Rethinking Advisor Alpha

Rethinking Advisor Value

Think Differently

Challenge YourselfBeware of The Reverse-Churn

Advisor Beware

Reverse-Churn

Advisors must be able to justify their value to charge fees in a robo world.

In the digital age of transparency, financial advisors can’t afford to have their reputations sullied by insinuations or accusations (or litigation) tying them to the unseemly act of reverse-churning accounts of unwitting clients.

If your not sure what reverse-churning is… ReverseChurn.com

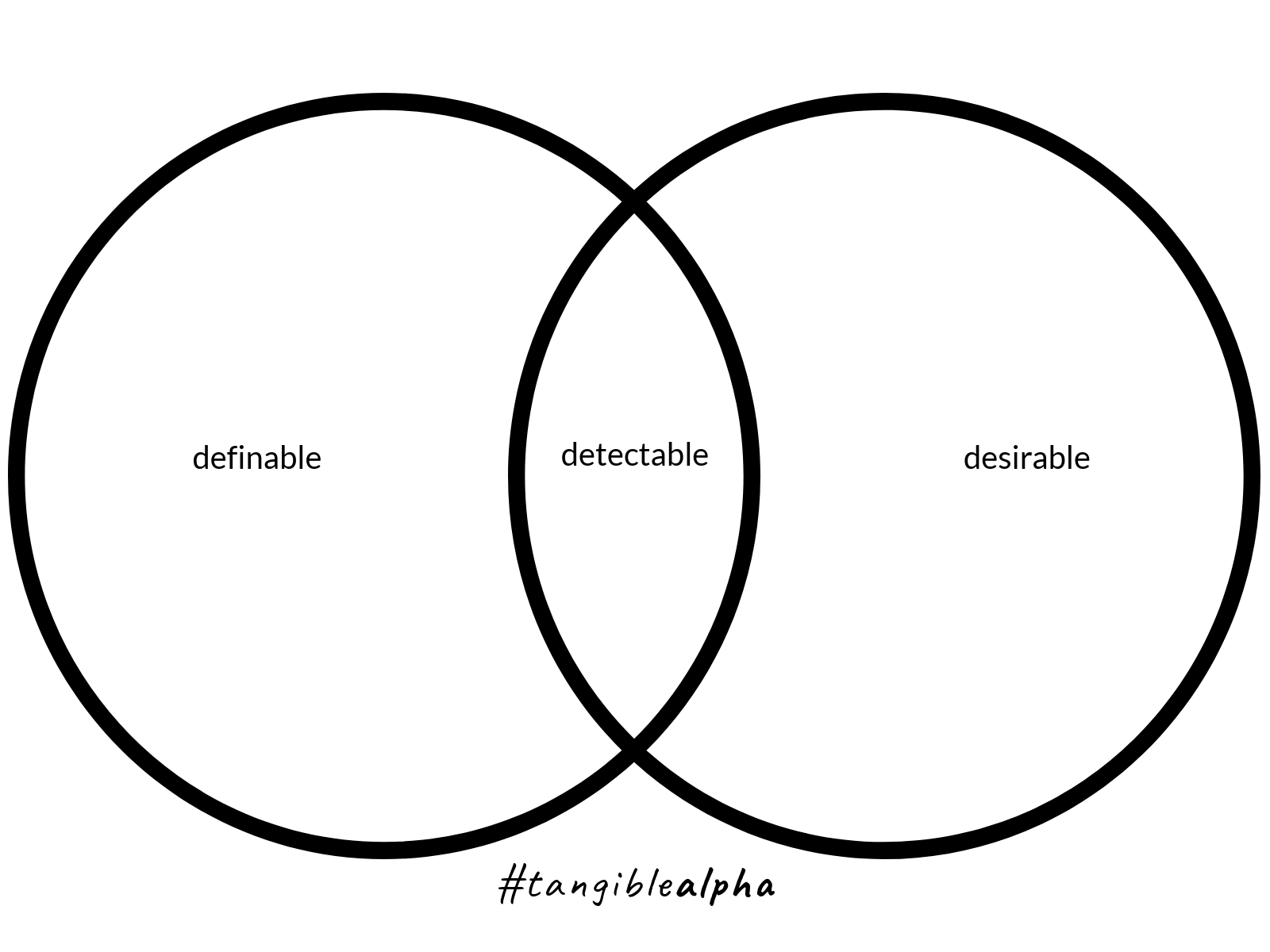

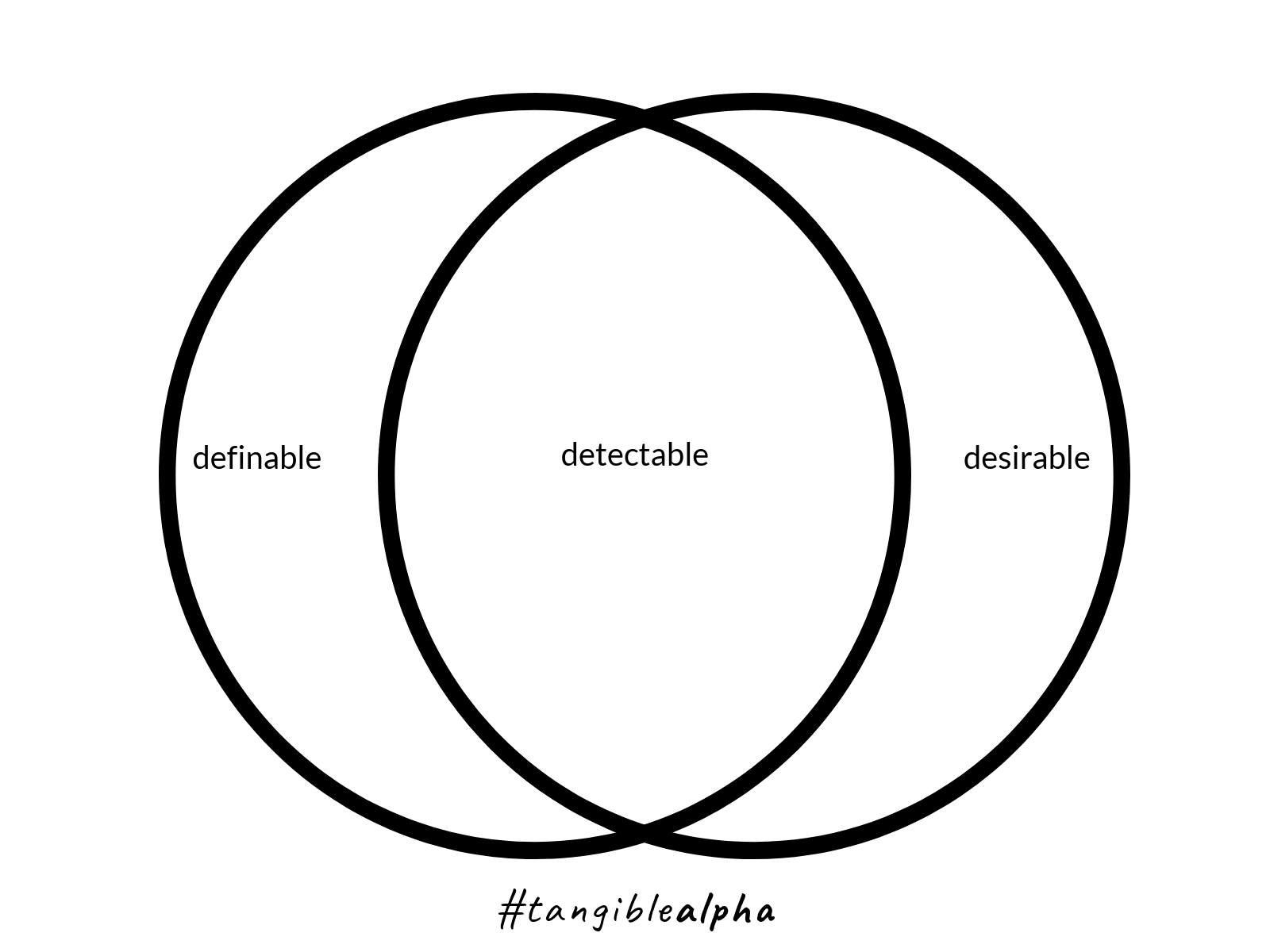

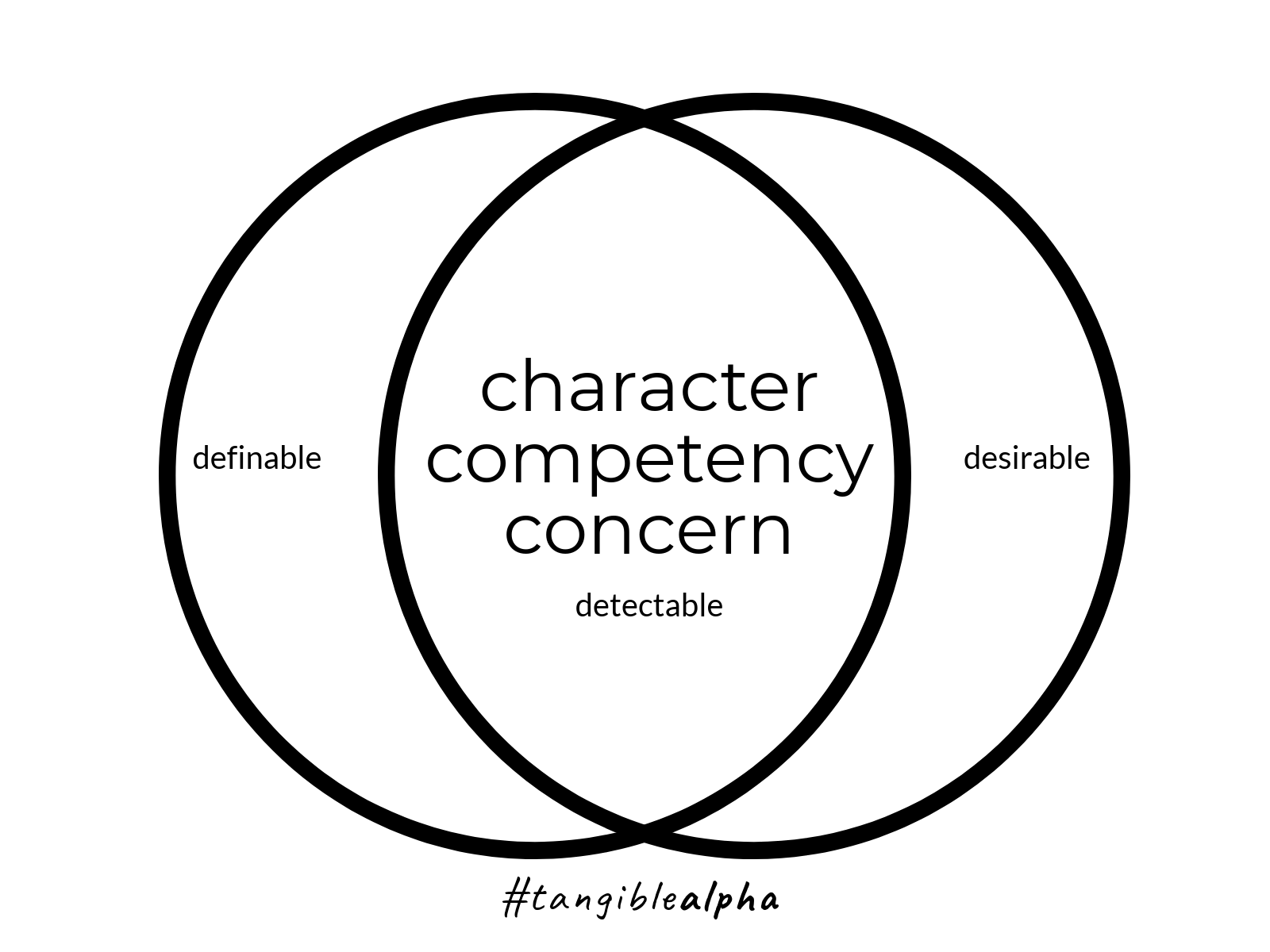

