Meaningful Engagement

The content that you publish must be relevant to your ideal audience…

That’s it.

You don’t have time to generate siloed content to put behind gated walls to gather emails (spam emails) of potential clients to put in a sales funnel to harass with an email campaign that creates a cost center for your business.

Those days are over.

Your content must create meaningful engagement for clients and prospects in one fell swoop.

Your published engagement must cause action… the action for your clients is to stay and continue to pay you. The action for prospects is to leave their current situation for your unique services (if they qualify).

Your position as a trusted wealth steward allows you to publish your beliefs and opinions without hesitation. Your client-centered purpose guides you in the direction of what topics to publish. Your behavior must be promised to elicit reciprocal actions (you promise yours, they promise theirs).

The topics you publish have been designed to lead the engagement to your unique value, but moreover, the unique value you control the most (no compliance required).

The way you see marketing must be different than what we have been taught.

Your marketing campaigns must generate revenue… not leads.

There is no time for legacy tactics in a robo-world.

The progression to generate meaningful engagement can only be found here.

Advisor By Design

They know they can’t be everything for everyone.

They use the word “no” as a strategy.

They are known for the quality of their questions.

They are never complacent.

Their reputation precedes them… digitally.

They have a defined process for their businesses.

They have work / life balance.

They are active philanthropists.

They work only with ideal clients.

They control exactly how their value is perceived.

They realize… their unique value is precisely what makes them relevant.

What is your unique, authentic, relevant value?

