Rethinking Advisor Alpha

Rethinking Advisor Value

Think Differently

Challenge YourselfBeware of The Reverse-Churn

Advisor Beware

Reverse-Churn

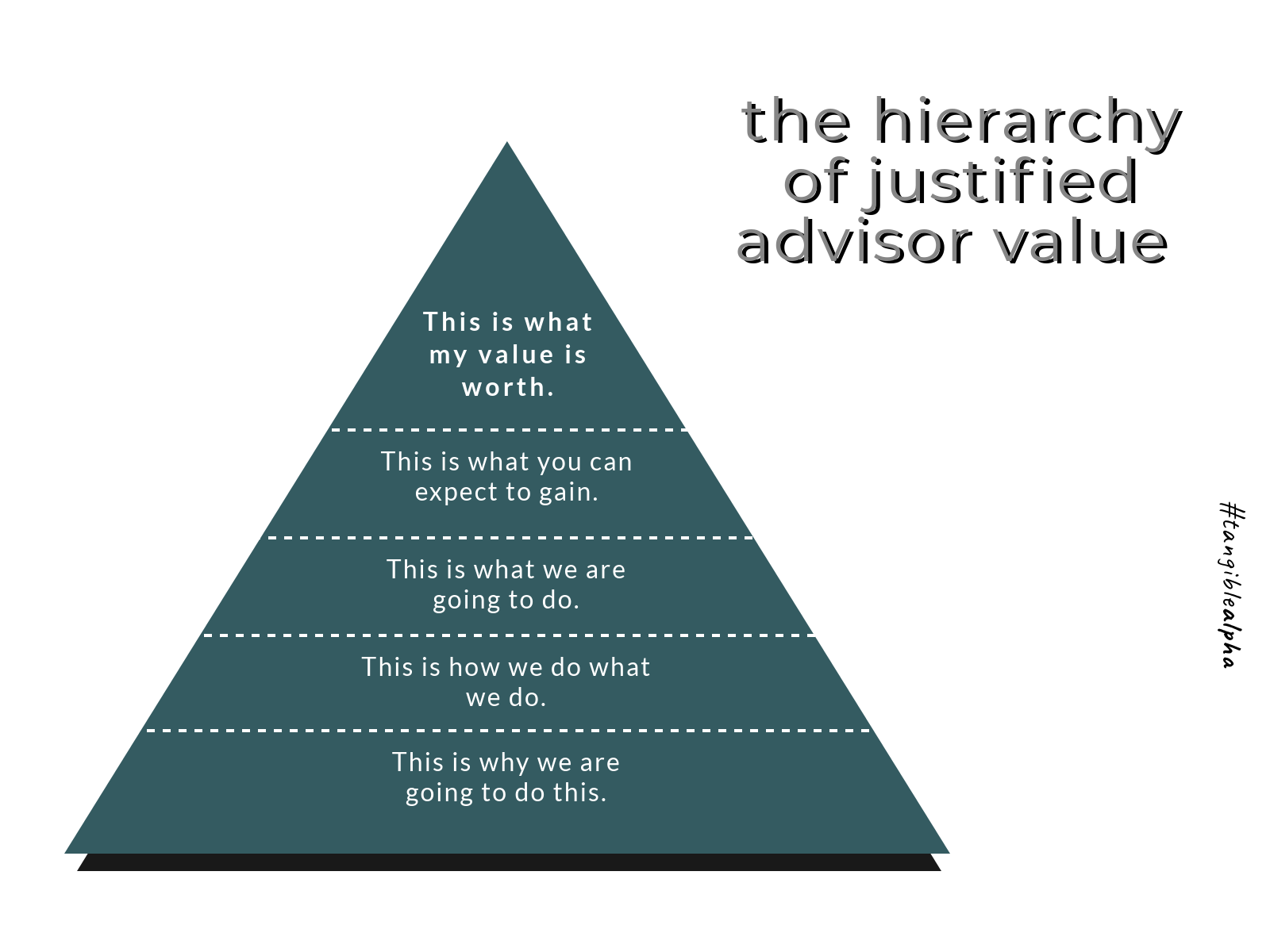

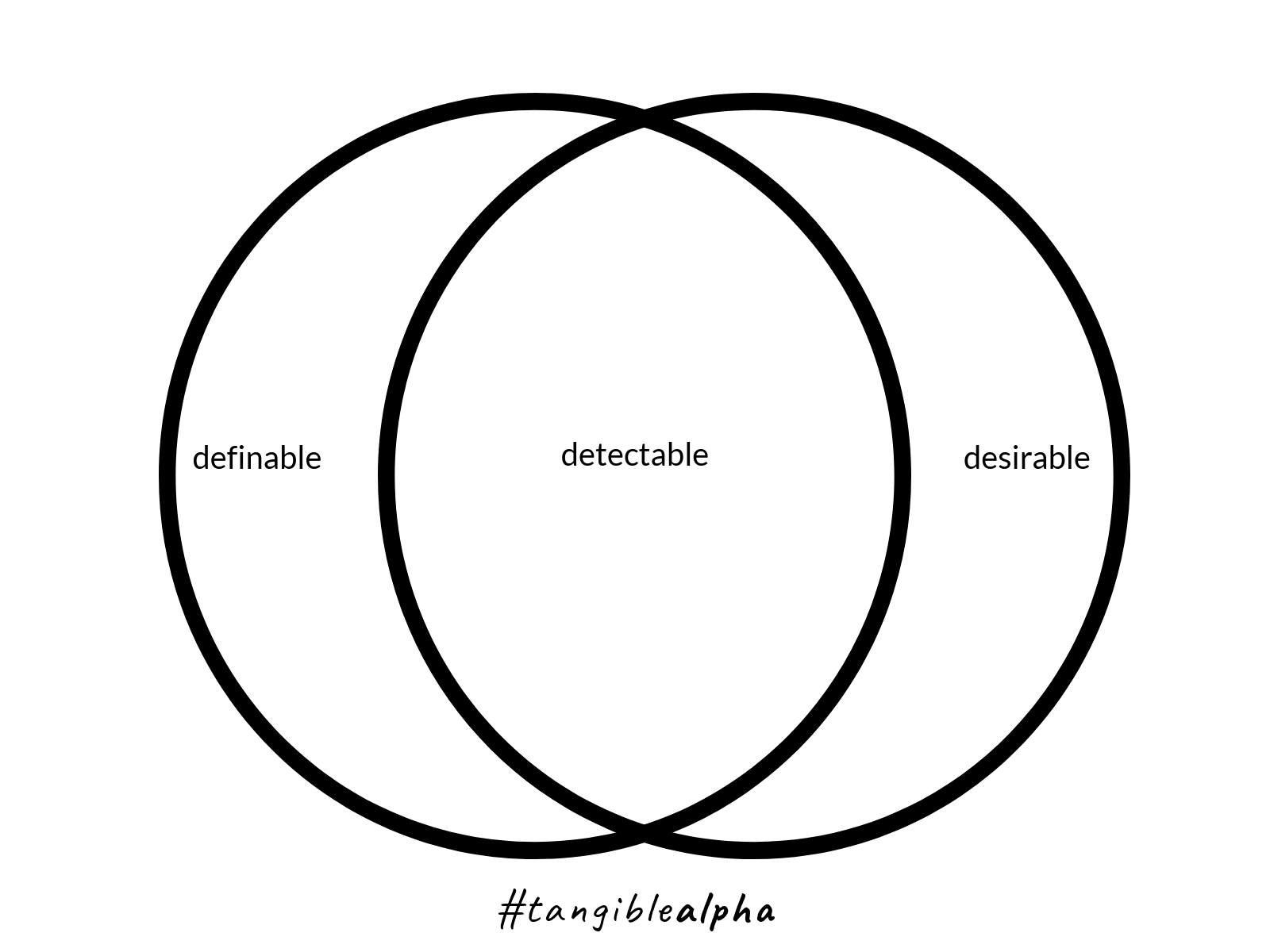

Advisors must be able to justify their value to charge fees in a robo world.

In the digital age of transparency, financial advisors can’t afford to have their reputations sullied by insinuations or accusations (or litigation) tying them to the unseemly act of reverse-churning accounts of unwitting clients.

