Adapt and Survive

It’s very important that you are able to challenge yourself to think differently on a daily basis so that you can remain adaptable to the ever-changing landscape of financial services. It’s equally as important to be able to challenge yourself in a 100% confidential platform. No one is looking over your shoulder, no one is judging you. This is the opportunity for you to take complete control of your business. Build on purpose at TangibleAlpha.com It truly is nobody’s business but yours.

Curated Article

Last week in Newport, Rhode Island I was reminded of what a healthy and robust economy we’re currently living in.

On a quiet Tuesday night, the restaurant we dined at, The Mooring, was anything but quiet. There wasn’t an empty seat in the place. We saw tables turned over multiple times and a constant lineup of eager diners with no reservations anxiously hoping a spot would open for them.

Nearly every great restaurant was experiencing the same. In fact, if a business didn’t have this type of demand, we could make an argument they were likely doing something wrong. As one person at my meeting said, “It’s almost hard to NOT to succeed in this market.”

That restaurant reminded me of one of the “classic” questions from the marketing world: If I were to ask you, what’s the single most valuable competitive advantage a company can have, what would you say?

Some would answer by saying money, or proprietary technology, or a monopoly.

The late Gary Halbert, a famous, contrarian direct response copywriter often wrote that the single most important competitive advantage any business could have was a “starving crowd.”

Halbert argued that the only competitive advantage you needed was an audience, hungry and salivating for your products and services. These restaurants were getting it right.

I love Gary and have often talked about him in my Tidbits, podcast, and while working with clients.

But in this case, Gary was wrong.

Sure, a metaphorically hungry, starving crowd is important, and many businesses have done a fantastic job cultivating that type of audience, but what about the rest of the companies out there?

What about companies facing industry-wide disruption from the Amazons of the world?

My friend and colleague, Colleen Francis, who consults for some of the biggest firms in the Fortune 100 suggested the single biggest threat she sees all clients facing, in nearly every sector, is literally Amazon.

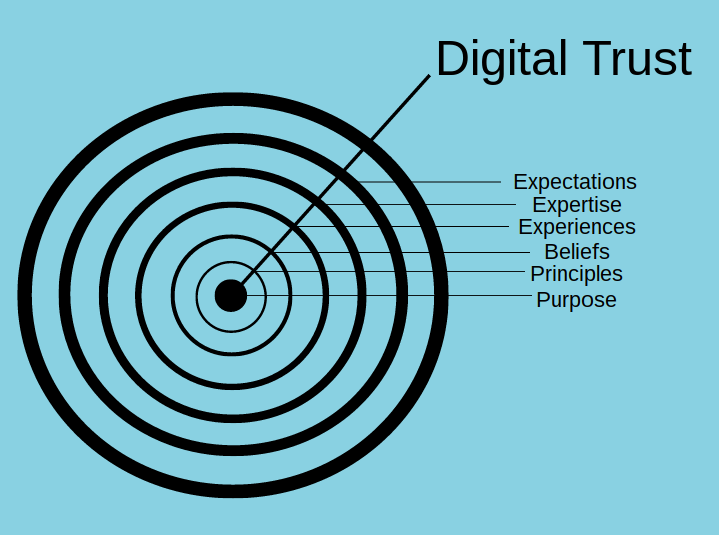

She calls the phenomenon the “Amazonification of Sales.” Colleen says that clients in every sector and every industry now expect the Amazon experience. They’re going online and price shopping. They expect fast turnaround times and speedy delivery. And they expect it, regardless of what you’re selling – even if you’re selling a 2 billion dollar piece of heavy manufacturing equipment, or making a multi-million dollar licensing sale.

I see this outside the Fortune 100 and in my privately-held midmarket clients all the time. They’re all facing customers and clients with exceedingly increased expectations almost solely because of their experiences with Amazon.

And this is why Gary was wrong. The single most important competitive advantage a business has isn’t a starving crowd.

It’s the ability and willingness to change.

It’s getting harder and harder to win with “what got you here.” The strategies and successes of your past can, if you’re not careful, create your downfall. (Consider Blockbuster passing up on buying Netflix).

As one of my colleagues said last week which I thought was brilliant, “If it can happen to #generalelectric, it can happen to you. Nobody is immune.”

So here’s a question for you to consider.

Are you experimenting with enough change?

None of us have even a smidgen of the resources available to Amazon, but it doesn’t mean we can’t be changing at a similar speed.

