Sustainable Organic Growth

The Value Algorithm

Sustainable organic growth comes from predictable recurring revenue… or at least the ability to create predictable recurring revenue when it is compounded by the catalyst of successful repetition. This is the magic formula or the “advisor value algorithm” that has enabled successful advisors to thrive (sometimes by default) by design. It is in your best interest (as well as the best interest of your clients) to discover your own personal advisor algorithm to create your own sustainable organic growth by design.

Advisor Summary

Inherent risk associated with default setup… (The issues associated with you not taking control of your advisor algorithm) What will happen to your business and your clients when you continue to ignore your own advisor algorithm…Options you have to discover your advisor algorithm… (really just one)

Successful outcomes of advisors who have discovered their advisor algorithm and the evolution of their businesses because of the proactive stance they have taken in owning their algorithm of value culture and growth…

3 types of risk you introduce into your business by refusing to own your advisor algorithm…

- One Step Up Risk (Two steps back)

- Culture Risk (Your people don’t have anything to take hold of… there must be autonomy and the opportunity to own one’s own advisor algorithm)

- Valuation Risk (Reducing your organic growth machine to chance reduces the value of your business in an inorganic spectrum)

One Step Up Risk (Copycat Risk)

The issues associated with not owning your advisor algorithm are numerous and compounding by nature. We can start this shortened summary of all risks inherent with not owning your own advisor algorithm… with the risk that you bring into your business by not having the framework for a successful business model in place to guide your daily actions. When you associate the success of your business with the success of tactical concepts that may have worked for other successful advisors you are tacking on additional risk (one step up risk). What initially might seem to be a hit with you and your clients is eventually exposed as the temporary fix that it is because you don’t have the same Advisor DNA as the advisor whose blueprint you have copied. These actions always lead to heartache and two steps back because of the additional work it takes to make up the difference in the perception of the value you have perpetuated and the actual authentic value that you can and should be offering your clients. Your authentic value (the value that you can actually control) must be made tangible to demonstrate its relevance. The relevance of your value is critical in uncovering (getting) and maintaining (keeping) ideal clients. When you turn you back on these critical components of the advisor algorithm you introduce one step up risk into your business… and you don’t need that. One Step Up or Copycat risk is incredibly toxic when it comes to building your business. The cleanup factor is enough to drive any serious advisor out of business… Your reputation will be forever sullied by the lack of authenticity you introduce into your business culture when you fall for One Step Up Risk.

Your business is far too valuable and your reputation is far too important to introduce this type of Copycat Risk into your business development model. When you discover and design your advisor algorithm you create a strategic foundation that makes you and your business culture far less susceptible to falling for One Step Up Risk. In fact it guarantees that you will never see tactical offerings as strategic solutions again.

(This should be enough to get you started down the path of building your business by design… if not, please continue reading to discover more risks associated with not taking ownership of your advisor algorithm.)

Culture Risk

When you don’t own your advisor algorithm you open your business up to a multitude of cultural issues associated with lack of focus. Your trusted partners have earned the right to become part of your culture and they are indelibly tied to your reputation and the story of your authentic relevant value. A certain level of autonomy is required to create this culture of trust. If you do not acknowledge the importance of owning your advisor algorithm you will introduce chaos into your business model. Each member of your valued team must be able to have critical conversations that matter, with the confidence of the courage of their conviction. And in this era of 24/7 collaborative services, all conversations matter. You must prepare all trusted partners with the ability to converse with confidence. Without the ownership of the algorithm, which sets the tone for your culture, you are adding risk by default… this sounds confusing… design… default… what the hell man? Just let it be known that you are not doing yourself, your partners, your staff or your clients any favors in the ways of client experience and trust by ignoring your advisor algorithm. For sustainable growth to occur by design you must have a culture that is built (on purpose) from the fundamentals of your advisor algorithm which empowers you to exude your integrity and trust in a multitude of mediums twenty-four hours a day. Your predictable recurring revenue is at risk every minute that you are not able to exude the culture of integrity that you have created by design for the good of your ideal clients.