If your not sure what reverse-churning is… ReverseChurn.com

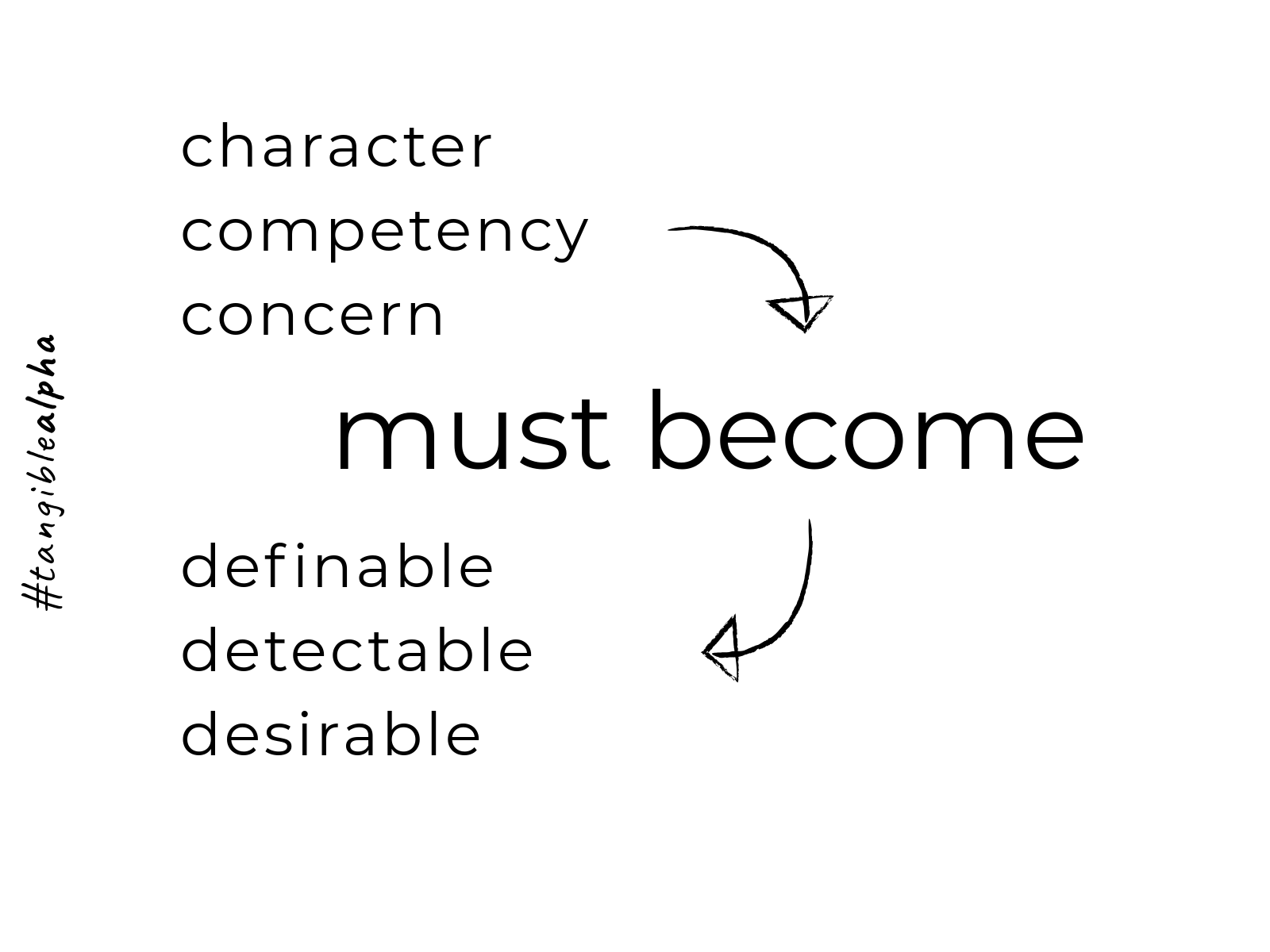

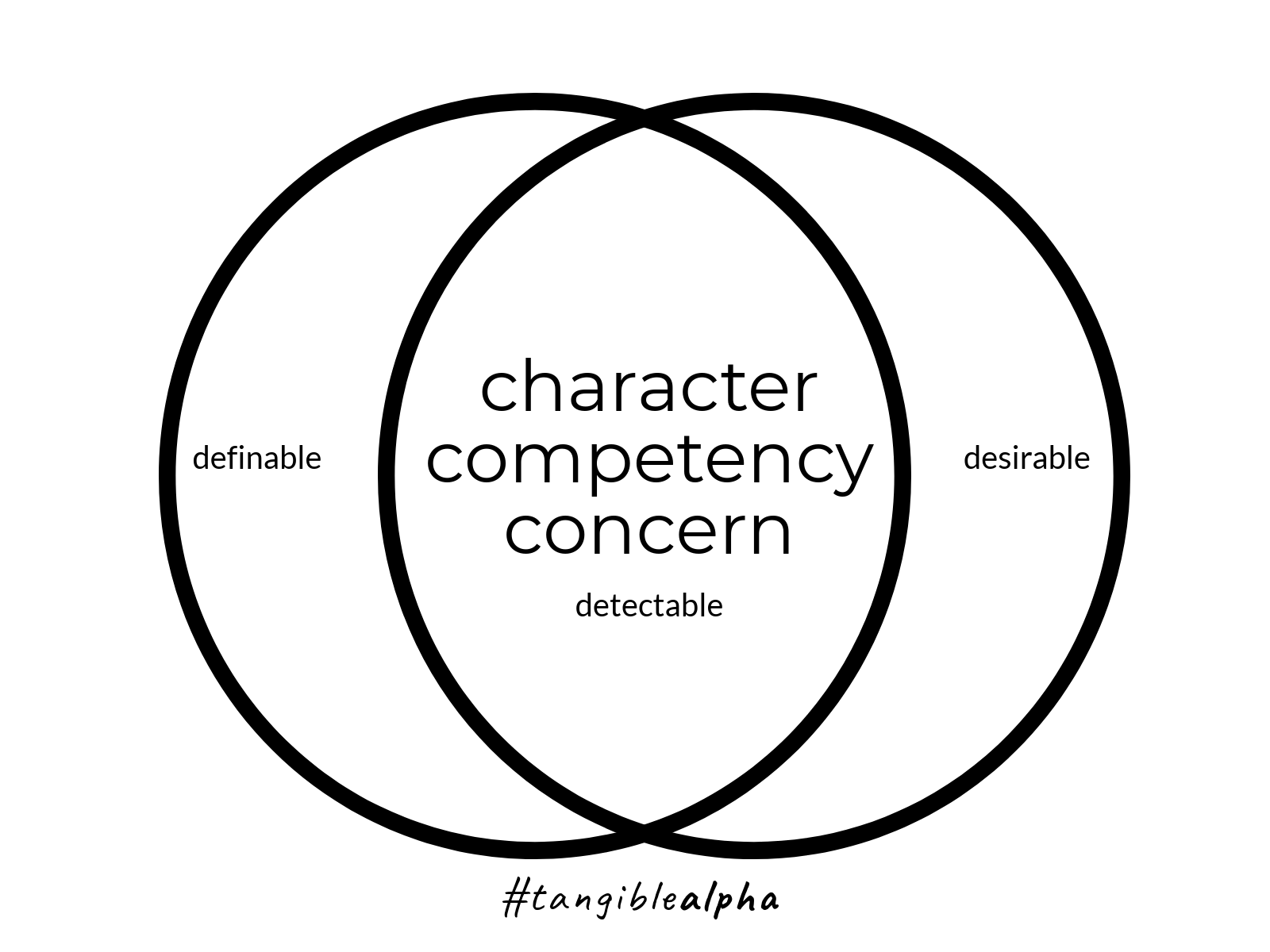

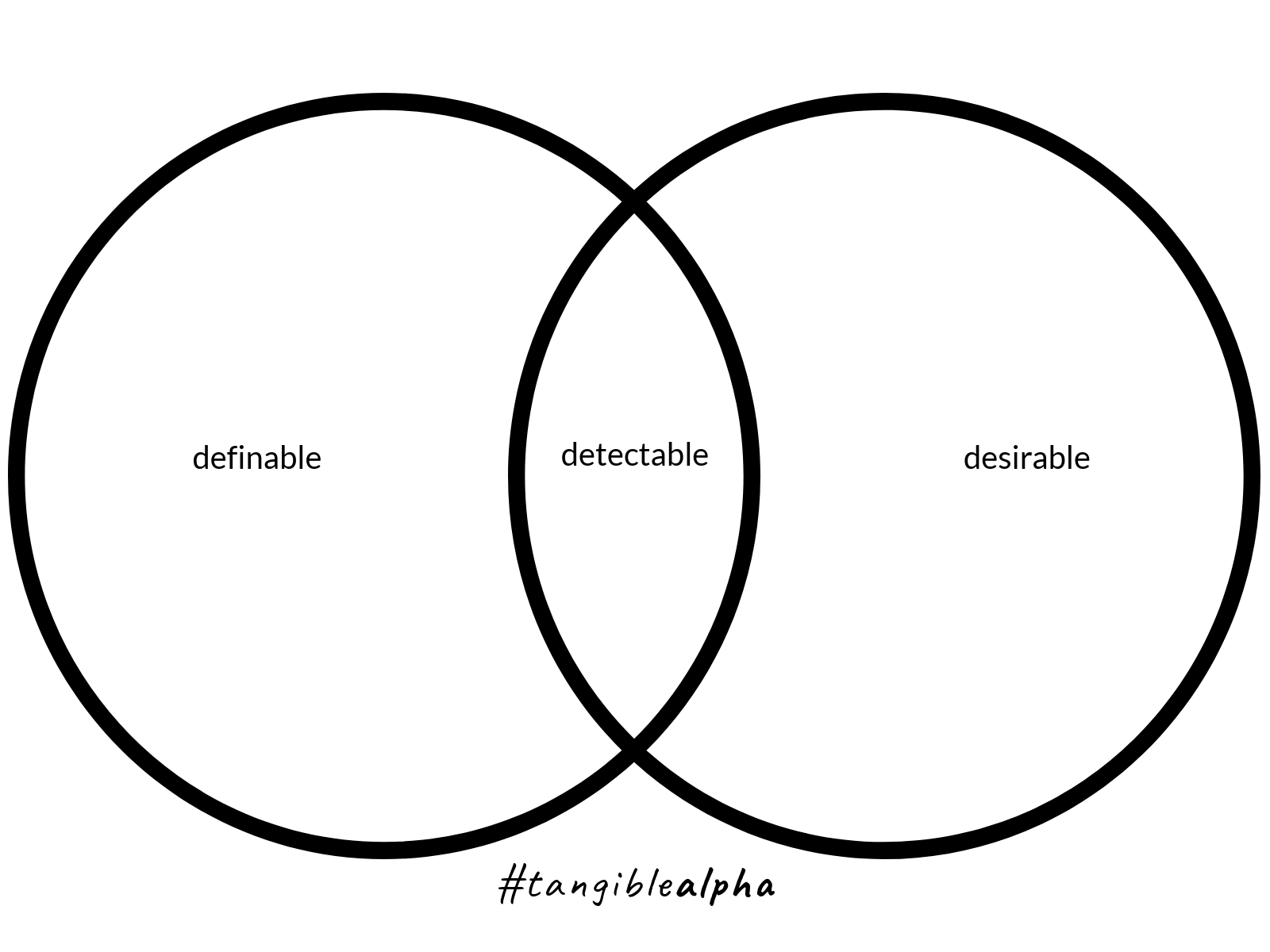

The process of the value that the advisor brings to the lives of his or her clients must be made tangible for digital delivery, consumption, refinement, and verification.

To validate the fees advisors must begin to charge, in lieu of commissions, deep introspection of unique advisor value is requisite for survival in these changing times of financial services.