For example, Amazon, Google, Apple and others are famously known in business circles for innovating through small teams and constant micro-experiments running all the time.

What experiments are you running in your business?

What processes are you engaged in changing or improving?

What can you change about your sales process, your customer experience, your decision-making process, etc?

There’s enormous pressure in the business world to optimize for results today. But the magic lies in optimizing for today while innovating for tomorrow. Excellent management can balance those objectives carefully.

Your Challenge For The Week: Devise a low-risk experiment you can run for a short time and share it with me.

Here are a few examples.

If you’re a VP of Sales, consider a new step or reducing steps in your sales process.

If you’re in charge of #customerservice, devise a new way of handling complaints, criticism, and feedback.

If you’re in charge of #customerexperience, consider testing something new as part of the customer’s post-purchase experience, or try testing a new way of caring for customers in a retail environment.

If you often launch new products into the market, try pre-selling those products before launching them.

The key is to make your experiments low-risk, and low-stakes, but enough to help you change, pivot, adapt, remain relevant, and thrive well into the future.

As a bonus challenge: Ask all your subordinates (VP Sales, CMO, CFO, etc.) to make a list of all the processes, tasks, and repetitive things the company does on a regular basis. If you asked why they’re done in a certain way, and the response is, “Well, that’s the way we’ve always done it….”

Start there.

Build On Purpose (3/3)

Building Your Business On Purpose Empowers You

In this three part blog post I am attempting to simplify what I have known to be fundamentally true about advisor value design for the past three decades… It can be tricky sometimes to simplify the complex.

