Beware of The Reverse-Churn

Advisor Beware

Reverse-Churn

Advisors must be able to justify their value to charge fees in a robo world.

In the digital age of transparency, financial advisors can’t afford to have their reputations sullied by insinuations or accusations (or litigation) tying them to the unseemly act of reverse-churning accounts of unwitting clients.

If your not sure what reverse-churning is… ReverseChurn.com

The process of the value that the advisor brings to the lives of his or her clients must be made tangible for digital delivery, consumption, refinement, and verification.

To validate the fees advisors must begin to charge, in lieu of commissions, deep introspection of unique advisor value is requisite for survival in these changing times of financial services.

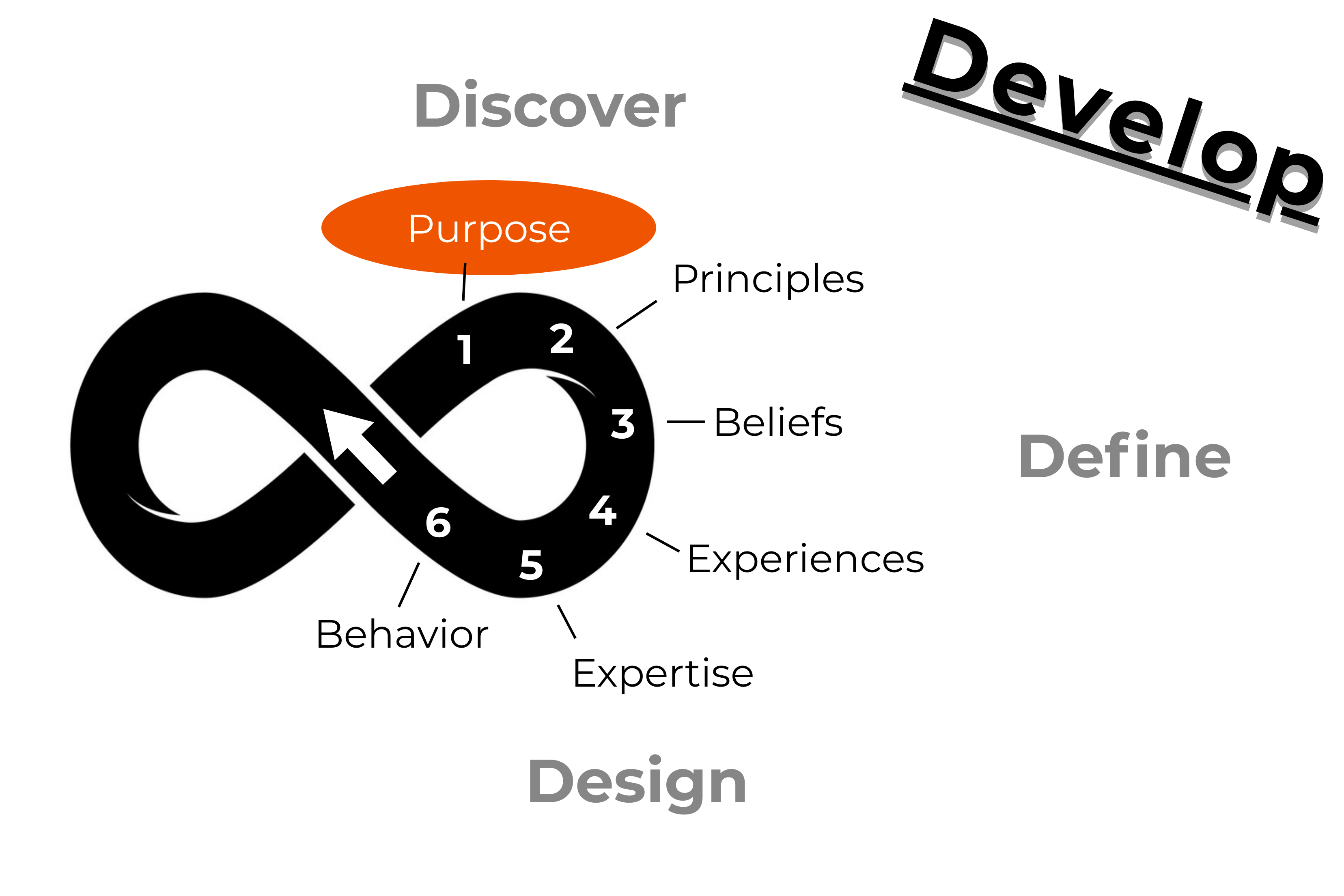

The best way for advisors to grasp this concept is by beginning to structure their businesses from a perspective of purpose. They must acknowledge a shared-purpose with their ideal audience to convey precisely why anyone should trust them with their wealth.

Once the cornerstone of a client-centered purpose is defined, a purpose-driven business model is the best way for any advisor to survive and thrive in this modern robo-world.

To avoid the heartache of the reverse-churn, start building your business on purpose.

Tap or click the image below to go to the purpose-driven branding modules of Tangible Alpha created by Grant Barger.