You Have To Make It Tangible

If They Can't Feel It... It Doesn't Exist

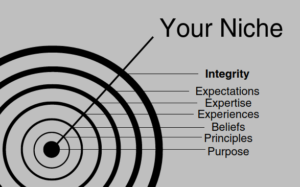

The best way for advisors to create a niche

Why form a niche?

Why must you discover your niche? Not because it works… not because others have had success… because you can’t compete in the financial services industry on price. If you try, you will be replaced either by the industry, your firm or your clients. When the measure of your value is price alone, you become replaceable. You must become responsible for the ownership of the perception of your value. In doing so, you must find ideal like-minded clients to serve… because you can’t be all things to all people. Attempting to be a jack of all trades is the quickest way to be forced to exit this industry. Trust me when I say this, You don’t want to miss out on the next 10 years.

Clients that come to you for discounts will leave for discounts.

So you need a niche to remain relevant and become irreplaceable. Not because it may have worked for someone else.

1. You can’t compete on price.

2. You can’t be all things to all people.

3. Price becomes an issue in the absence of value.

4. Prescription without thorough diagnosis is malpractice.

5. Quality over quantity.

You must increase the quality of your clientele but you can’t afford to have your reputation tarnished by making promises you can’t keep. Your authentic value must be made available 24/7 for the world to see and here. This is not the corporate slogan or the company catchphrase… this begins with your client-centered purpose. You must own the words that define your authenticity and it all begins with your shared purpose. Ideal relationships are formed with a shared purpose… this is where you begin to carve out your niche.

To survive in the digital age advisors I must not compete on price… to thrive I must be able to increase the quality of my relationships by design. My process must become simplified yet productive.

Your Process Must Empower You…

- Connecting the dots of the critical components (simplification).

- Building the foundation of your advisor alpha to create tangible value (exude value 24/7).

- Expand tangible value to remain relevant and become irreplaceable (completing the process but never finishing).

- Productive repetition by design (small steps).

You must get ideal clients…

you must remain relevant…

and you must become irreplaceable to keep ideal clients…

while you simultaneously expand the breadth and depth of your services 24/7.

Your niche can be formed by your purpose… in fact, it’s the only way to truly connect to your ideal audience in the new digital era of financial services.

Quality relationships begin with shared purpose.

I will pay you to solve my problems if you can prove to me that our end-game is mutual success.

~ Ideal Client

Stay Relevant

You can’t afford to simply be top of mind you must become an icon on your clients’ smartphones. #Advisors #TangibleAlpha #WealthStewardship pic.twitter.com/vbuj9imqtS

— Grant Barger (@TangibleAlpha) February 20, 2017

Discover define design deliver remind and refine… not just good ideas but a taxonomy for advisor value development that takes your business to another dimension.

It’s not a checklist… it’s a progression.

The next dimension of your business requires your complete attention… we afford you the opportunity to give your business the attention it requires to survive in a robo-world.

Advisor Icon

Be There 24/7Three Reasons Sales Funnels Don’t Work Anymore

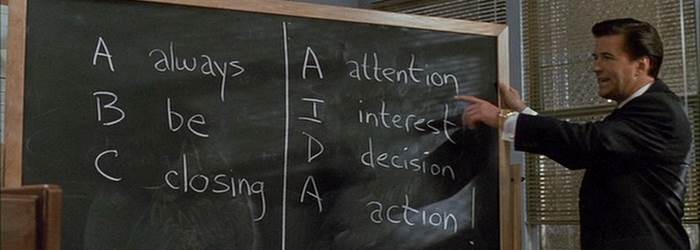

Legacy sales practices are quickly becoming obsolete for financial advisors.

The three main reasons sales funnels don’t work anymore:

-

Time

-

Product Focus

-

Transparency

Time

In a robo-world there simply isn’t enough time to compete in the arena of product sales for shrinking commissions.

Product Focus

You are not selling products in a vacuum behind a curtain of opacity surrounded by smoke and mirrors. The focus of the modern advisor must be on the services that he or she provides that are unique to the individual and relevant to his or her ideal audience. People can buy products from their smart phones Clients don’t need an advisor for that. They don’t need you to “sell” them anything anymore. What clients need is a trusted source of wisdom… which is what you are. Obviously, a trusted source of wisdom would never use anything as shady as a product sales funnel to convey their client-centered focus to their ideal audience. Because that would be impossible. Which leads us to why that would be impossible to pull off in the modern era of financial services… transparency… reason number three.

Transparency

Do you think you can convey that message?

In which you are using obvious sales tactics?

By using sales gimmicks from the late 1990’s?

Gimmicks to fill your sales funnel with leads?

The same transparency that is killing the sales funnel and traditional lead generation can make you irreplaceable if you understand how to leverage it for the good of your clients and for yourself.

So What Can You Do?

Be proactive… be responsible… be yourself.