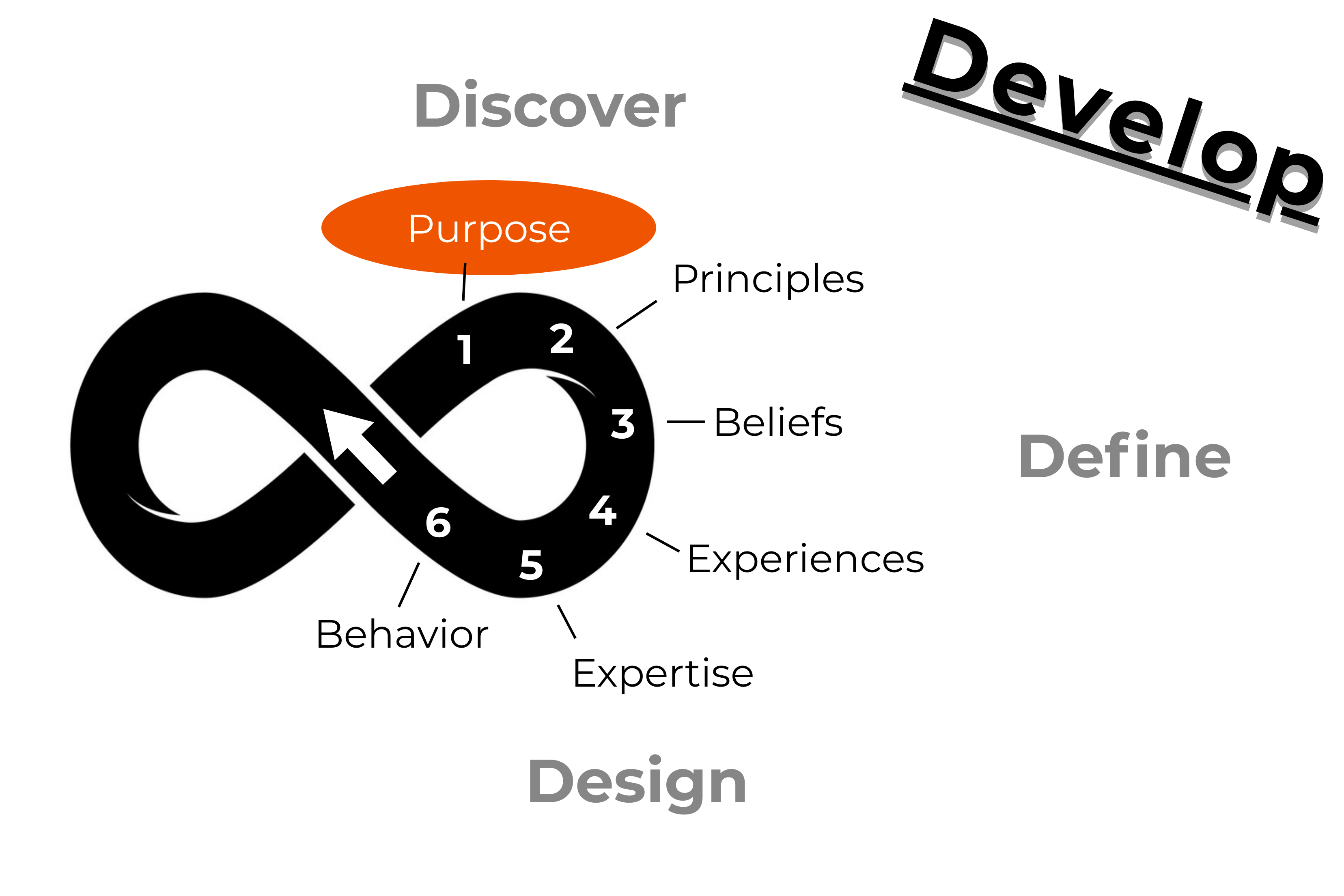

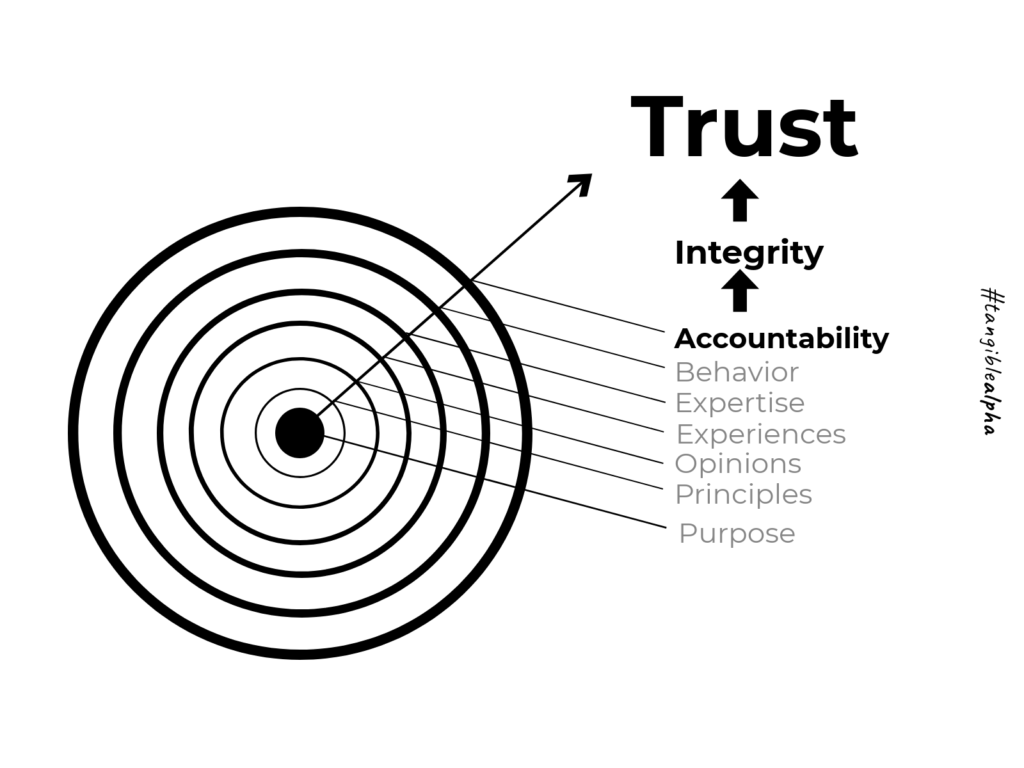

The best way for advisors to grasp this concept is by beginning to structure their businesses from a perspective of purpose. They must acknowledge a shared-purpose with their ideal audience to convey precisely why anyone should trust them with their wealth.

Once the cornerstone of a client-centered purpose is defined, a purpose-driven business model is the best way for any advisor to survive and thrive in this modern robo-world.

To avoid the heartache of the reverse-churn, start building your business on purpose.

Tap or click the image below to go to the purpose-driven branding modules of Tangible Alpha created by Grant Barger.

What is Micro-Learning?

For Financial Advisors

What is Micro-Learning?

- What if there were a place where you could go, that was available 24 hours a day, to help you amplify your unique value?

- What if it only took minutes of your time and energy to see benefits from your incremental effort?

- What if it were a platform built specifically for you?

- Would you take advantage of it?

