Originally Published 12.27.2016

Building a digital footprint is critical in the era of collaboration.

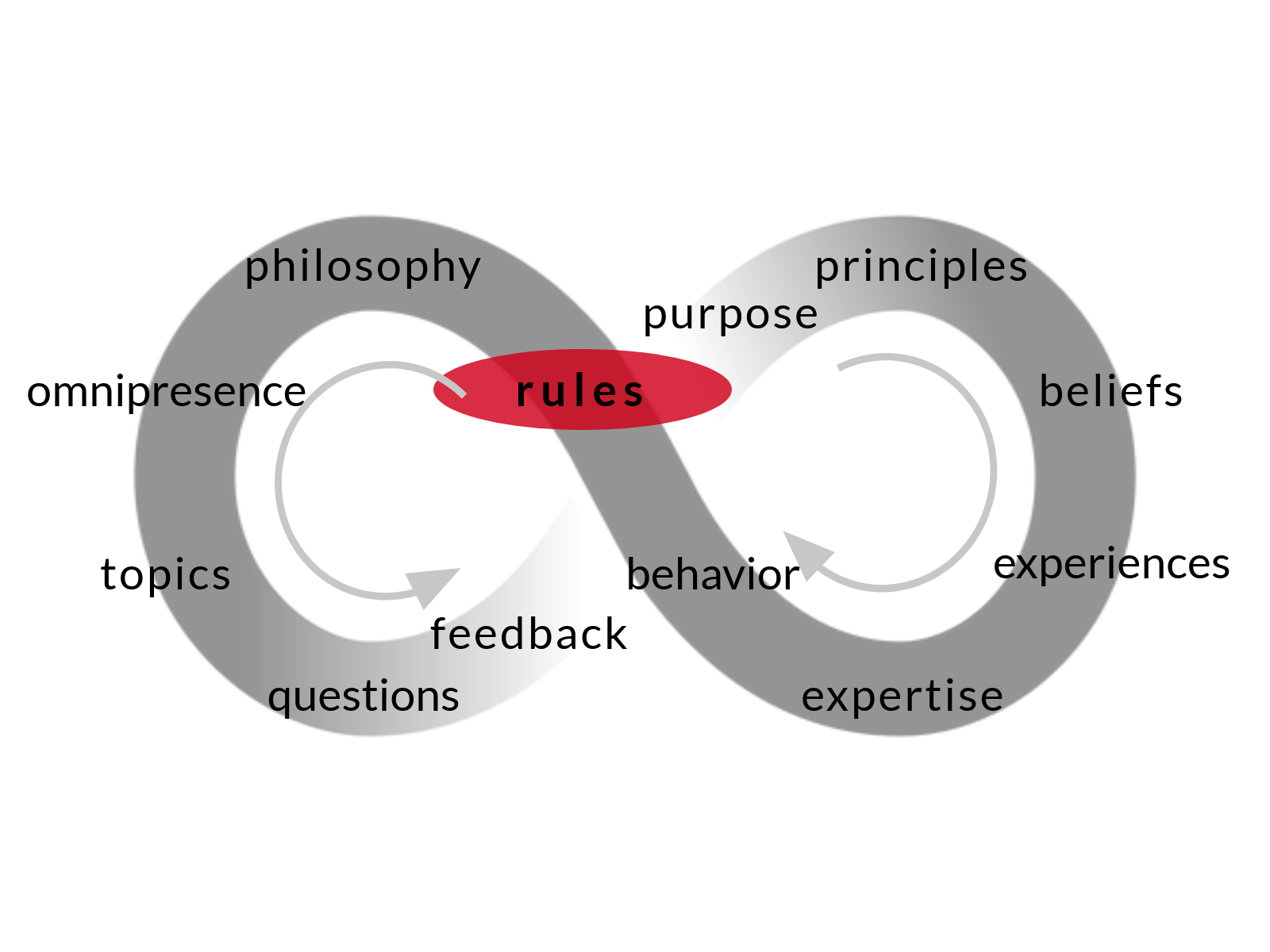

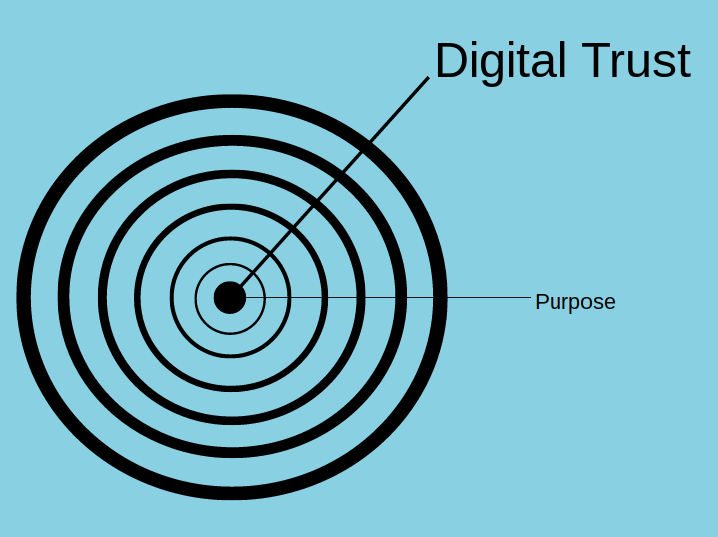

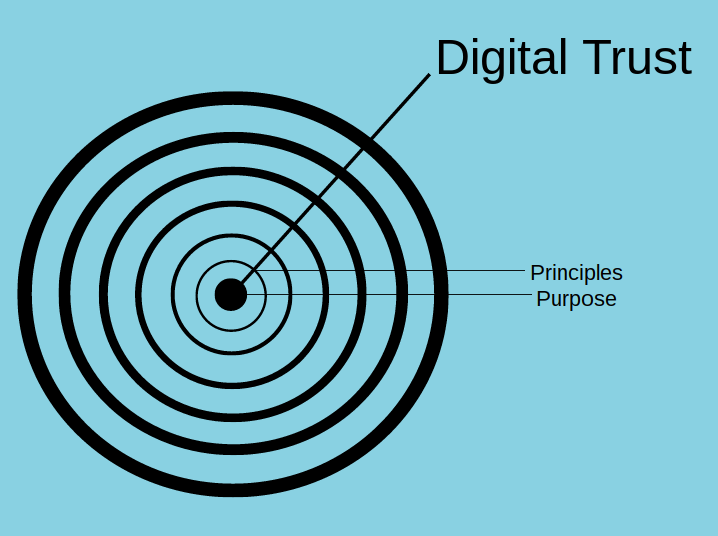

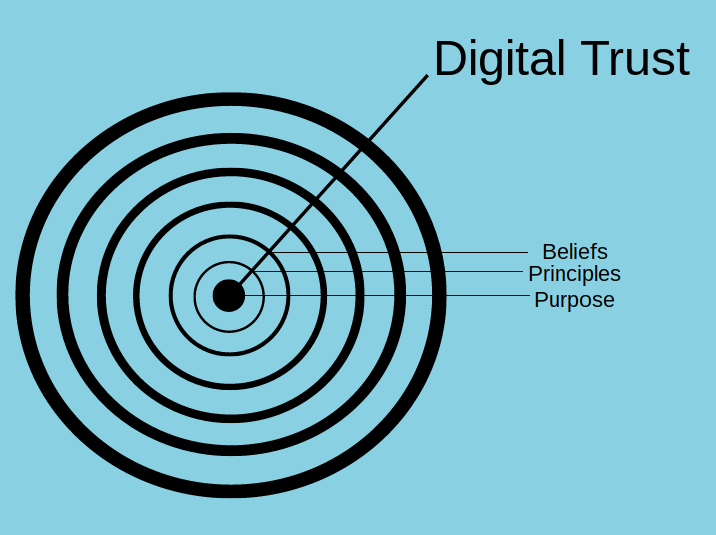

Everything that you publish, whether it be in the form of comments as in this article, or in the form of blog posts as seen here on this blog post… or a combination of the two, curated to bring meaning to my beliefs and opinions in a tangible fashion. This blog post is a working example of HOW to leverage your digital footprint by exuding your authentic value 24/7. Your ideal audience will find you so you had better be publishing with a purpose.

The Future for Advisors is about proving value. 24/7.

When Advisors allow any other entity besides themselves to define their authentic value they diminish the chances of survival and hinder their plans to thrive in the digital age. You mustn’t allow your plans to thrive in the digital age be undermined by anyone… much less yourself. Avoid self-sabotage by reading on…

