3 reasons to nail down your topics for meaningful engagement.

1 Content leads to your unique value.

2 Questions lead to your value to filter.

3 Conversations are competent and add to your confidence.

Your virtual value must be aligned with the human experience.

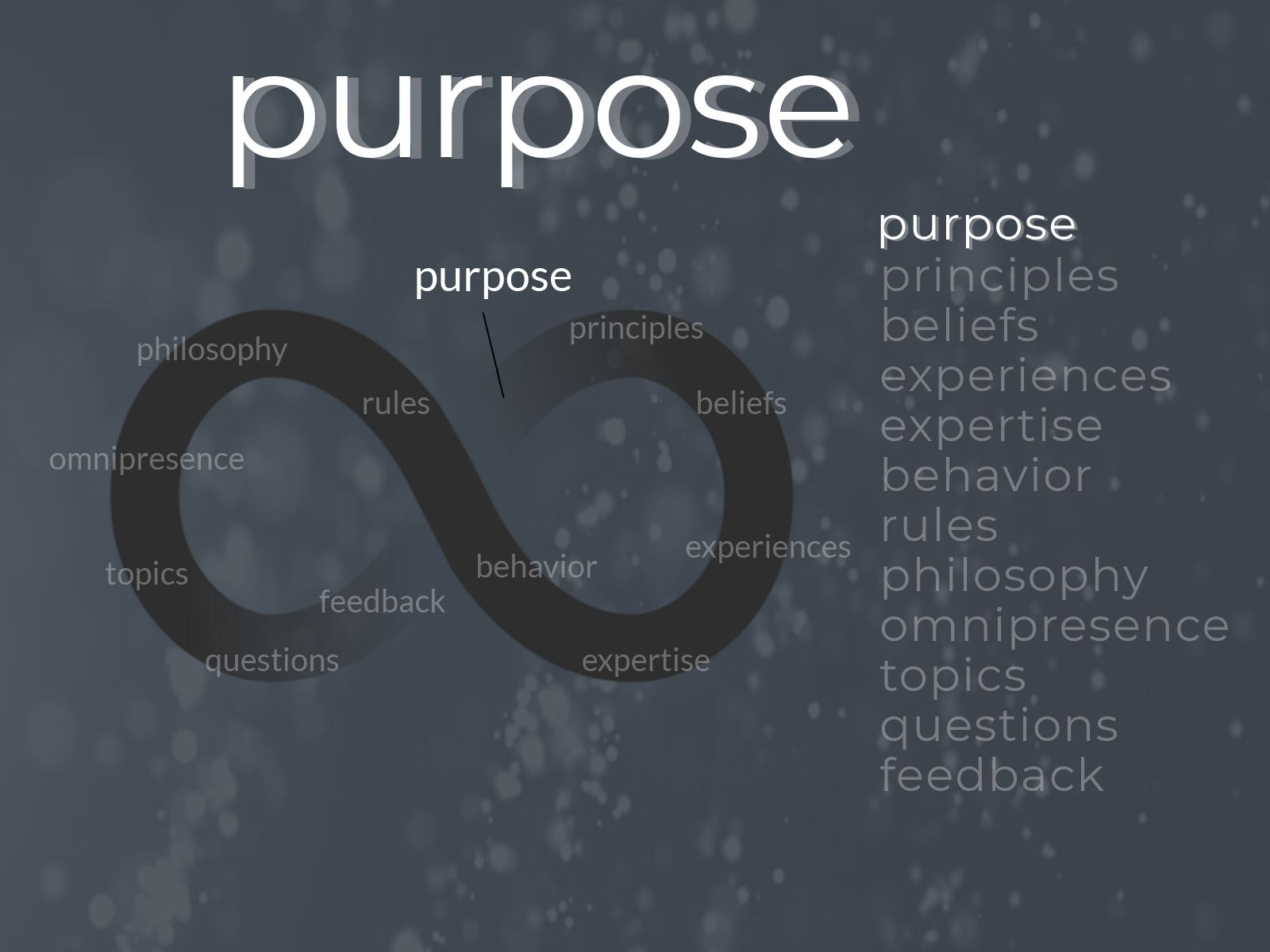

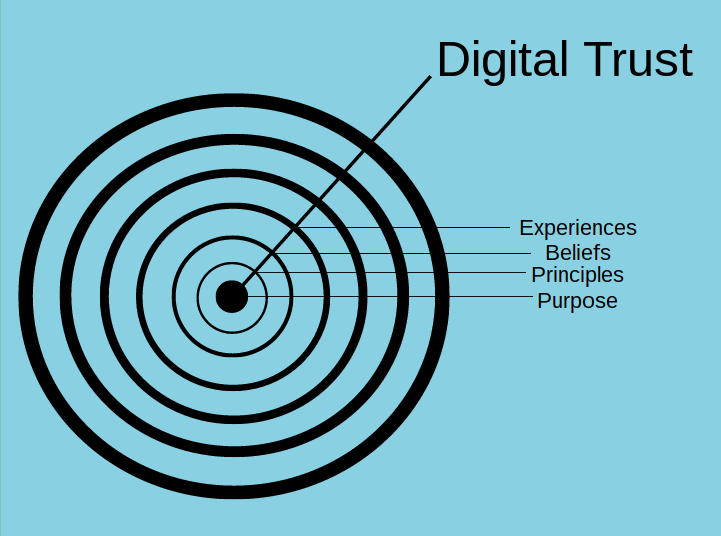