This is part three of three. We pick up where we left off in part two…

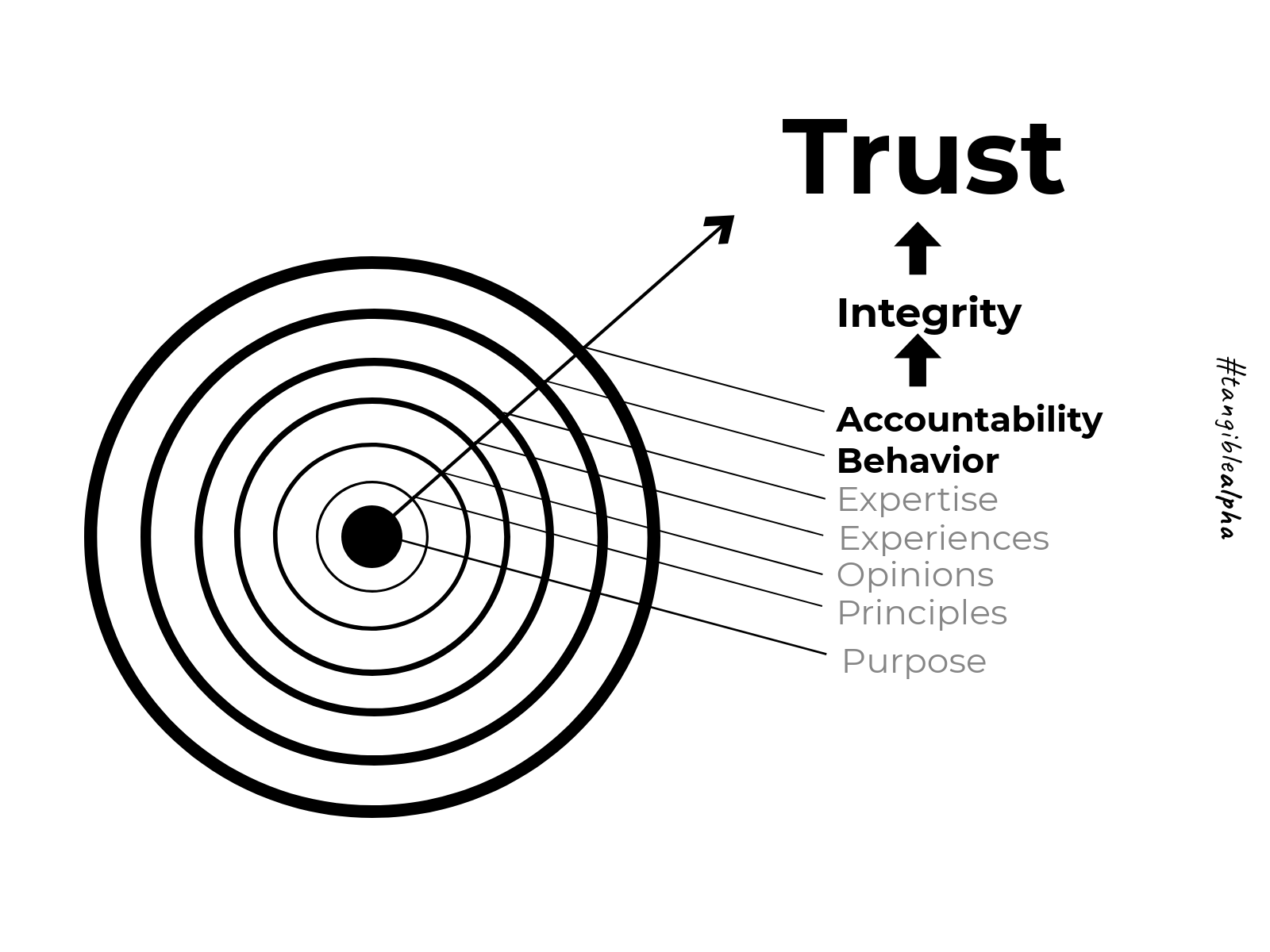

A big part of what I do is trying to simplify what I have learned over the past 30 years in the financial services industry. The models and slides that I share freely can be the biggest piece of the puzzle for some advisors looking to break out of the opacity of the industry designed “black box” that defines advisor value. Building on purpose is a metaphor for doing the right thing all the time but it also can be physically modeled to demonstrate how a progression of value design can justify value while empowering advisors to take complete control over how their unique value is perceived. The big picture for advisors in the new digital age is control over perception… if you are an advisor you must become responsible for the definition and perception of your advisor alpha (advisor value). If you are counting on the industry to do this for you, you will be replaced by the industry.

Previously in parts one and two we touched on the purpose driven model to demonstrate exactly how advisors can ultimately promise their behavior.

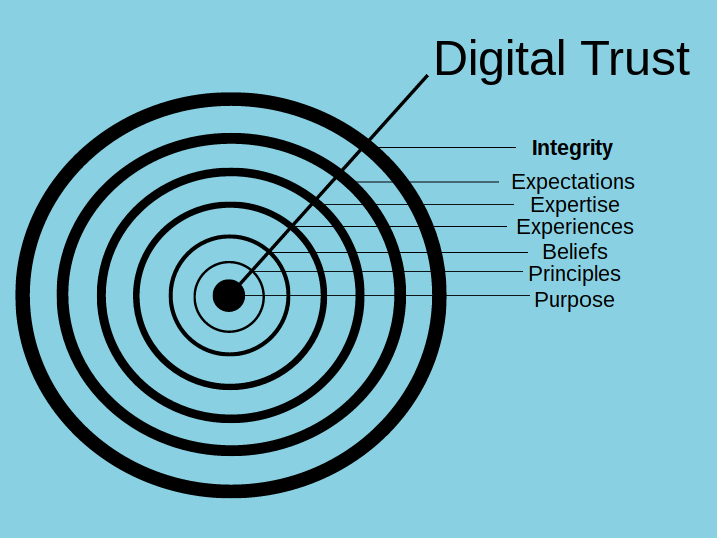

Your relevance hinges on your ability to promise your behavior. By promising your behavior you are able to get and keep ideal clients with your digital filter. By promising your behavior you’re able to control the perception of your relevance. By promising your behavior you’re able to demand reciprocal actions from your trusted clients. By promising your behavior you’re able to gather feedback that matters. Your promises tied to behavior leads to the value that you control the most which allows you to take complete control over the perception of your value.

Earning trust controlling perception and creating collaborative relationships are the three main elements that are required for survival in a robo world.You must be able to promise your behavior to create that culture by design.