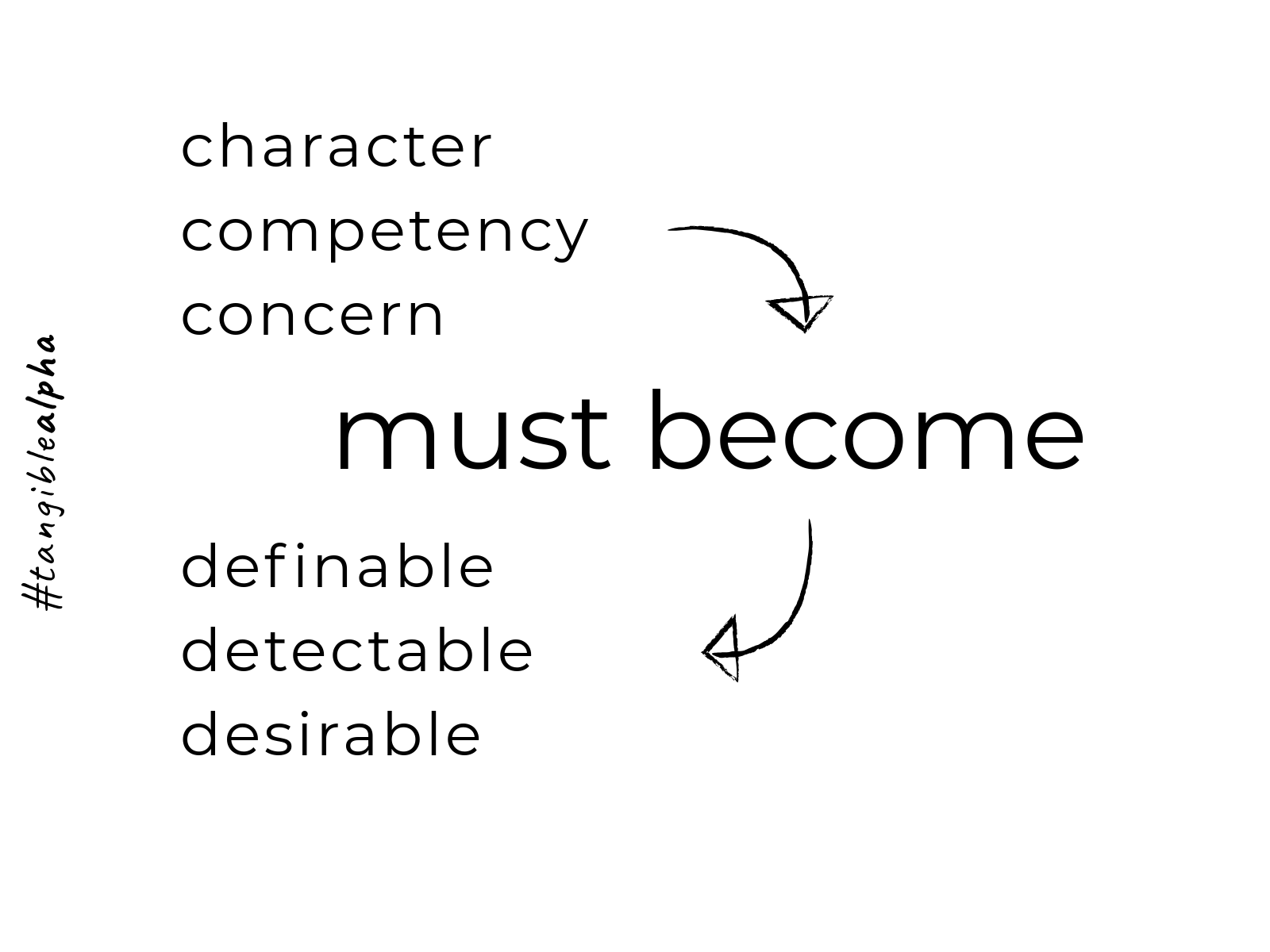

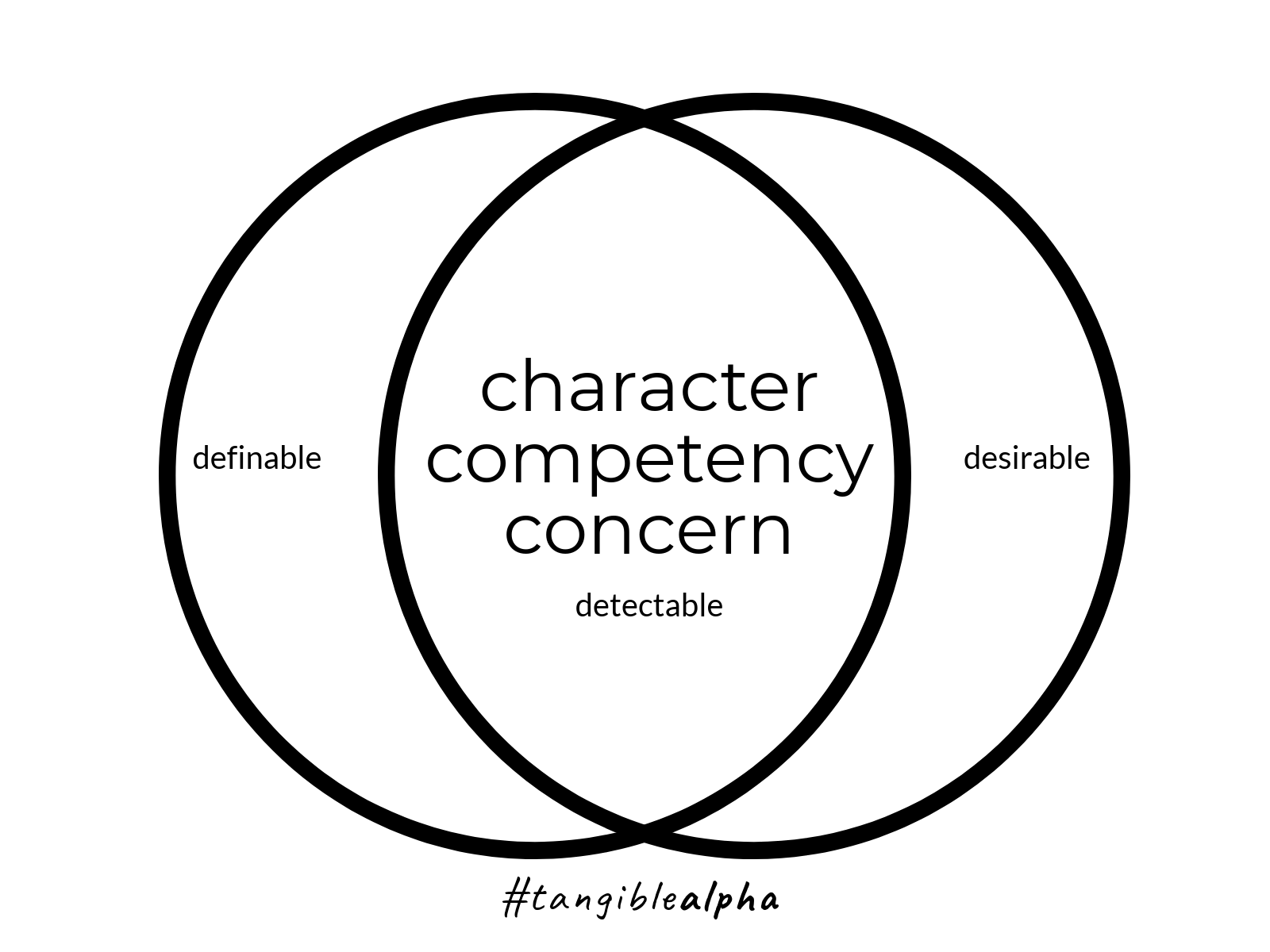

The advisor in the future must look beyond industry standards and minimum antiquated regulation to demonstrate in a tangible fashion why anyone should do business with them Pertaining specifically to this article, (Original Article from RIABiz.com) the advisor who relies on the industry to demonstrate his or her value through a benchmark is more likely to be replaced by the industry. Advisor autonomy goes beyond the realm of value props.. In order to thrive in the digital age of transparency advisors must own a “client-centered purpose.” Technology and transparency will weed out the ne’er do wells. It’s already happening without (and in spite of) regulation. Clients are becoming more empowered through transparency and technology , which is a beautiful thing. Advisors must also leverage the same transparency and technology to empower themselves.

You can’t police advisors into stewardship roles.

Any form of industry standard benchmark weakens the advisor… it does nothing to empower the perception of value, which is under the complete control of the advisor… more specifically, the advisor who owns a client-centered purpose. – Most advisors are good.-(Especially those advisors who subscribe to RIA Biz.) More industry drafted oversight is only adding to the digital noise. Advisors must become empowered through autonomy to thrive in the new collaborative world of 24/7 advice. My opinions about the facts in this article are backed by my conviction about HOW advisors can and should become empowered. Advisors must be afforded the opportunity to exude their authentic value through – ownership – of the perception of their value. Acquiescing to antiquated industry standards that limit the ability of the advisor to own the perception of his or her value, in my opinion, is a catastrophic mistake that can and should be avoided. Now, more than ever, investors are searching for a trusted source of wisdom. Advisors who are empowered through autonomy will be more likely to exude that wisdom than those advisors who agree to become suppressed by industry created benchmarks. ((BTW, this is a great article that shines a much needed light on the difference b/t portfolio alpha and advisor alpha. Keep ‘em coming.)) This article is an important component in moving the conversations away from the “what” that most RIABiz readers are already well aware of.

The comments after the article (found in the link above) are nearly 2 years old… and there they sit… Conveying my unique beliefs and opinions about this business.