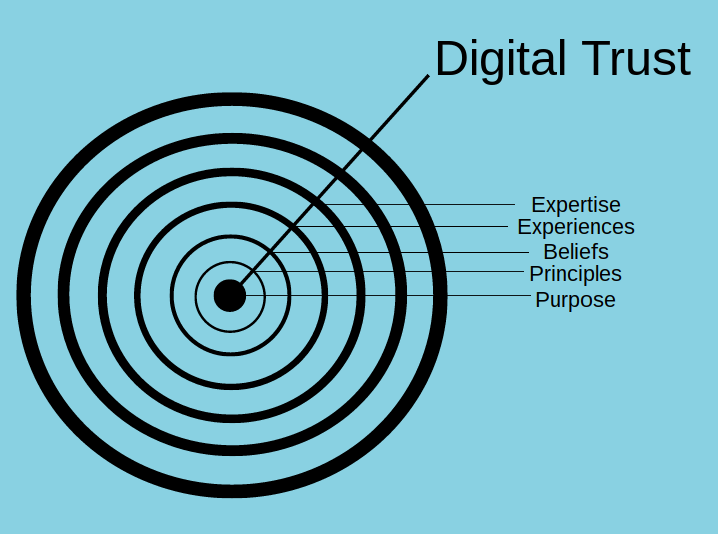

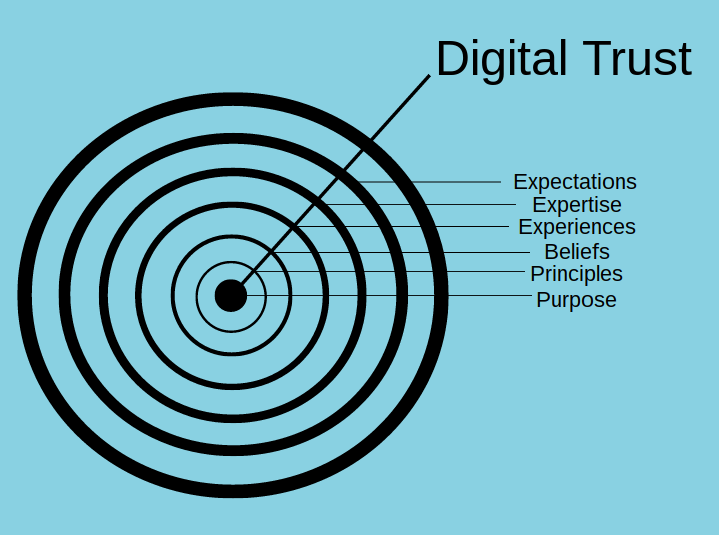

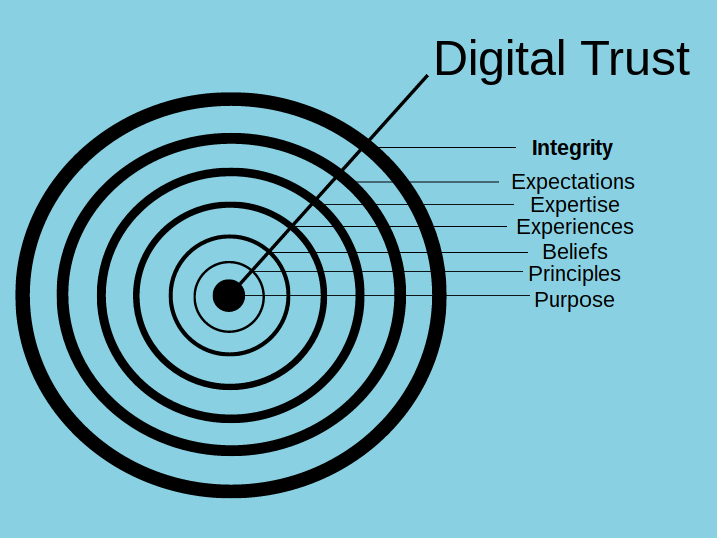

Topics are derived from your purpose, principles, values, beliefs, opinions, experiences, expertise, promised behavior, behavior you expect from clients, your philosophy, and your processes…