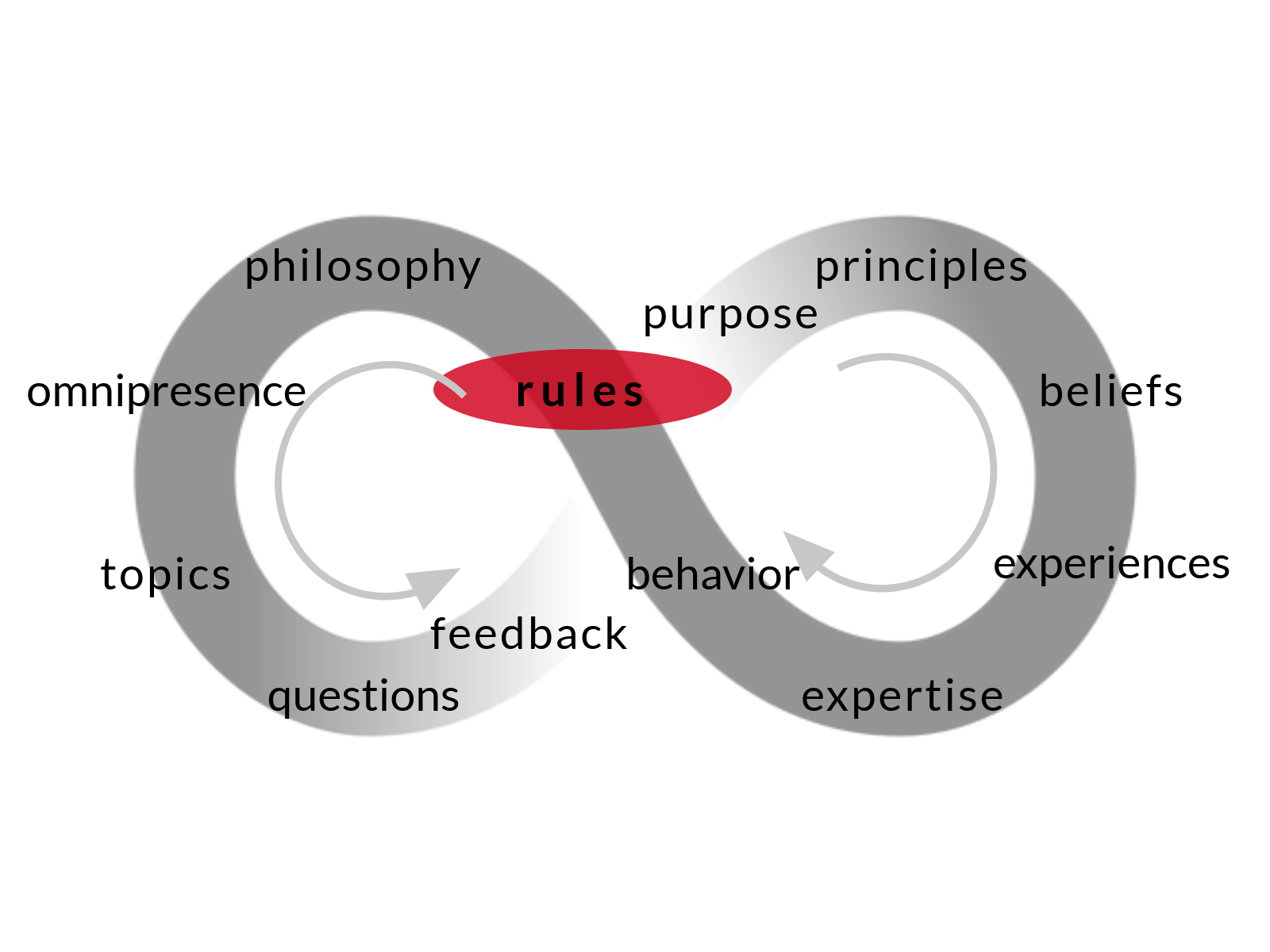

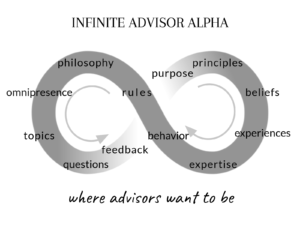

The progression of infinite advisor alpha empowers advisers to promise their behavior so they may remain relevant in a robo world.

We are now shifting from the slides that model how to earn trust by promising behavior to the infinite progression of advisor value development which empowers advisors to get and stay exactly where the want to be… a state of perpetual relevance.

Amplify the value that you can control. Take complete control over how that value is perceived. And maximize your relevance to get and keep ideal clients in a robo world.

This is what it means to build on purpose.

Earn trust, promise your behavior, demand reciprocal behavior, create trusted partners as clients, make your value tangible, gather feedback, continue to amplify your value and your business, and live your preferred life.

In order for your business to have a positive change 30 days from right now, you must start making incremental changes daily. And those incremental changes must add up in a way that makes sense. Your focus must be appropriate the system you choose to maximize your relevance must make complete sense and you must carry the discipline that it takes to make incremental improvements daily.