Business Valuation Risk (Inorganic Value)

The value of the moving parts of your business when you cease to be there is considered by many to be the valuation of your business. There are many more variables associated with the value of your business in the inorganic perspective… there are buyers and sellers markets when it comes to valuations and the grey matter involved is beyond the scope of this article. Suffice it to say that you must be able to demonstrate your predictable recurring revenue and the ability to maintain that predictability and growth when you are not their holding the reigns. The other side of the coin is if you are acquiring another business and need to create your own specific variables for valuation… owning your advisor algorithm empowers you to go beyond the spectrum of third party evaluations of ROI into cultural details that can uncover cultural alignment which must not be ignored when there is so much at stake when it comes to potentially adding risk to your current client base if you do not have an ideal fit with the firm you are acquiring. This is a light summary of the possible risks inherent in the valuation of advisor businesses when it comes to inorganic acquisition. Sustainable organic growth is indelibly tied to inorganic acquisition regardless of which side you reside… both buyer and seller must verify the ability of the acquired business to generate predictable recurring revenue and sustainable growth…Simply not recognizing the opportunity (owning your algorithm) to create a stronger business model while reducing risks associated with valuations is just not acceptable. Your clients deserve better, so does your staff and you do too.

Conclusion

What advisors can gain by owning their advisor algorithm is a dramatic reduction of three inherent risks associated with lack of focus, vision and or purpose.

The advisor algorithm is a merely synonym for alpha or value by design… some advisors see things one way, some see it another.

To get all advisors exposed to the opportunity of tangible alpha I have designed multiple synonyms for tangible alpha… anyway, back to the point of this story…

The need to create sustainable organic growth is often undermined by risks that advisors unwittingly add to their businesses while trying to create predictable recurring revenue. It’s a kind of sabotage that advisors can’t see because they are often times too close to the business to see clearly the missteps they are taking. That’s why I feel it is my calling to enlighten and empower advisors with the wisdom I have been able to gather through my affiliation with one of the best advisor coaches that has ever walked the planet. I might be a little biased.

Anyway… on to the conclusion…

To gain a competitive advantage in a multitude of dimensions (moving forward in the digital age) the advisor in the future will own his or her advisor algorithm and increase the probability of success while simultaneously reducing inherent risks associated with cultivating a business that thrives on sustainable organic growth.

Keep It Tangible,

Grant

Yours Is Unique

Discover It NowTop 10 Traits of Advisors

How Will You Do It?

What Will It Take?

