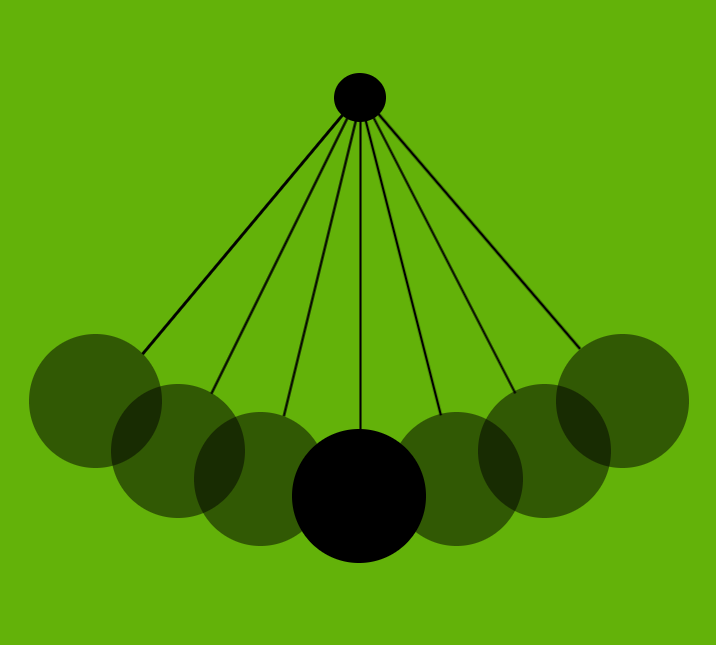

The Pendulum Effect

The Pendulum Effect

→SUMMARY

The theory holding that trends in culture, politics, capital markets, etc., tend to swing back and forth between opposite extremes.

→OVERVIEW

In order for advisors to remain relevant in both bull and bear markets, they must have complete control over the perception of their value. If you tie your advisor alpha too closely to portfolio alpha your relevance will ebb and flow with every fluctuation in the capital markets.

Taking control over the perception of your value allows you to maximize your relevance regardless of market conditions.

The most efficient way to control the perception of your value is to make your advisor alpha tangible.

The bottom line is, advisors must be able to recognize their own authentic relevant value and make it tangible for digital consumption 24/7.

Taking control over the perception of your value allows you to maximize your relevance regardless of market conditions.

The most efficient way to control the perception of your value is to make your advisor alpha tangible.

The bottom line is, advisors must be able to recognize their own authentic relevant value and make it tangible for digital consumption 24/7.

NEXT