Organized

Efficient

Simplified

Driven

Realistic

Interesting

Fun

Adaptive

On-point

Relevant

Healthy

It’s all about you.

This is where you want to be.

Ultimately you are earning trust by becoming accountable because you’re able to promise the behavior that leads to the value that you can control the most. Which is exactly why your ideal audience should be paying you.

Build your business on purpose.

Build On Purpose (2/3)

Trying to Break Down the Fundamentals of Value Design Can Be an Overly Complicated Endeavor…

In this three part blog post I am attempting to simplify what I have known to be fundamentally true about advisor value design for the past three decades… It can be tricky sometimes to simplify the complex.

This is part two of three. We pick up where we left off in part one…

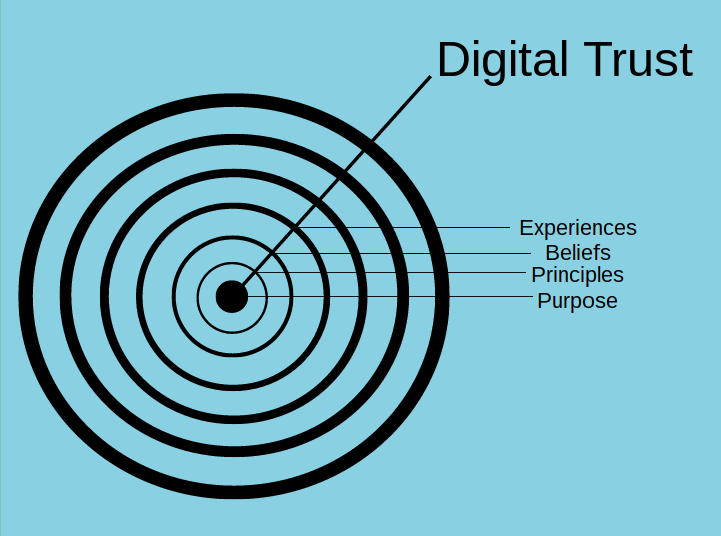

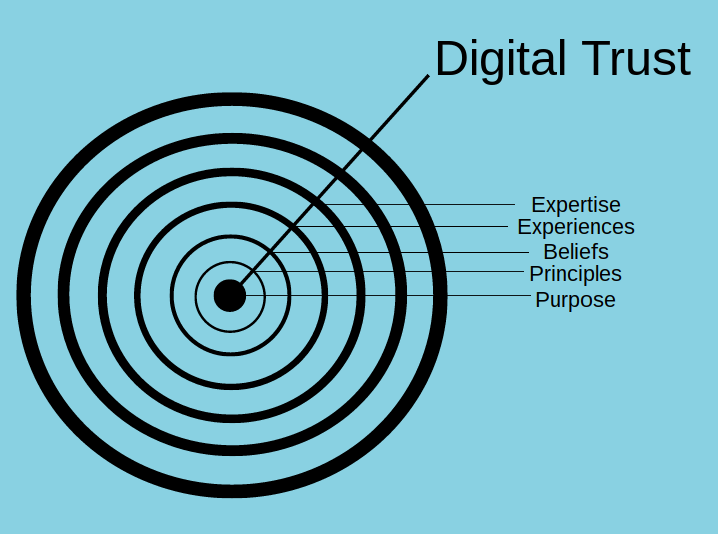

After you are able to define your client-centered purpose and publish your values and principles, as well as document your beliefs and opinions about your unique value… (seems complicated but we make it easy). You are ready to share your experiences your expertise and promise your behavior.

These are the activities required to connect the dots between the collaborative behavior required by your trusted clients and the behavior you can promise as a trusted advisor. Remember, this is about three main things.. Earning trust, controlling the perception of your value, and setting collaborative rules to remain relevant.

The progression of your value development must be acknowledged as part and parcel with your value design… in other words, how you design your value becomes a part of your value design.

The simplification of the Infinite Alpha Progression allows you to make incremental additions to your overall success by continuing your exponential engagement with clients and prospects.

Each one of the elements shown on the slides included is a fundamental discipline that requires your attention daily to meet the demands of exuding your value exponentially every day. When combined in a variety of ways, the disciplines of your value are the building blocks of your relevance. They work together in conjunction to empower you. The progression gives you the luxury of saved time while you attend to the daily actions required by you to survive, while giving you the opportunity 24/7 to build your business on purpose.