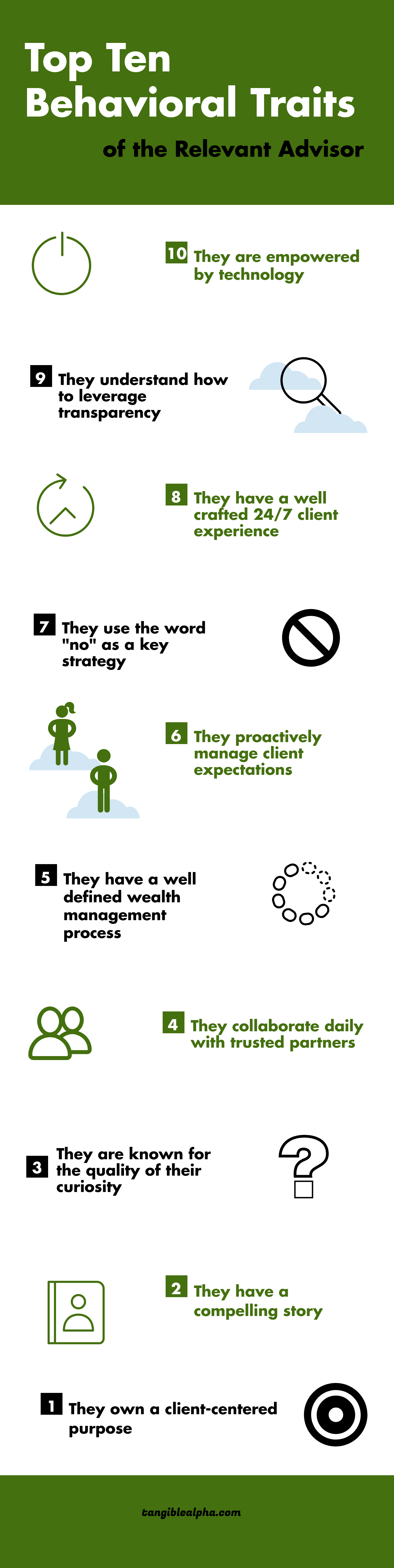

The Advisor in the Future will create demand for her/his services in the digital age of transparency by crafting a strategic foundation that showcases the relevance of her/his value. Remaining relevant has been the number one challenge for the entrepreneurial financial Advisor during the past three decades and will continue to be a genuine concern for the Advisor in the Future.

Setting and maintaining client expectations while creating the measurement of value over which the Advisor has the greatest control is of paramount importance. To fall into the trap of being measured by industry standards is a real danger for “the Advisor in the Future” and s/he will take special care to not fall prey to the status quo industry pitfalls that lie in waiting for all Advisors.

Build On Purpose

The strategic foundation of the Advisor in the future will be built with a cornerstone that is a client-centered purpose. This will work to the advantage of the client as well as the entrepreneurial Advisor moving forward in the digital age of transparency. The Advisor in the future will survive and thrive by creating a business that empowers her/him to do well by doing good…

In order to simply survive, the Advisor in the future will have to demonstrate in a tangible fashion that they have the best interests of their clients at stake ahead of their own… (this goes beyond fiduciary) or the Advisor will be replaced.

In order to thrive, the Advisor in the future must have a system in place that is a progression which leverages their client-centered purpose within their business development model. Tangible Alpha is the model that empowers Advisors with that highly coveted progression.

In the digital age of transparency the Advisor in the future acknowledges that they are replaceable until they can prove in a tangible fashion that they are not.

Serious Advisors also realize that if they continue to measure themselves by the industry standards that have been handed down for decades that they will become dinosaurs… Recognizing the opportunity disguised as a threat is critical when taking advantage of transparency by delivering a consistent message of authentic relevant value throughout multiple (but not all) digital mediums.

Promise What You Can Control

The Advisor in the Future will zealously demonstrate their expected behavior (what clients and prospects should expect from them) which amplifies exactly what their client-centered purpose is… throughout multiple mediums. The promise of expected behavior will become the contract that forms a bond of trust for the serious Advisor and the serious investor. That bond will be quantified tangibly throughout multiple mediums in a 24 hour a day society in which expectations can be set and maintained rather than exceeded in quarterly meetings.

To step into the next dimension of business development that will make you relevant and irreplaceable the strategic foundation of Tangible Alpha has been constructed to not only create your digital voice but to create a proactive filter which aligns your solutions with ideal prospects (while constantly reminding your clients of your value). Your Tangible Alpha foundation and progression create a platform to exude your authentic relevant value while filtering in ideal trusted partners.

It is critical to make tangible… not what the client and prospect want to hear… but what you can deliver and promise (your behavior, not returns).

Learn about yourself before you try to implement any digital solutions… not doing so could be a costly mistake.

Introspection is the key to successful technology integration.

The life of the Advisor in the future must be simplified by technology and not over complicated by too much information. The Advisor in the Future will take advantage of different modern tools made available throughout the industry by first going through the Infinite Alpha Progression to discover and design her/his unique Tangible Advisor Alpha.