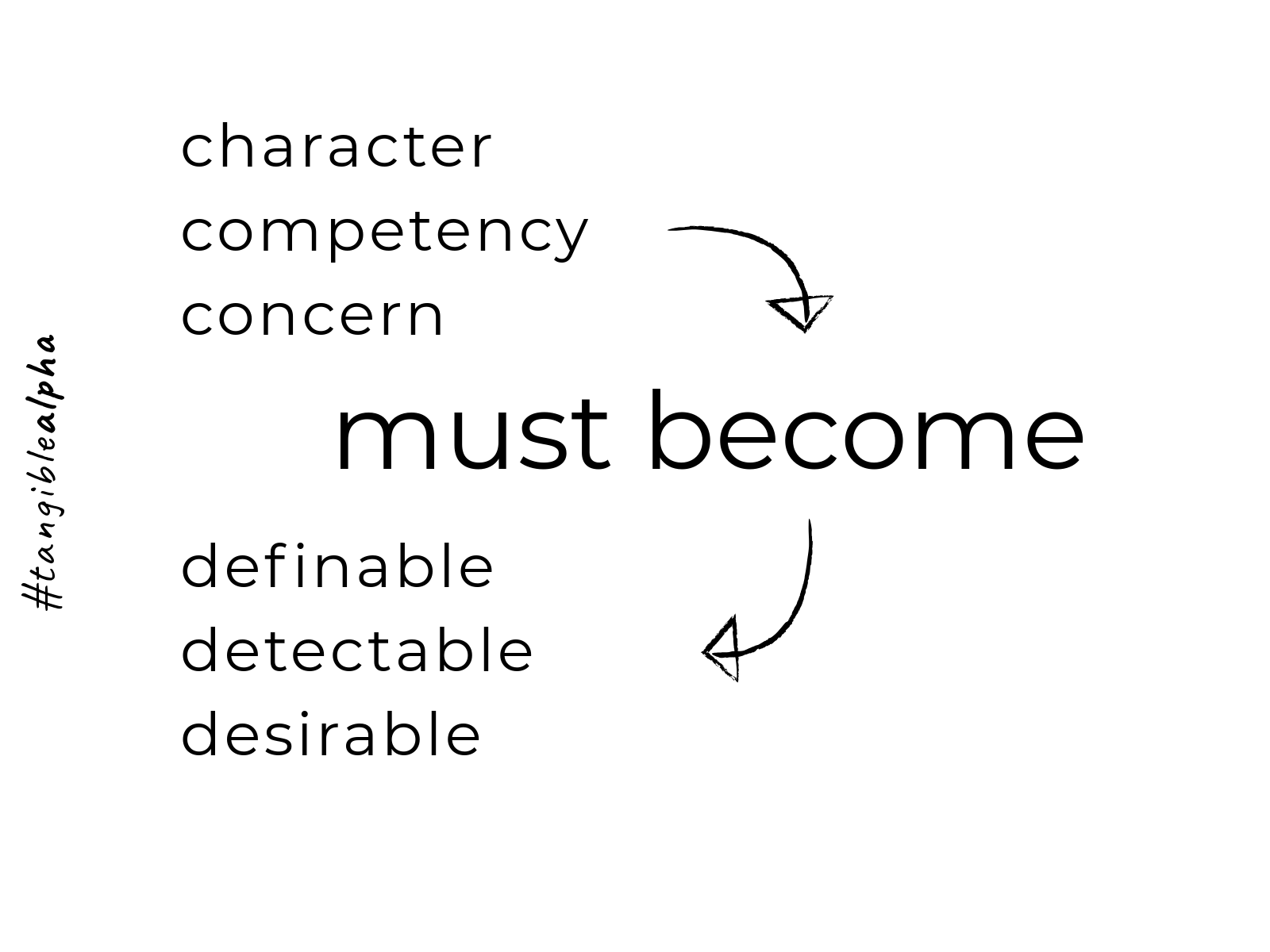

The process of the value that the advisor brings to the lives of his or her clients must be made tangible for digital delivery, consumption, refinement, and verification.