Take Control

Focus

The Advisor in the Future

Future Advisor

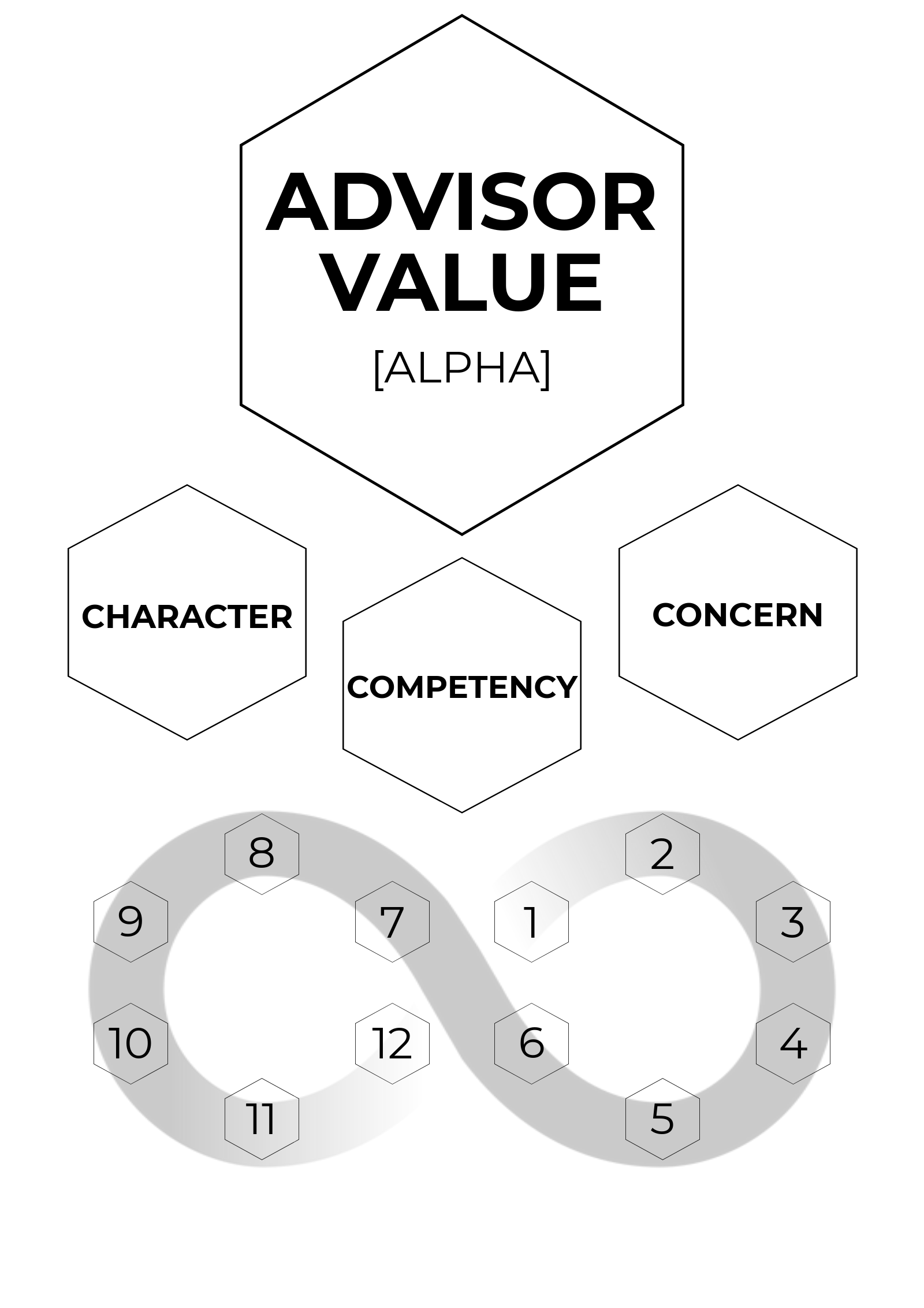

How the digital age of transparency is disrupting the long-time cryptic industry of financial services and exactly how the advisor in the future will create a competitive advantage.

In a robo-world… change happens quickly. Advisors of today must prepare to adapt proactively to become advisors in the future.

Top Down concerns… Shareholder vs. Client-The inherent conflict between shareholder value and client value has never been more readily apparent. (the Goldman rules) Advisors could have both shareholder and client value working seamlessly, but this can’t be accomplished with the status-quo, this paradoxical dilemma will be solved by looking at the business from another dimension… Antiquated industry standards are not cutting it… which is why advisors today are looking for answers to better questions. How can we create shareholder, enterprize or lifestyle value by actually putting the interests of our clients in the forefront?

Client-centered reality… They are picking you… and they are armed with knowledge… In the power shift created by over-empowered investors, how will advisors create a tangible demand for wisdom? The cornerstone of the foundation of the advisor business in the future must be a client-centered purpose… without it advisors don’t stand a chance… Advisors in the future will create powerful purpose statements which differentiate them from advisors who continue to use catchphrases, value props and elevator pitches.

Sales or service… Product sales has its place but not in the collaborative world of wealth-care… Always be closing??? or Always be Collaborating? The days of clients and prospects being sold on advisor selling capability are waning… The advisor in the future will sell the appointment, not the product…

The elevator pitch is being replaced by the appointment script… because prescription without thorough diagnosis is malpractice… advisors in the future will not waste time selling products or services to prospects without first setting the appointment. For the advisor in the future, the appointment is the first “yes.”

Collaboration over consulting and sales… Advisors in the future will be collaborating with clients who are considered trusted partners. The success or the failure of the client portfolio leading to goals and aspirations is a shared responsibility… this is why… The days of selling products in a vacuum are over…Unfortunately, digital marketing of advisor services lands in a category which is being confused with sales… antiquated top-down thinking has created marketing monsters that try to close the deal on contact, putting the reputation of the advisor at great risk in the process. The reality of the digital age of transparency unveils this fundamental truth, the receiver of your digital marketing material doesn’t care about the sales pitch… they don’t even care about the solutions (yet)… they care about their issues.