Keep It Tangible,

Grant

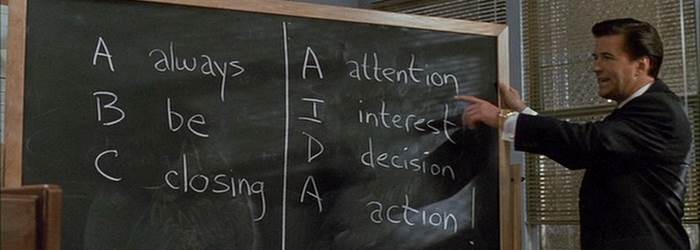

Three Reasons Sales Funnels Don’t Work Anymore

Legacy sales practices are quickly becoming obsolete for financial advisors.

The three main reasons sales funnels don’t work anymore:

-

Time

-

Product Focus

-

Transparency

Time

In a robo-world there simply isn’t enough time to compete in the arena of product sales for shrinking commissions.

Product Focus

You are not selling products in a vacuum behind a curtain of opacity surrounded by smoke and mirrors. The focus of the modern advisor must be on the services that he or she provides that are unique to the individual and relevant to his or her ideal audience. People can buy products from their smart phones Clients don’t need an advisor for that. They don’t need you to “sell” them anything anymore. What clients need is a trusted source of wisdom… which is what you are. Obviously, a trusted source of wisdom would never use anything as shady as a product sales funnel to convey their client-centered focus to their ideal audience. Because that would be impossible. Which leads us to why that would be impossible to pull off in the modern era of financial services… transparency… reason number three.

Transparency

Do you think you can convey that message?

In which you are using obvious sales tactics?

By using sales gimmicks from the late 1990’s?

Gimmicks to fill your sales funnel with leads?

The same transparency that is killing the sales funnel and traditional lead generation can make you irreplaceable if you understand how to leverage it for the good of your clients and for yourself.

So What Can You Do?

Be proactive… be responsible… be yourself.

Right now we live in the greatest era of opportunity for financial advisors. WHY? Because… Your ideal audience is seeking a trusted source of wisdom… and that is YOU.

Your Future Awaits

Build My FilterAre You A Trusted Source of Wisdom?

Content Curation

- amplify their value

- control how that value is perceived

- maximize their relevance

Curated Article

As an information scientist, one of the most depressing aspects of modern social media is the way in which it is reshaping our global society to focus on the what, rather than the why. From the sciences to the humanities to the arts, the underpinning of the scholarly knowledge that advances our collective society is the understanding of why the world is the way it is. Documenting the “what,” the state of the world, is a necessary and important component of that process, but without the synthesis of those observations into the “why” that describes how they came to be and explains their outcome, we can never truly understand our world. This raises the question of how to restore the “why” in a social media world that teaches us that all that matters is the “what.”

The social media revolution has turned everyone with a smartphone into a realtime embedded reporter, live chronicling their own lives and events they experience and commenting on events happening elsewhere across the world. When journalists and tech experts start seeing a strange survey from Facebook pop up in their newsfeed, their first reaction is not to turn to the company to learn more about the feature, to examine it through the lens of proper survey design, to consider the implications of its design in terms of limiting the insights it can provide or to ruminate deeply on what it means for Facebook to be asking such a question and its societal implications. Instead, they all respectively race to be the first to plant their flag in the Twitterverse of having been among the first wave of people to mention it. Speed matters over comprehension.

The realtime conversational nature of Twitter in particular is often touted as offering a global scale collective collaboratory that extends the realtime nature of environments like Slack to the entire planet, allowing adhoc teams to form across geographic, disciplinary and cultural boundaries. The reality couldn’t be further from the truth. Instead of the world’s citizens working together towards a greater good, cataloging all known information about an emerging event and trying to synthesize a basic understanding of its scope, scale and characteristics and bringing in experts from related fields to comment on the potential meaning of each element, the online conversation simply devolves into a bunch of users saying they saw it too and competing for the snarkiest or most meme-worthy response in their never-ending search for viral fame.

Knowing that Facebook is running a new opinion poll might be of interest to media strategists, investment analysts and government regulators, but just knowing there is an opinion poll is of little use without the why, the understanding of what Facebook intends to do with the collected information.