Build On Purpose (1/3)

Three Simple Reasons Why Building On Purpose Is Critical

- It Empowers you to earn trust quickly in a digital world.

- It allows you to highlight the value you control the most. (Perception)

- It sets the standard for behavior in collaborative relationships.

What does it mean to “Build on Purpose?”

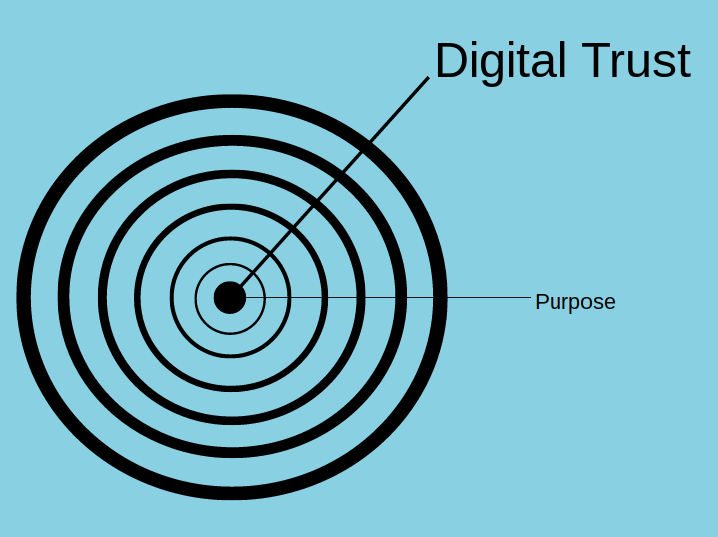

When your client-centered purpose has been defined by you, it empowers you to earn trust quickly in a digital world. This tangible demonstration of your shared interests with your ideal audience is the cornerstone of your unique foundation of trust. The words you choose to define your purpose must carry the weight of the seriousness of your calling… in other words, your purpose can’t be a catchphrase.

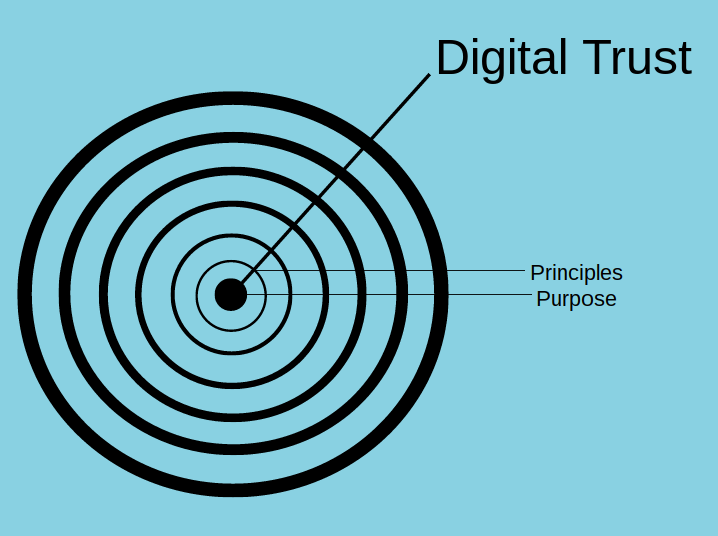

When you are able to align your purpose with your principles and values, you are beginning to demonstrate your integrity in a tangible format.

This is my purpose… these are the principles that have helped me form my unique purpose… these are the values that I hold dear… they are connections that must be published by you to demonstrate connecting points with the behavior that will be promised by you and your clients.