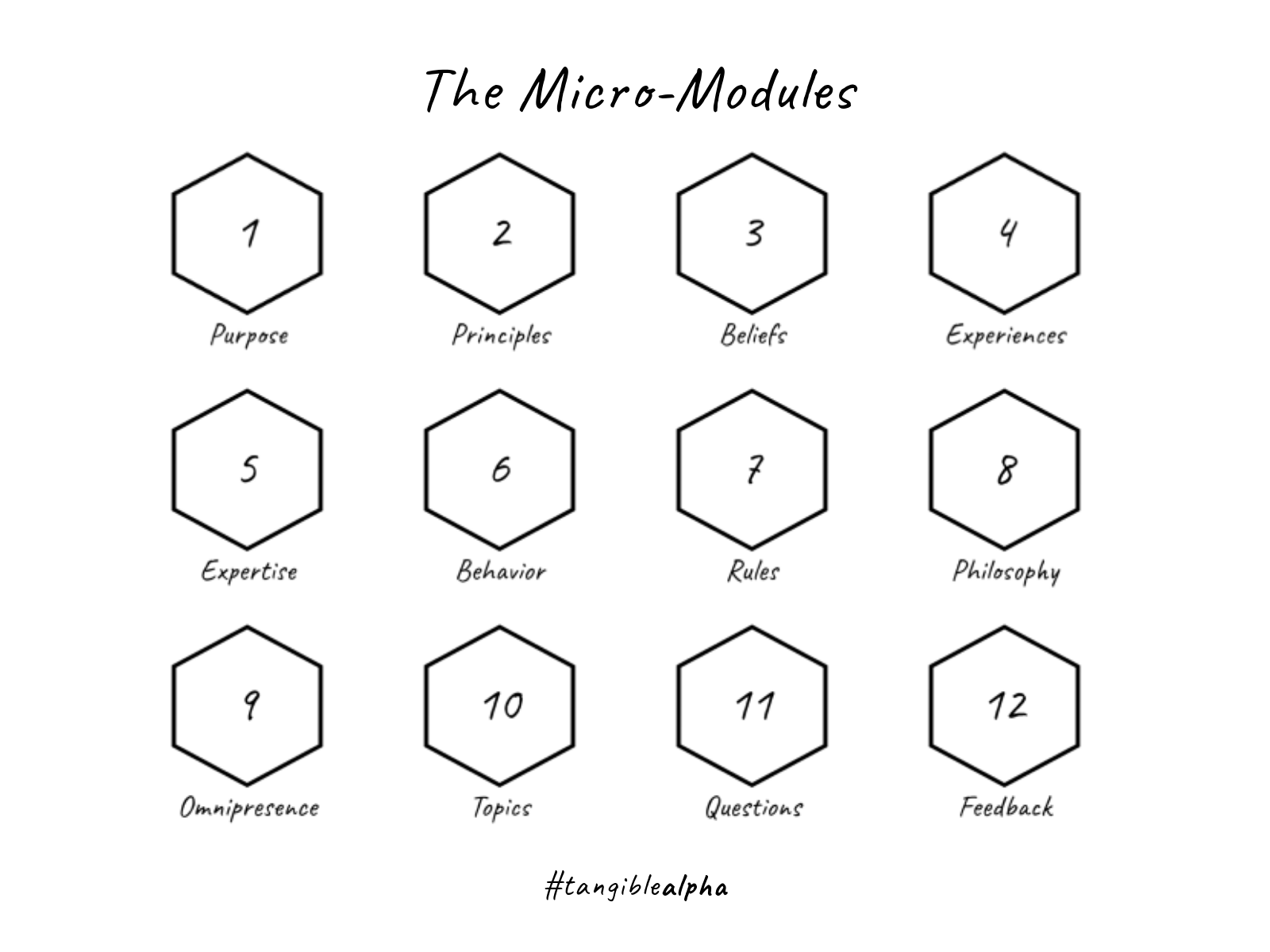

The digital marketing progression for gaining interest from ideal clients is straightforward… here are the issues, here are the options, here are the solutions… If the issue is real to me, then I (the prospect) will discover your options… then (call to action) I may chose your solution if, and only if, it is a good fit for me. Advisors in the future will acknowledge this fundamental truth... they can’t be all things to all people. Advisors in the future will be leveraging this fundamental truth by first defining the solutions they provide when they customize their advisor alpha. Bottom line… there is too much digital noise to “think and do” any other way… there simply isn’t enough time.