Similarly, in the physical world it can be of great use to first responders to get a realtime alert from a surge of tweets in a particular city block reporting a giant plume of smoke emerging from the roof of a building. The problem is that without knowing the why, it is impossible to know if that “smoke” is simply steam from a vent, humidity from an air conditioning plant, ordinary pressure exhaust from a liquid nitrogen storage system, routine maintenance sandblasting or simply a rooftop party featuring a fog machine. Focusing on the “what” can mean critical resources diverted for a false alarm that makes them unavailable for a real emergency elsewhere in town.

At least one can argue that having increased situational awareness can be of benefit to first responders in alerting them to situations they may wish to examine further. The same can’t be said, however, for the deeper implications of teaching an entire generation of people that relentless focus on speed over comprehension is what affords one success in life.

Perhaps most remarkable is the degree to which academia has embraced social media to discuss issues ranging from developments in their own fields to events and topics completely astray from their own expertise. In contrast to the general public, which might be forgiven for focusing on simplistic reporting of what they see in front of them, the scholarly and scientific worlds emphasize the search for understanding, that the why matters far more than the what.

One might assume therefore that academics would bring that search for understanding with them to the social sphere, lending a critical perspective to raging debates and seeking to explain why it is that everyone else is seeing what they see. Instead, much of the academic discourse on social media is little more esteemed that the rest of the billions of ordinary users they engage with.

Rather than the measured informed discourse and heavily cited and referenced exposition that would be found in an academic journal or the Q&A section of a conference, these same academics that ordinarily pepper their speech with “isms” and speak as though they’ve memorized Roget’s Thesaurus from front to back will suddenly devolve to one-line responses and petty flame wars where the most meme-worthy response wins and adherence to scholarly norms of debate, including sticking to factual statements and citing the source of all claims, goes right out the window.

Putting this all together, social media’s fixation on realtime updates and the unfortunate fact that it is the most entertaining comment rather than the most enlightening that tends to go viral and reward its author with fame in today’s world, means we are teaching an entire generation to focus on information in isolation, rather than spend the time to properly situate it in context. Indeed, this is one of the driving forces behind the ease with which false and misleading information spreads on social platforms. When even the academic world discards millennia of tradition that evolved to maintain the scholarly and scientific world’s focus on the why over the what, we run the risk that social media will ultimately permanently refocus humanity to forget the past, ignore the future and live in a world in which information no longer has any context and where all that matters is what we see before us at this moment, not the understanding of why it is that the world is as we see it. In short, for the thousands of years of human history that we have sought to understand our world, we stand today amongst the unimaginable riches of having all of human knowledge at our fingertips and a quarter of the world’s population just a mouse click away, but rather than harness this brave new world to reimagine how we understand ourselves, we have instead taught an entire generation that speed matters more than explanation, entertainment more than enlightenment. From the Age of Enlightenment to the Age of Entertainment.

Based in Washington, DC, I founded my first internet startup the year after the Mosaic web browser debuted, while still in eighth grade, and have spent the last 20 years…

Kalev Leetaru

Are You A Trusted Source of Wisdom?

Advisors must be more than social influencers to survive in a robo-world.

In a robo-world advisors must become more than simply social influencers. The seriousness of the undertaking of your calling must be made tangible within your own unique CliqPage.

Now more than ever your ideal audience is in search of a trusted source of wisdom.

This isn’t entertainment and it’s more than just enlightenment… this is about the quality of life, the dreams, the goals, and the aspirations of your ideal audience.

This is a serious business and the context of your meaningful digital engagement must reflect exactly how serious this business is.

The scholarly implications and the meanings in academia referred to in this article will all sort themselves out… my genuine concern is for advisors and their clients… my concern is for you… it is entirely up to you to create the meaningful context that will guide both you and your clients through the digital noise that grows exponentially in today’s robo-world.

You must be able to walk the talk.

You must promise your behavior.

Your clients must promise their behavior to establish a trusted collaborative relationship.

You must frame the relationship with your rules.

Your filters must be designed by you topically to lead to the value you can control the most.

Discover your why and make your what relevant.