Build On Purpose (3/3)

Building Your Business On Purpose Empowers You

In this three part blog post I am attempting to simplify what I have known to be fundamentally true about advisor value design for the past three decades… It can be tricky sometimes to simplify the complex.

This is part three of three. We pick up where we left off in part two…

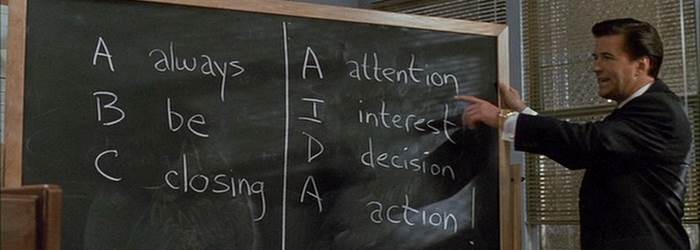

A big part of what I do is trying to simplify what I have learned over the past 30 years in the financial services industry. The models and slides that I share freely can be the biggest piece of the puzzle for some advisors looking to break out of the opacity of the industry designed “black box” that defines advisor value. Building on purpose is a metaphor for doing the right thing all the time but it also can be physically modeled to demonstrate how a progression of value design can justify value while empowering advisors to take complete control over how their unique value is perceived. The big picture for advisors in the new digital age is control over perception… if you are an advisor you must become responsible for the definition and perception of your advisor alpha (advisor value). If you are counting on the industry to do this for you, you will be replaced by the industry.

Previously in parts one and two we touched on the purpose driven model to demonstrate exactly how advisors can ultimately promise their behavior.

Your relevance hinges on your ability to promise your behavior. By promising your behavior you are able to get and keep ideal clients with your digital filter. By promising your behavior you’re able to control the perception of your relevance. By promising your behavior you’re able to demand reciprocal actions from your trusted clients. By promising your behavior you’re able to gather feedback that matters. Your promises tied to behavior leads to the value that you control the most which allows you to take complete control over the perception of your value.

Earning trust controlling perception and creating collaborative relationships are the three main elements that are required for survival in a robo world.You must be able to promise your behavior to create that culture by design.

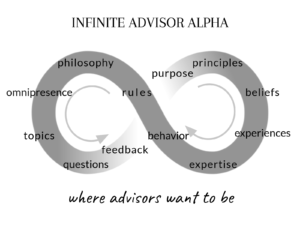

The progression of infinite advisor alpha empowers advisers to promise their behavior so they may remain relevant in a robo world.

We are now shifting from the slides that model how to earn trust by promising behavior to the infinite progression of advisor value development which empowers advisors to get and stay exactly where the want to be… a state of perpetual relevance.

Amplify the value that you can control. Take complete control over how that value is perceived. And maximize your relevance to get and keep ideal clients in a robo world.

This is what it means to build on purpose.

Earn trust, promise your behavior, demand reciprocal behavior, create trusted partners as clients, make your value tangible, gather feedback, continue to amplify your value and your business, and live your preferred life.

In order for your business to have a positive change 30 days from right now, you must start making incremental changes daily. And those incremental changes must add up in a way that makes sense. Your focus must be appropriate the system you choose to maximize your relevance must make complete sense and you must carry the discipline that it takes to make incremental improvements daily.

Organized

Efficient

Simplified

Driven

Realistic

Interesting

Fun

Adaptive

On-point

Relevant

Healthy

It’s all about you.

This is where you want to be.

Ultimately you are earning trust by becoming accountable because you’re able to promise the behavior that leads to the value that you can control the most. Which is exactly why your ideal audience should be paying you.

Build your business on purpose.