To validate the fees advisors must begin to charge, in lieu of commissions, deep introspection of unique advisor value is requisite for survival in these changing times of financial services.

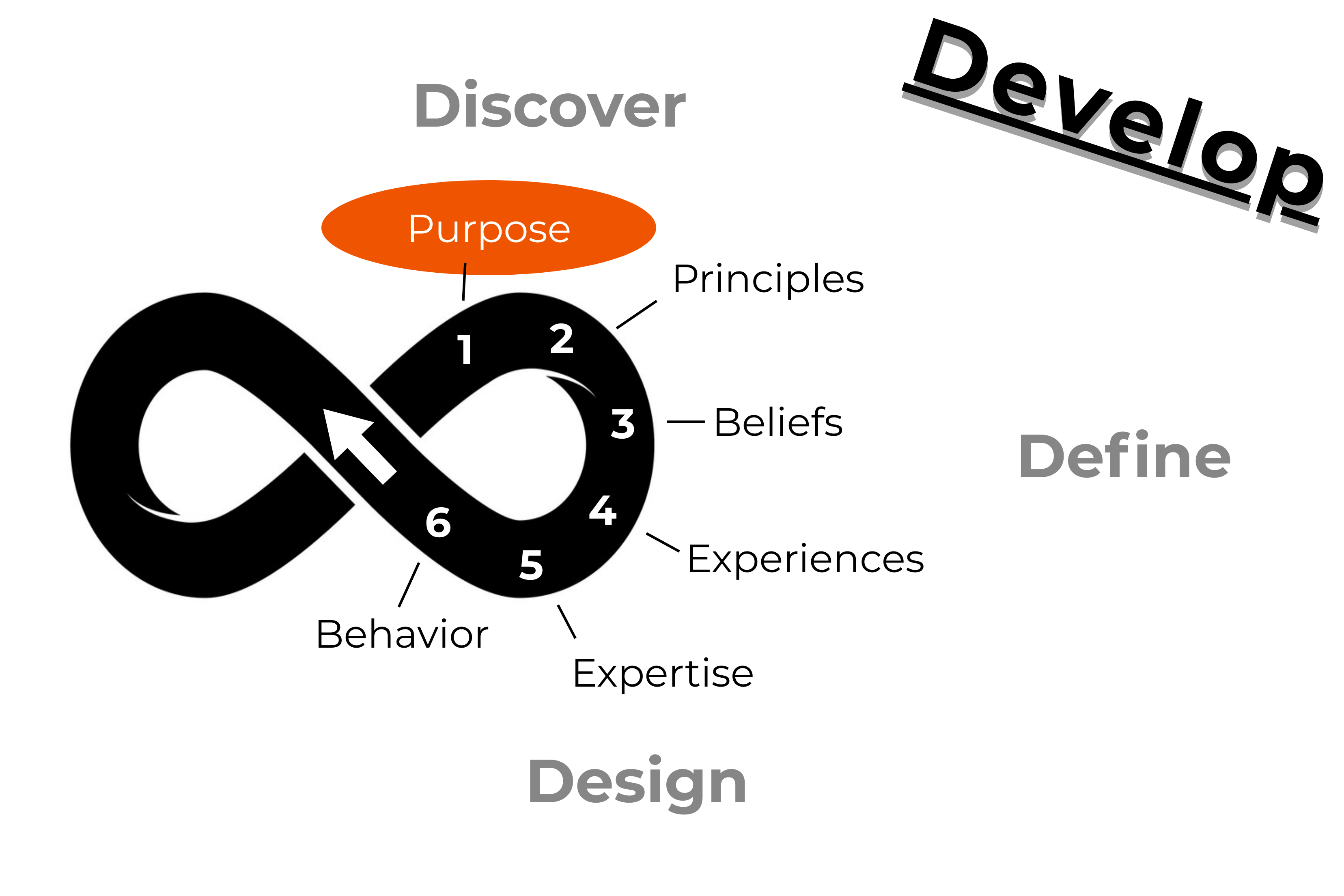

The best way for advisors to grasp this concept is by beginning to structure their businesses from a perspective of purpose. They must acknowledge a shared-purpose with their ideal audience to convey precisely why anyone should trust them with their wealth.

Once the cornerstone of a client-centered purpose is defined, a purpose-driven business model is the best way for any advisor to survive and thrive in this modern robo-world.

To avoid the heartache of the reverse-churn, start building your business on purpose.

Tap or click the image below to go to the purpose-driven branding modules of Tangible Alpha created by Grant Barger.

Will Sales Pros Survive?

Will Sales Pros Survive?

Maybe...Curated Content

This is content posted by someone else… I get to share it with you… here, on my website… because the internet is awesome.

by Phil Stubbs | @philstubbs14

‘I love your closing techniques’? or ‘your novelty socks are so amazing’? perhaps it’s: ‘I wish I could sit through more of your huge PowerPoint presentations, I just love the way you cram so much onto each slide’? No?

One of mine was ‘Oh sorry, I always thought you worked here’. It happened to me a number of times when I was ‘social selling’ in the late 90’s. On one occasion it was during an internal, onsite, party at Panmure Gordon, a British corporate and institutional stockbroker and investment bank. The same party where I had been dancing on a chair in full view of a group of board directors.

I remember an old sales manager telling me that a ‘great’ salesman would have a desk at the office of his top clients. Well, I didn’t need a desk, although that may have been safer than dancing on a chair! At the time, I was selling voice and data to financial institutions in the City of London and whilst Panmure had been a client I changed company but it had zero impact on my relationship. It was business as usual, I was just getting orders signed under a different company name.