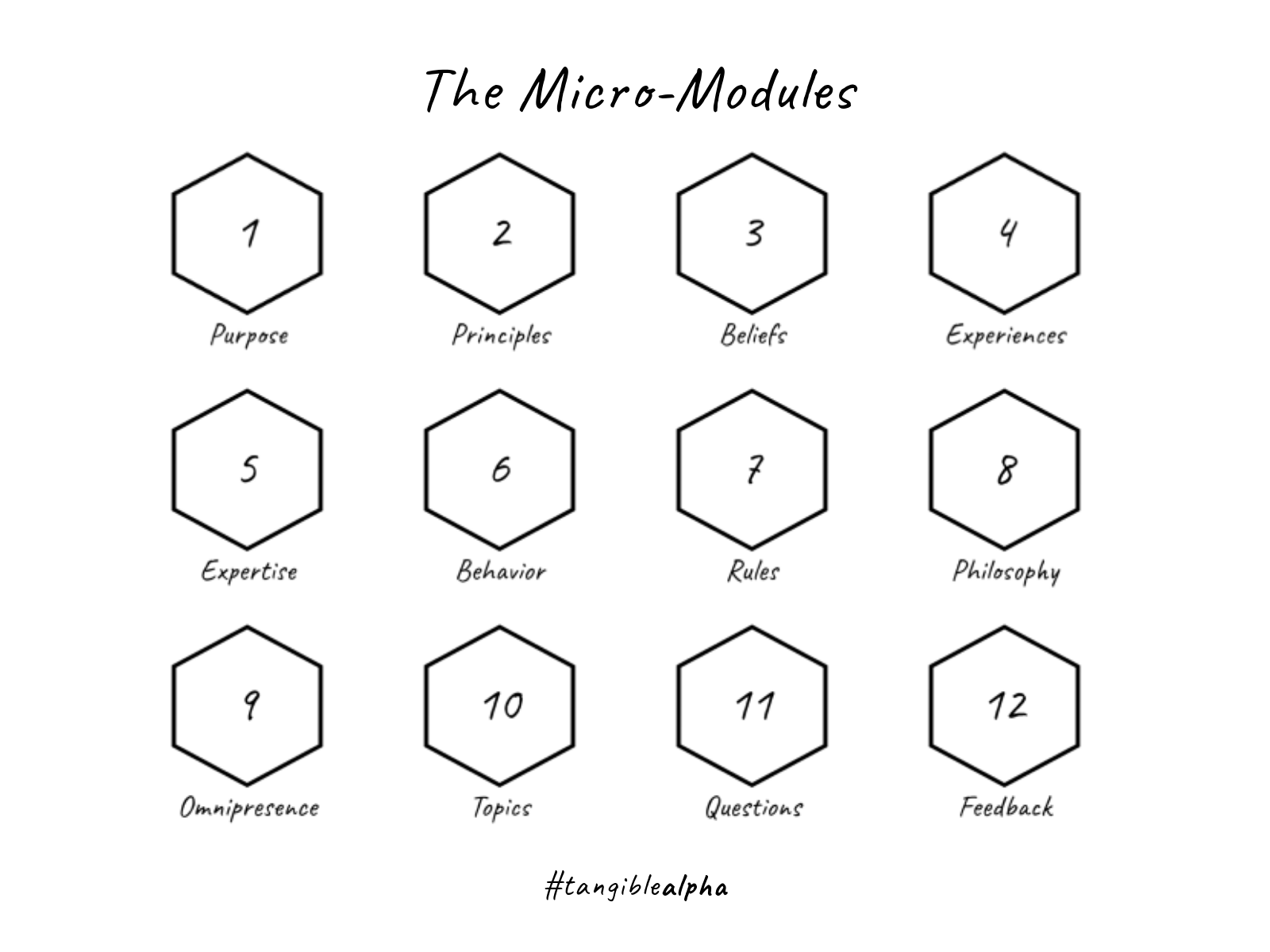

With micro-learning, advisors just need to take a few minutes in their schedule to improve their infinite value that can make them invaluable to their ideal audience for years to come.

Micro-learning is a technique that involves tiny chunks of information, ingested in short bursts of time. This is in-line with the way the brain naturally takes in and retains information, making it an effective way to learn.

It is granular… each lesson serves as its own unit but serves as a part of a larger objective in the progression of your advisor value development.

Incremental Steps. Exponential Results.

After your initial completion of the Infinite Alpha Cycle…You can watch any lesson in any order while gaining a broader perspective on a more dynamic or complex concept.

You can learn from one end of the spectrum to the other, and piece the micro-sessions together to create a whole that is greater than the sum of its parts.

Traditional learning is linear and trainer driven while micro learning is multidimensional flexible and driven by the learner.

This is all about you…We don’t interrupt your life, ever. You don’t have to wait for the rest of the class to catch up. The benefits are unique to you. Stop and start at your convenience. You are in complete control of your advisor value development.

Our modular learning program has been designed to create a seamless flow… from your working-mind to actionable-concepts to tangible-results in minutes.

Make the adaptations required for your business to thrive in a robo-world by learning, in minutes, exactly how to amplify your unique value, control how it is perceived, and maximize your relevance… 24/7.

Micro-Learning is exactly what you need to remain relevant in the new age of financial services. Enjoy the journey!

If you want to discover more about us click here…

Design Your Value for a Robo-World

How To Design Your Value

Remaining relevant is of paramount importance in a robo-world… but how do we get there?

- Staying relevant seems more important than building value… but today’s advisor must first amplify his or her unique value in order to remain relevant.

- The modern advisor can only remain relevant when empowered to amplify significant value in a progression that enables complete control over exactly how advisor value is perceived.

