Legacy sales practices are quickly becoming obsolete for financial advisors.

The three main reasons sales funnels don’t work anymore:

-

Time

-

Product Focus

-

Transparency

Time

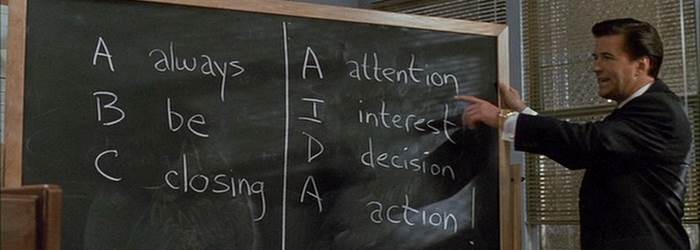

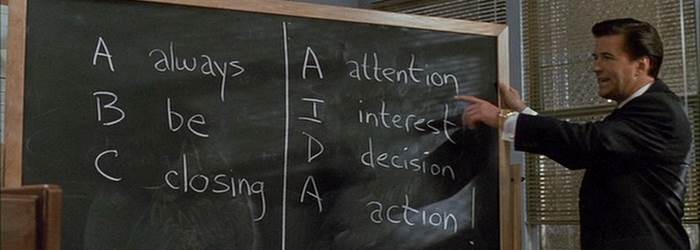

There simply not enough time to try and be all things to all people in a sales cycle in which 50 no’s will render you one yes. Your website must become more than a mechanism to gather leads. You must design a user experience that overlaps the client and the prospective client journeys. Treating your engagement hub as a trap for gimmicky sales practices is a death sentence for your reputation. The marketing sales concepts that are being pushed on you (as an advisor) by marketers, are the same types of sales rhetoric you were probably taught in your rookie advisor training classes. The gimmicks they are peddling are built on a foundation of lies and opacity. You don’t have time to gather the metrics they need to justify their existence when they should be helping you discover the metrics you need to survive in a robo-world. There is no time for awareness, interest, decision, action… that mode of lead generation is no longer relevant because you are not selling products… which leads us to reason number two.

In a robo-world there simply isn’t enough time to compete in the arena of product sales for shrinking commissions.

Product Focus

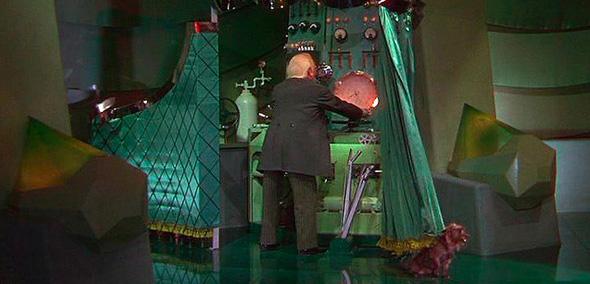

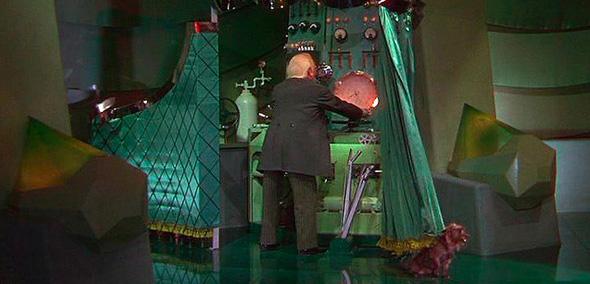

You are not selling products in a vacuum behind a curtain of opacity surrounded by smoke and mirrors. The focus of the modern advisor must be on the services that he or she provides that are unique to the individual and relevant to his or her ideal audience. People can buy products from their smart phones Clients don’t need an advisor for that. They don’t need you to “sell” them anything anymore. What clients need is a trusted source of wisdom… which is what you are. Obviously, a trusted source of wisdom would never use anything as shady as a product sales funnel to convey their client-centered focus to their ideal audience. Because that would be impossible. Which leads us to why that would be impossible to pull off in the modern era of financial services… transparency… reason number three.

Transparency

In the digital age of transparency clients can see exactly where they are in the process of your sales funnel. They can see how full of shit you may or may not be… and they can see through your smoke and mirrors sales pitch as well. In a robo-world you have to become authentic. You must be able to convey your genuine concern for your clients 24/7.

Do you think you can convey that message?

In which you are using obvious sales tactics?

By using sales gimmicks from the late 1990’s?

Gimmicks to fill your sales funnel with leads?

They can see right through that… it’s not that hard to see your obvious lead generation and “sales marketing prowess” when you lock content behind gated walls on your website to gather email addresses.

The same transparency that is killing the sales funnel and traditional lead generation can make you irreplaceable if you understand how to leverage it for the good of your clients and for yourself.

Who you follow and what you like on social media is indicative of the type of services you offer your clients. If you are following sales gurus and liking their content, it is very simple for clients and potential clients to discover – what drives you is the commission – and not the well-being of the client.

It is this digital transparency that will be your end if you don’t walk away from the antiquated lead generation/sales funnel concept.

The same transparency will help you build filters to discover reputable digital marketing experts to guide you to the metrics you must gather to survive in today’s robo-word.

So What Can You Do?

Be proactive… be responsible… be yourself.

Your digital footprint tells your clients and your prospects exactly where you stand in relation to their well-being versus your sales commission. In a robo-world advisors must think differently and act accordingly, because sales funnels are dead. Advisors must first understand and identify their authentic relevant value before they can become and remain relevant to their ideal audience.

Right now we live in the greatest era of opportunity for financial advisors. WHY? Because… Your ideal audience is seeking a trusted source of wisdom… and that is YOU.

Discover more about how to shift your focus from sales to service, leverage your time efficiently, and take complete advantage of transparency to survive in a robo-world. You must become empowered to think differently about the value you provide. You must be able to rethink what might be considered as acceptable practices in the new era of financial services. Sometimes you just have to let go of the past to stay relevant.

One final thought from the author… If you don’t say goodbye to legacy concepts like lead generation and sales funnels, you can kiss your assets goodbye.

Keep it Tangible,

Grant