I was pushing 90’s style ‘social selling’ to the max – birthday drinks, leaving do’s, departmental celebrations, lunches, even Christmas parties – I was invited to them all!

The same was happening at another big client of mine, ABN AMRO Bank, who at the time were one of a handful of triple ‘A’ rated banks. When I switched jobs, I gave my new employers a presentation on how I was going to win the ABN account for them. I then went and did what I said I would and at the next sales conference I presented how we won it. It made me look a star but I knew the truth – I actually ‘bigged up’ what I had done to seal the deal. In reality it was easy, I told ABN I was changing employer and they worked with me to shift services.

Through that style of ‘social selling’ I had gained the trust of so many people – and they bought from me, Phil Stubbs. Even if we screwed up, one time I recall a Friday night stood outside a pub in Holborn as I rang directors of the company I worked for and got them to fix an issue, it was never a deal breaker. ABN had a big move that weekend and none of the voice circuits had been pre-provisioned – we solved it and no drama.

I was giving advice on data networks, when to be honest, my knowledge was limited – but I built a strong virtual account team around me that I had faith in and I encouraged them to develop their own relationships within ABN.

I was trusted and liked, not just as a person but also for my knowledge, openness and dependability. That speaks so much louder than what’s on a business card.

Looking back and comparing to what I do now – the similarities are easy to see. All that work I did at being ‘social’ can now be done online. I connect with people, I get introduced to people as my network grows. I share content, thoughts and views and I get asked for my opinion. Just like the 90’s without the late nights!

Using social media to sell is a must for us today. The buyer – seller relationship has evolved with the buyer now having the power. Social gives you the chance to get into your customer and prospects ‘inner circle’.

If you aren’t immersing yourself into the ‘social world’ of your clients and prospects then you don’t have the bond and level of relationship needed to win.