Disconnected

The HNW Disconnect

The average advisor is not able to interact with the conference big wigs that we see plastered all over social media. When we see posts from Carl Richards or Michael Kitces we know that the high end of wisdom is in the room. Yet, most financial professionals don’t have the time or the resources to rub elbows with these high end gurus.

What can connect you with the great minds of financial services is social and digital media. Yet, the promise of good fortune seems to be more distant when we realize that the lives they live are well beyond our grasp.

So what can you do as an average advisor to take advantage of the high end wisdom they espouse?

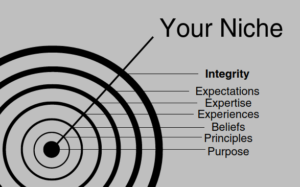

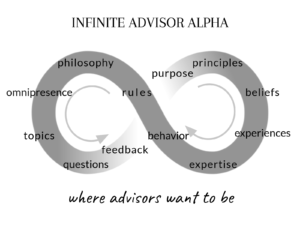

Your model of value must be specific to your circumstances… you can’t achieve the greatness of the HNW advisors by simply copy and pasting what has been done by others… no matter how successful they might have been.

Your model of success is dependent on the introspection that the “successful” HNW advisors have already gone through.

It’s great to read and hear about the success of other advisors who are immersed in HNW business models, but your reality lies within your ability to emulate how they got there and not just a cookie cutter model of what they have done.

Your success, like the success of HNW advisors, is dependent on introspection of your very unique circumstances.

Your future is dependent on your ability to be honest with yourself about your value…

Discover your value… Define it… Design your value for digital consumption.

Make your value tangible so you can survive and thrive in a robo world.