Given what I know today…

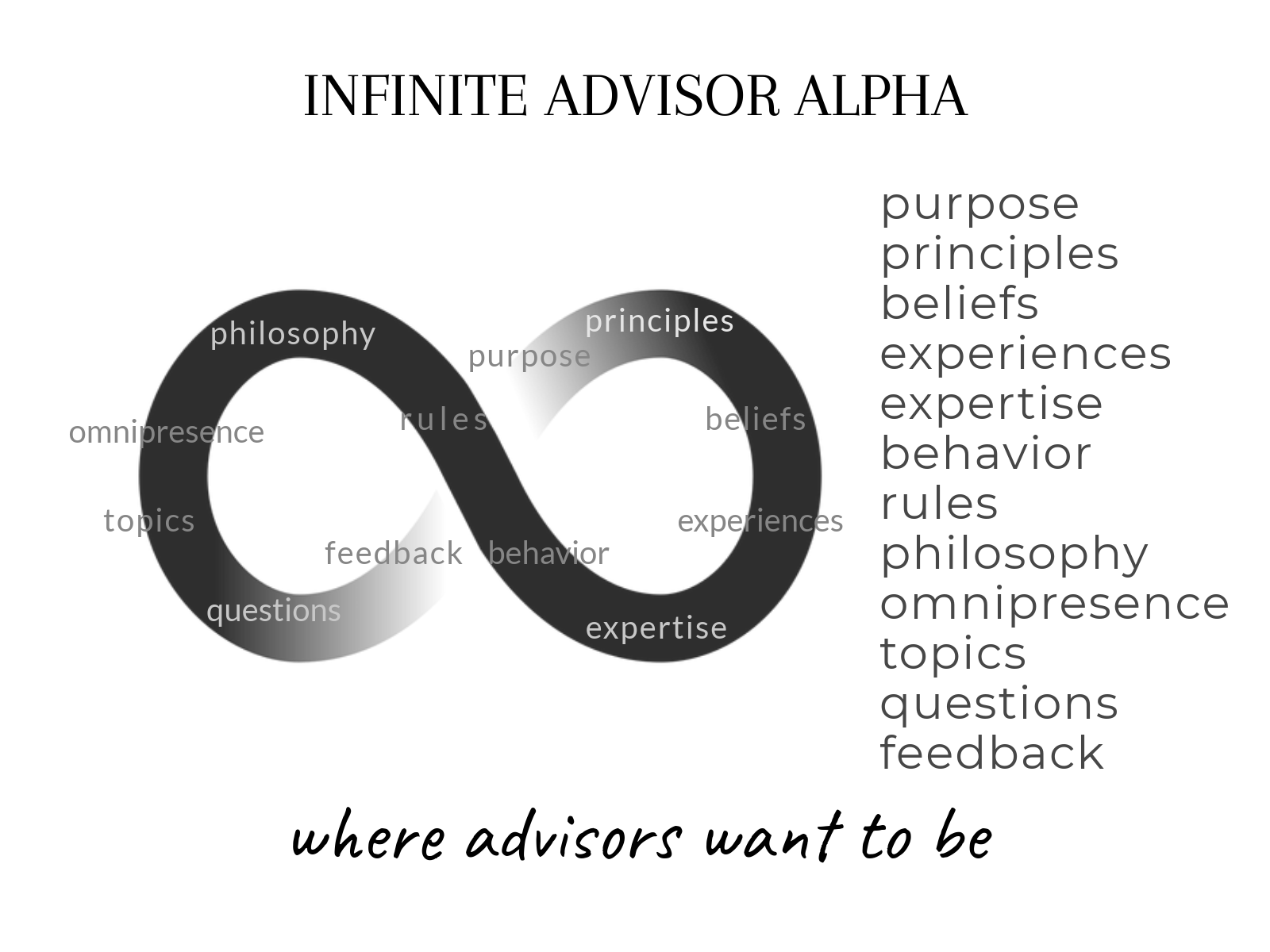

- My purpose has been defined by me as being beyond-profit and client-centered so I may get where I want to be.

My client-centered purpose defines why I do what I do and it is the cornerstone in the foundation of my infinite value development. - My principles and values have been documented by me for publication to help me get where I want to be.

My principles and values have been documented in my own words to demonstrate my character my competency. - My beliefs and opinions have been defined and documented for private introspection so I may get where I want to be.

My beliefs have been defined by me so I can share what I believe to be fundamentally true. My opinions have been documented for publication so I can tangibly demonstrate the genuine concerns I share with my ideal audience.

- My experiences in life have been documented and are ready to share with my audience so I can get to where I want to be.

My experiences have been documented to create meaningful points of engagement between me and my audience. - My expertise has been defined by me in my own words so I can get to where I want to be.

My expertise has been defined in my words to translate exactly what my licenses and designations and certifications mean to my clients.

- I have set standards for behavioral expectations by documenting what my clients can expect from me so I may get to where I want to be.

The behavior that I can promise shines a spotlight on the value I control the most which also holds the most significance in the lives of my ideal prospects and clients.

This has been a summary of what advisors can accomplish in the first six micro-learning modules of Infinite Advisor Alpha.