If advisors rely on the industry to define their value will they be replaced?

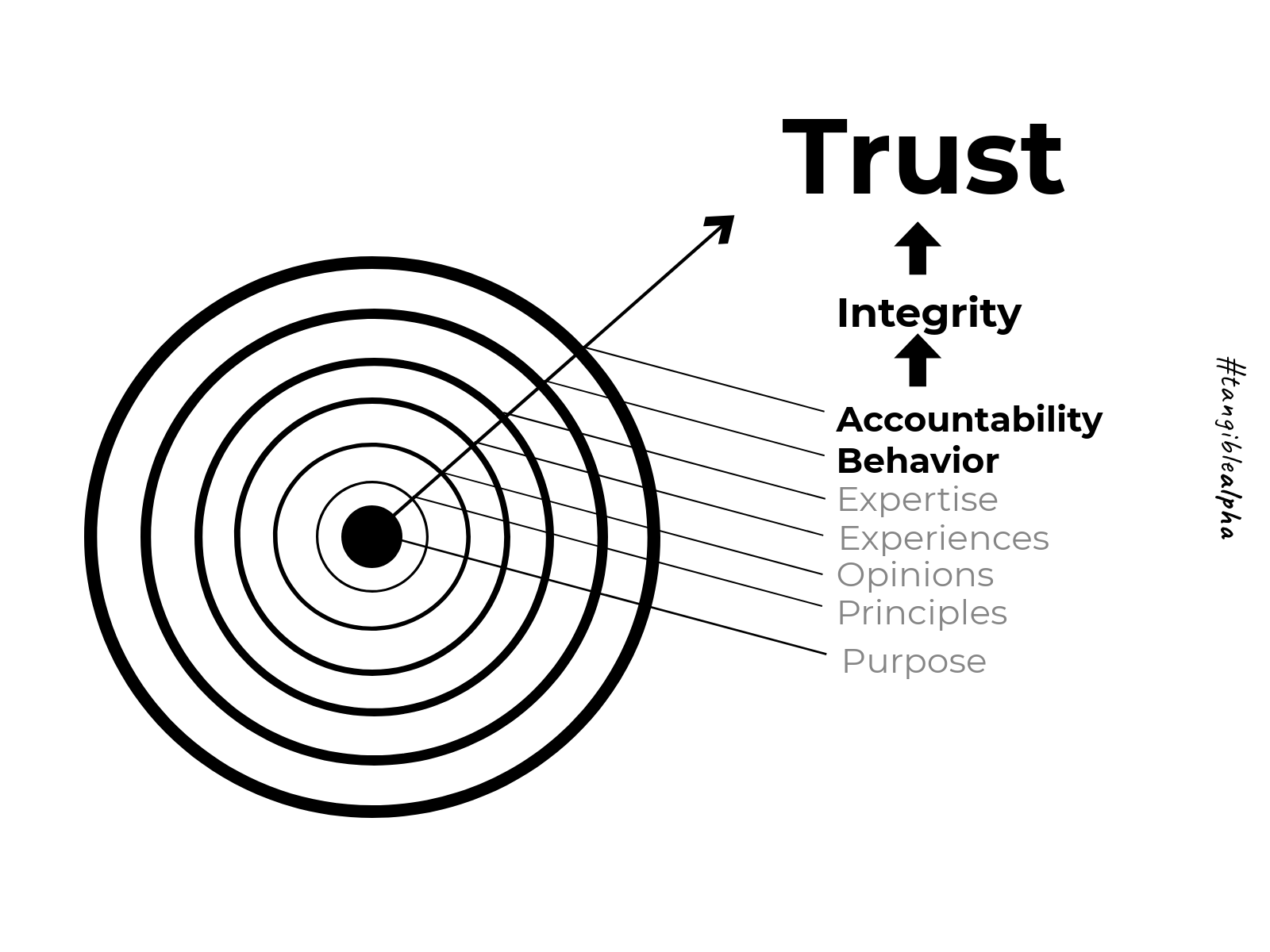

Who do you trust?

Who should your clients trust?

Better conversations start with questions that lead to better definitions which lead to better solutions that can truly make a difference in the lives of trusted clients…

By posing these questions I am reminding my current ideal clients of my authentic value while exuding my alpha to a new audience who is looking for a trusted source of wisdom to help them see hear and feel about their business in a different dimension. The perception of my value is entirely up to me. There has never been a greater opportunity for advisors to take advantage of technology. By ignoring this statement you risk extinction… discover as much as you can as soon as you can.

#TangibleAlpha

Always available when the time is right for you.