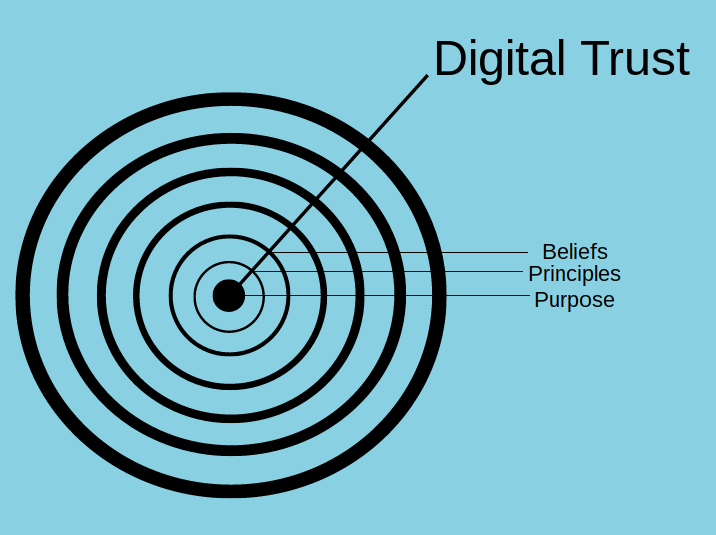

Your beliefs and opinions must be demonstrable as well. After all, they are why you get paid in the first place. If you aren’t forming beliefs and opinions about this industry and the value you provide to your clients, you aren’t really in the business of financial advice.

These are my beliefs… I state them as being fundamentally true because that’s how strong my conviction is around the decisions I make daily. My opinions are published in the form of genuine concerns that I have for my clients.

Your purpose principles and beliefs must be in complete alignment and you must be able to prove that alignment tangibly to survive in a robo world.

Advisor Benchmarks

Originally Published 12.27.2016

Building a digital footprint is critical in the era of collaboration.

Everything that you publish, whether it be in the form of comments as in this article, or in the form of blog posts as seen here on this blog post… or a combination of the two, curated to bring meaning to my beliefs and opinions in a tangible fashion. This blog post is a working example of HOW to leverage your digital footprint by exuding your authentic value 24/7. Your ideal audience will find you so you had better be publishing with a purpose.

The Future for Advisors is about proving value. 24/7.

When Advisors allow any other entity besides themselves to define their authentic value they diminish the chances of survival and hinder their plans to thrive in the digital age. You mustn’t allow your plans to thrive in the digital age be undermined by anyone… much less yourself. Avoid self-sabotage by reading on…

The advisor in the future must look beyond industry standards and minimum antiquated regulation to demonstrate in a tangible fashion why anyone should do business with them Pertaining specifically to this article, (Original Article from RIABiz.com) the advisor who relies on the industry to demonstrate his or her value through a benchmark is more likely to be replaced by the industry. Advisor autonomy goes beyond the realm of value props.. In order to thrive in the digital age of transparency advisors must own a “client-centered purpose.” Technology and transparency will weed out the ne’er do wells. It’s already happening without (and in spite of) regulation. Clients are becoming more empowered through transparency and technology , which is a beautiful thing. Advisors must also leverage the same transparency and technology to empower themselves.

You can’t police advisors into stewardship roles.

Any form of industry standard benchmark weakens the advisor… it does nothing to empower the perception of value, which is under the complete control of the advisor… more specifically, the advisor who owns a client-centered purpose. – Most advisors are good.-(Especially those advisors who subscribe to RIA Biz.) More industry drafted oversight is only adding to the digital noise. Advisors must become empowered through autonomy to thrive in the new collaborative world of 24/7 advice. My opinions about the facts in this article are backed by my conviction about HOW advisors can and should become empowered. Advisors must be afforded the opportunity to exude their authentic value through – ownership – of the perception of their value. Acquiescing to antiquated industry standards that limit the ability of the advisor to own the perception of his or her value, in my opinion, is a catastrophic mistake that can and should be avoided. Now, more than ever, investors are searching for a trusted source of wisdom. Advisors who are empowered through autonomy will be more likely to exude that wisdom than those advisors who agree to become suppressed by industry created benchmarks. ((BTW, this is a great article that shines a much needed light on the difference b/t portfolio alpha and advisor alpha. Keep ‘em coming.)) This article is an important component in moving the conversations away from the “what” that most RIABiz readers are already well aware of.

The comments after the article (found in the link above) are nearly 2 years old… and there they sit… Conveying my unique beliefs and opinions about this business.

If advisors rely on the industry to define their value will they be replaced?

Who do you trust?

Who should your clients trust?

Better conversations start with questions that lead to better definitions which lead to better solutions that can truly make a difference in the lives of trusted clients…

By posing these questions I am reminding my current ideal clients of my authentic value while exuding my alpha to a new audience who is looking for a trusted source of wisdom to help them see hear and feel about their business in a different dimension. The perception of my value is entirely up to me. There has never been a greater opportunity for advisors to take advantage of technology. By ignoring this statement you risk extinction… discover as much as you can as soon as you can.

#TangibleAlpha

Always available when the time is right for you.