Those disciplines of your alpha must be defined (by you) before you can create categories for content topics for engagement and questions that lead to your value.

Topics Tie It Together

The medium is the message. Your digital experience must flow seamlessly with your daily behavior if you want to survive in a robo world.

This is how to do exactly that… quickly.

If you are thinking about outsourcing your content to a third party, think differently.

You don’t need leads for a sales funnel.

You need to filter in prospects and keep clients with personalized topics.

Cookie cutter content will get you washed away.

No more silos.

Your value must become tangible for clients and prospects to see and hear.

Nobody wants to be placed in your sales funnel. Transparency lets prospective clients know exactly what you are up to.

Think Differently.

Own the words. Design your topics. Get and keep ideal clients. In perpetuity.

Conversations that matter don’t happen “off-the-cuff.”

Most advisors have never been afforded the opportunity to discover and define their authentic relevant value… they were hired to sell products. To remain relevant and become irreplaceable advisors are going to have to think differently about their job description. You are going to have to think differently about sales… you are going to have to think differently about service… you are going to have to think differently about your unique value.

-

You can’t have a conversation about the solutions you provide without the courage of your conviction.

-

The courage of your conviction comes from well defined value…

The conversations of most advisors, up until recently, have been centered around either products or the trustworthiness of their firm. But now, the greatest opportunity in the history of financial services awaits you…

Owning The Words That Define Your Value

By owning your value you are creating opportunities to have conversations that matter 24/7

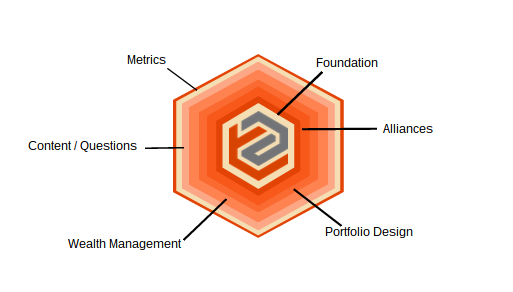

In order to engage in conversations that matter you must have a formalized process in place in which the client experience is never left to question. Your business must become designed to exude your value and leverage all of your resources to consistently improve your client experience while simultaneously engaging in (and improving) the conversations that matter. Essentially, the client experience and the conversations that matter dovetail to enhance the overall development of your business. Owning your Advisor Alpha creates this opportunity.

Once you define your value… you own your Advisor Alpha

Owning your Advisor Alpha and making it tangible nullifies the element of desperation inherent in a business where you can’t exude your value.

Lacking the courage of your conviction to have conversations of your value is the number one killer of all advisor client relationships… If you can’t put into words why your clients should be paying you, you will neglect them… and neglecting your clients is still the reigning champ of client defection.

They need to feel it… and you need to know how it makes them feel… Tangible Alpha.

If you don’t own the words that define your value you will be destined to attempt to become a version of “all things to all people.” This version of you fails eventually… and this version of you fails more rapidly in a robo-world.

Not owning your value will be the number one reason behind your failure… hourly, daily, monthly failures will ensue… and eventually, not owning your value will be the end of your advisory business.

You must first own your value before you can engage in conversations that matter.

Owning the words that define your value enable you to create a business in which your conversations fuel the client experience and the client experience fuels the conversations that matter. Owning your Advisor Alpha and making it tangible will drive the success of your business in the future… by design.

Ponder This…

How can you escape the trap of client defection due to advisor neglect? How can you empower all trusted partners to have conversations with the courage of their conviction? How will you remain relevant and become irreplaceable?

ors to empower them by allowing the to own the perception of their value. Otherwise the pending crunch that is spearheading commoditization of services and reducing margins (including NIM) will destroy the firm and the industry.

ors to empower them by allowing the to own the perception of their value. Otherwise the pending crunch that is spearheading commoditization of services and reducing margins (including NIM) will destroy the firm and the industry.