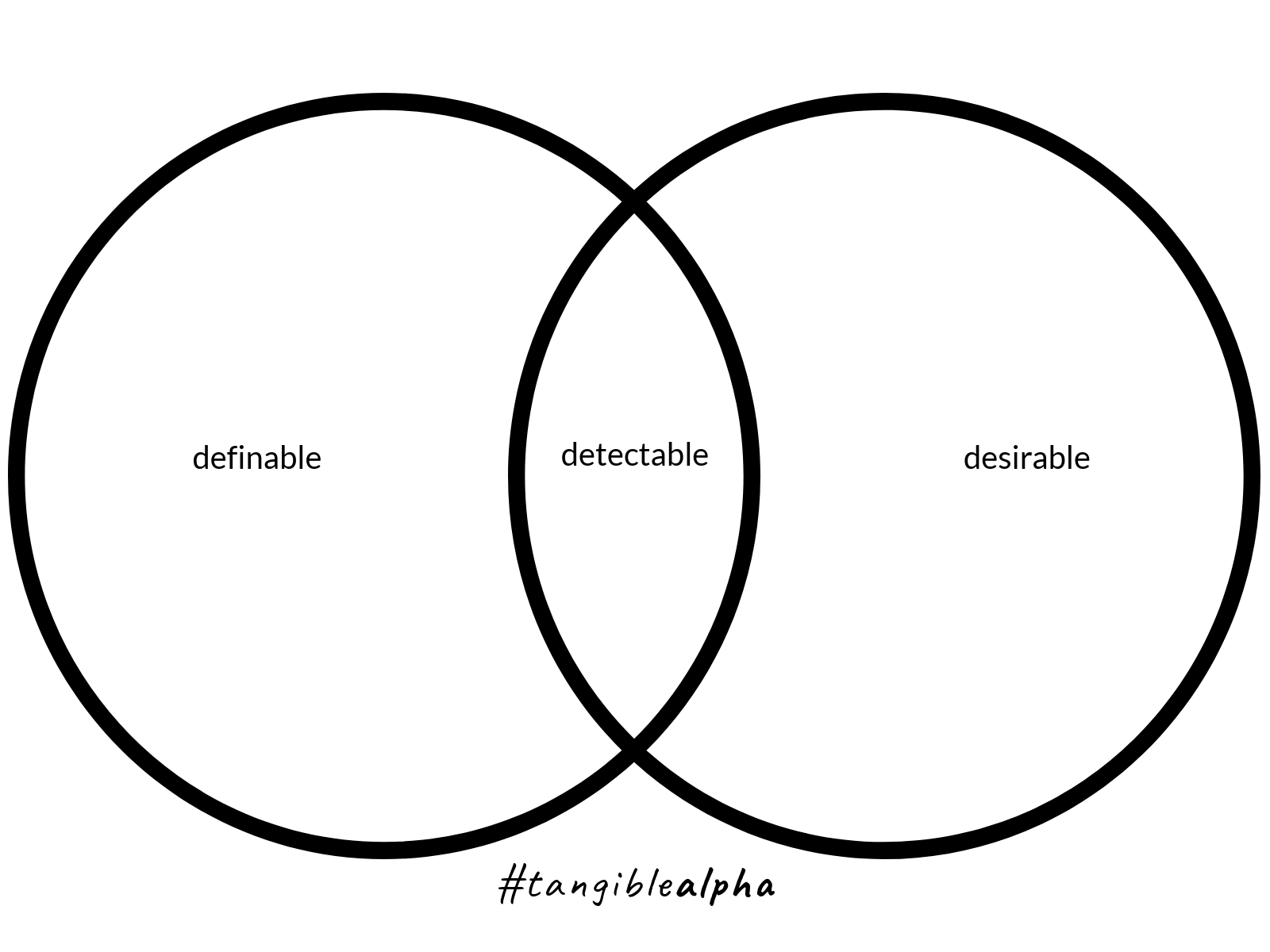

- Expertise Your expertise must be defined by you… in words that your ideal audience can understand and appreciate.

- Behavior You can’t promise returns… you must promise your behavior to survive in a robo-world.