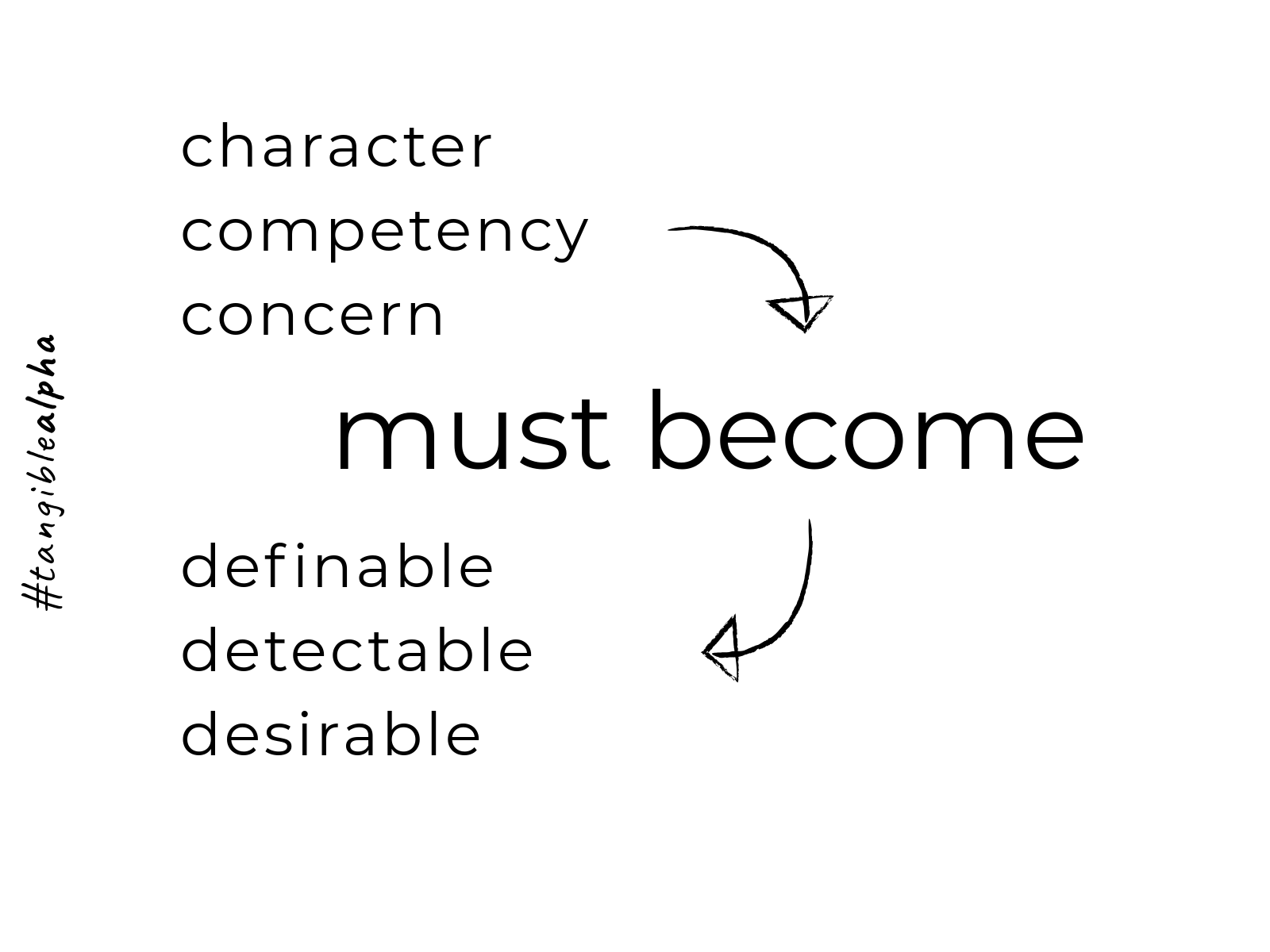

Authenticity Integrity Trust and Accountability… The advisor in the future will understand… they must own perception of their authenticity by owning the words… Not “owning the words” that define their authentic value is tantamount to shuttering their business tomorrow. Their behavior will hold them accountable to the words they own in the digital age of transparency… their digital footprint will become a critical aspect in demonstrating their accountability as part of her or his expected behavior. The advisor in the future will realize…This is the greatest opportunity in the history of time to maximize her or his brand and reputation with a touch of a button…

…this is also the greatest opportunity to ruin a reputation… it takes 1000 Tweets to build a reputation and 1 Tweet to ruin it…

The advisor in the future will customize a formalized progression to develop the content they publish in all forms… the content they publish will be in complete alignment with their beliefs, opinions, values, principles and client-centered purpose… and it doesn’t hurt if it leads to their solutions.

The How… The advisor in the future will become keenly aware of industry issues or “the what.” The web is full of “the what.” In the future there will be a premium placed on understanding and leveraging the HOW. To accomplish this, advisors in the future will require a trusted collaborative partner who can help them with The How by simplifying the complexities that are inherent in the digital age of transparency. Leveraging Tangible Alpha gives advisors in the future a competitive advantage with the opportunity to own the perception of their customized value by creating a filter to turn down the digital noise masquerading as potential tactical solutions.

The advisor in the future realizes…It all begins with a client-centered foundation. Having a strategic foundation in place is a requirement for advisors who wish to avoid old-school tactics that can lead them down multiple paths and put their business at undue risk. To get and keep ideal clients in the digital age of transparency advisors in the future will be leveraging business development tools that simplify “The How.”

It is crunch time for advisors… The advisor in the future understands…To remain relevant and become irreplaceable in the digital age of transparency their competition will be leveraging the Robo Advisor Coach to create customized solutions for their business development needs. They also realize that time is of the essence. Robo Advisor Coaches that recognize the genuine concerns of Advisors and can also provide The How will become an essential component in helping the advisor in the future get and keep ideal clients in the digital age of transparency.

Keep it Tangible,

Grant