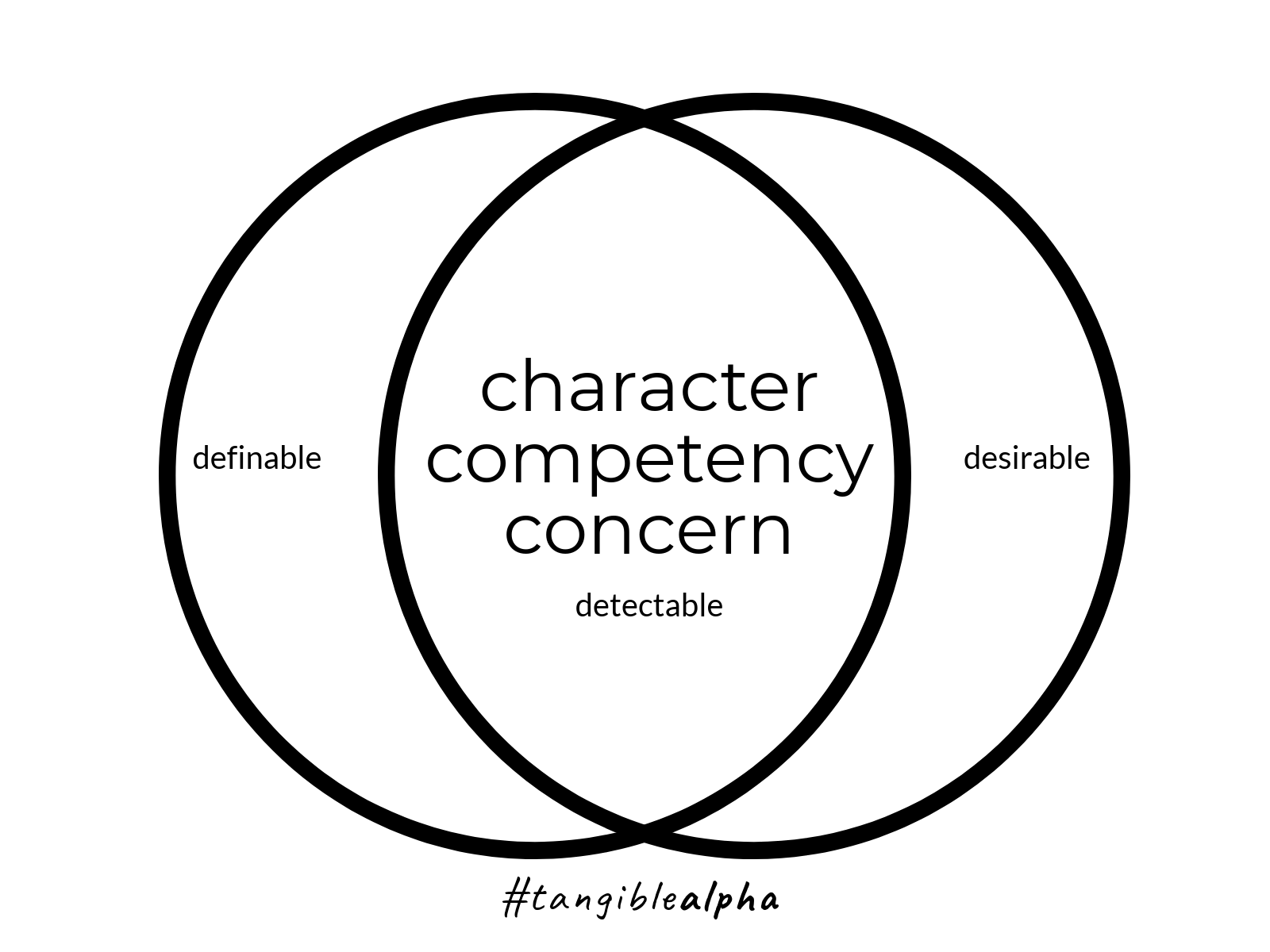

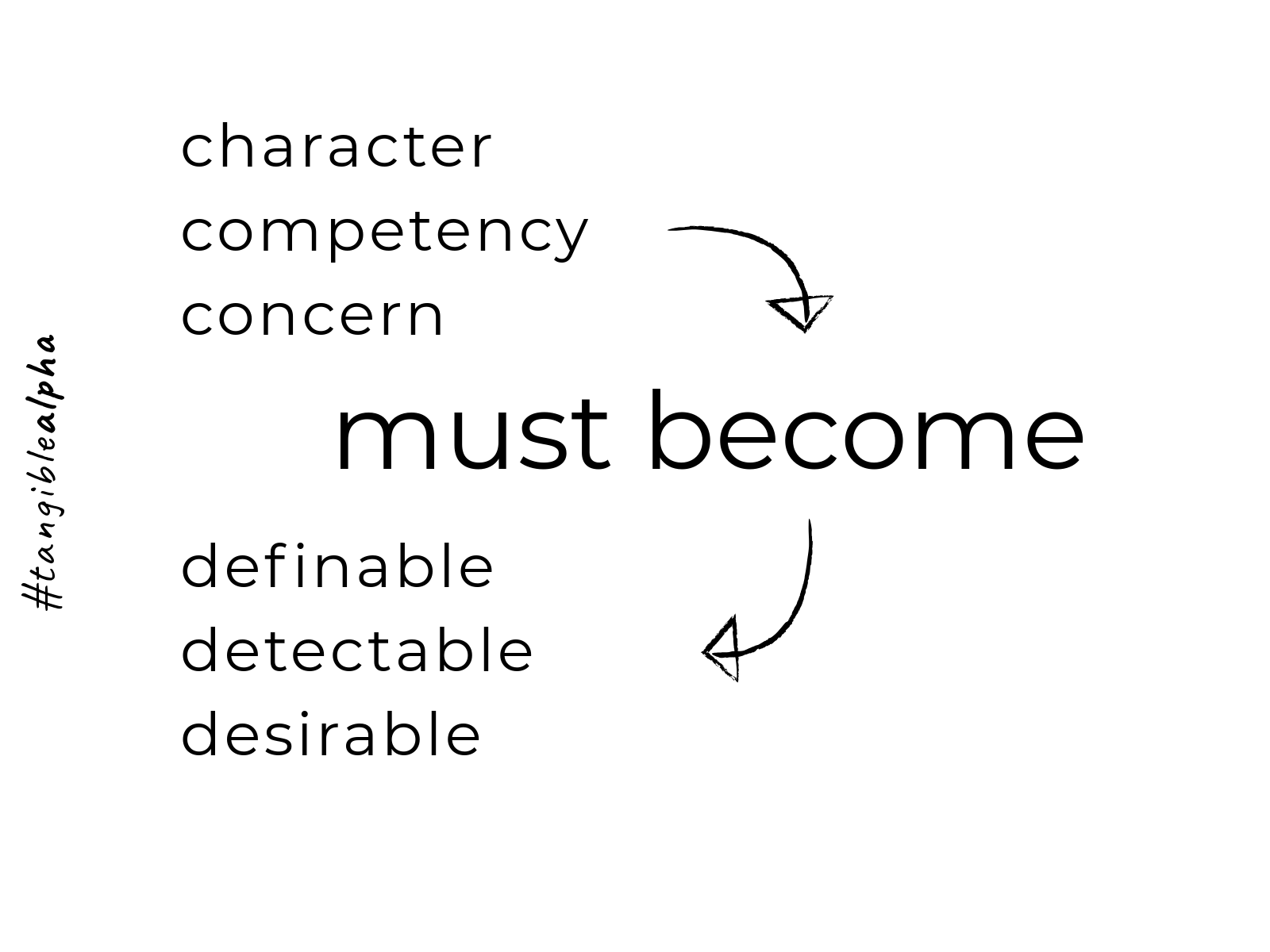

Building a solid foundation of trust is a two-way street in the digital era of financial services. Not only must you convey your wisdom and integrity 24/7… but your digital marketing campaigns must be relied upon to filter in ideal trusted, like-minded prospects… while simultaneously reminding your current clientele of your unique authentic value… 24/7.

If you are a returning advisor, this should encourage you to keep moving down the right path…

If you haven’t taken the plunge, please feel free to dip a toe into our pool of wisdom. Our sole purpose is to help good people get better… every day.

Enjoy the journey,

Grant