What Did We Learn?

Recap of Last Week’s Posts

-

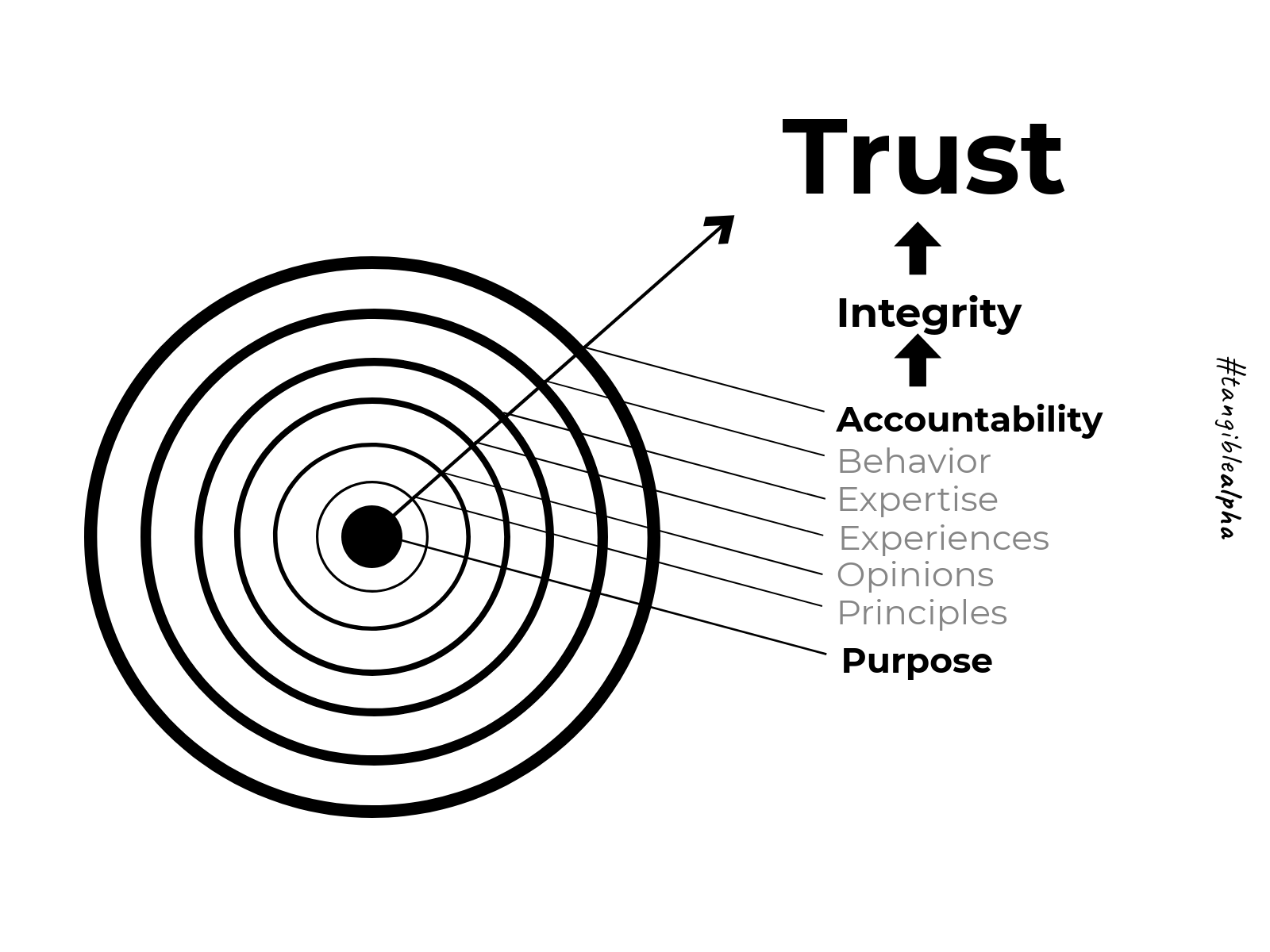

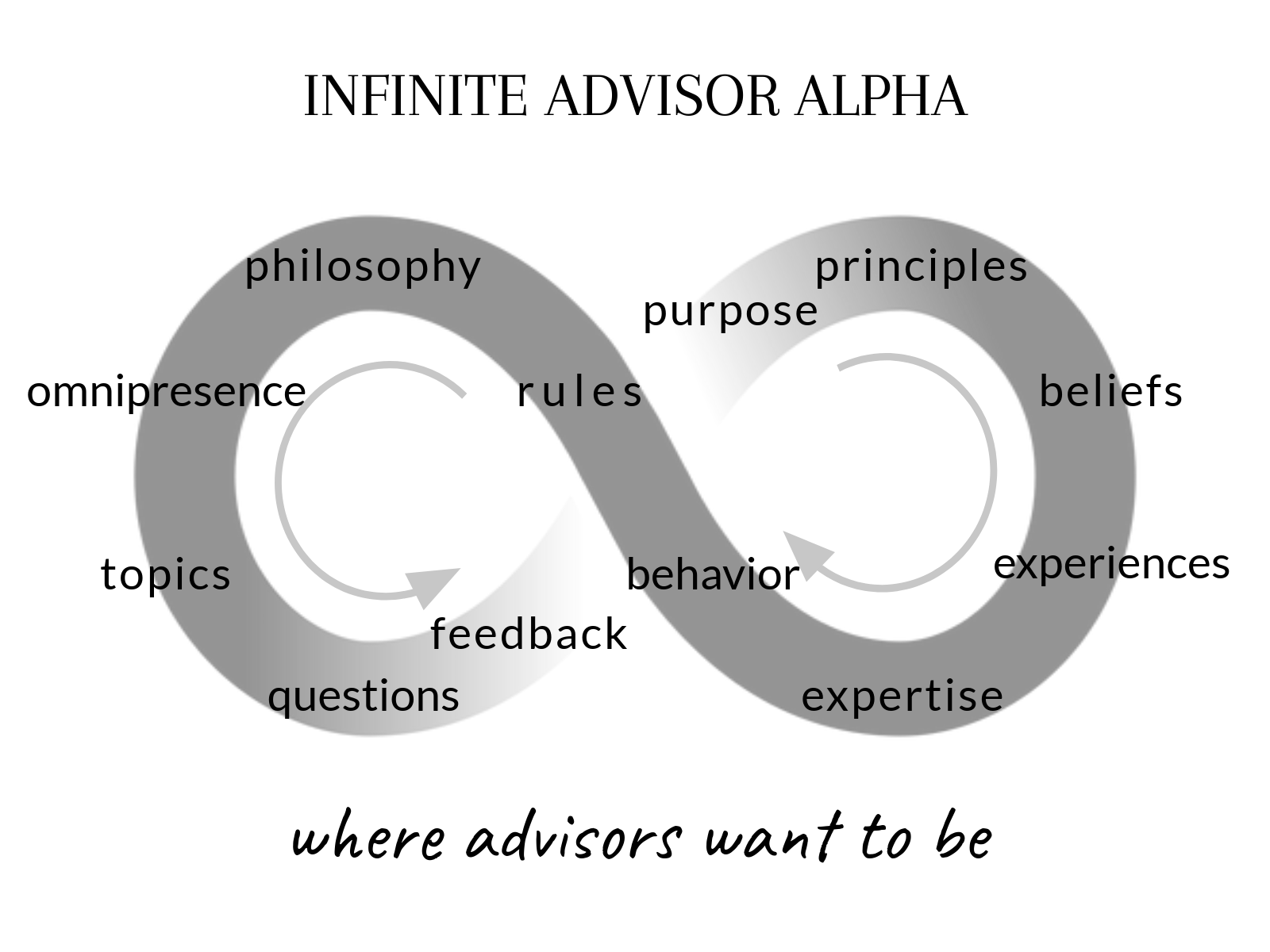

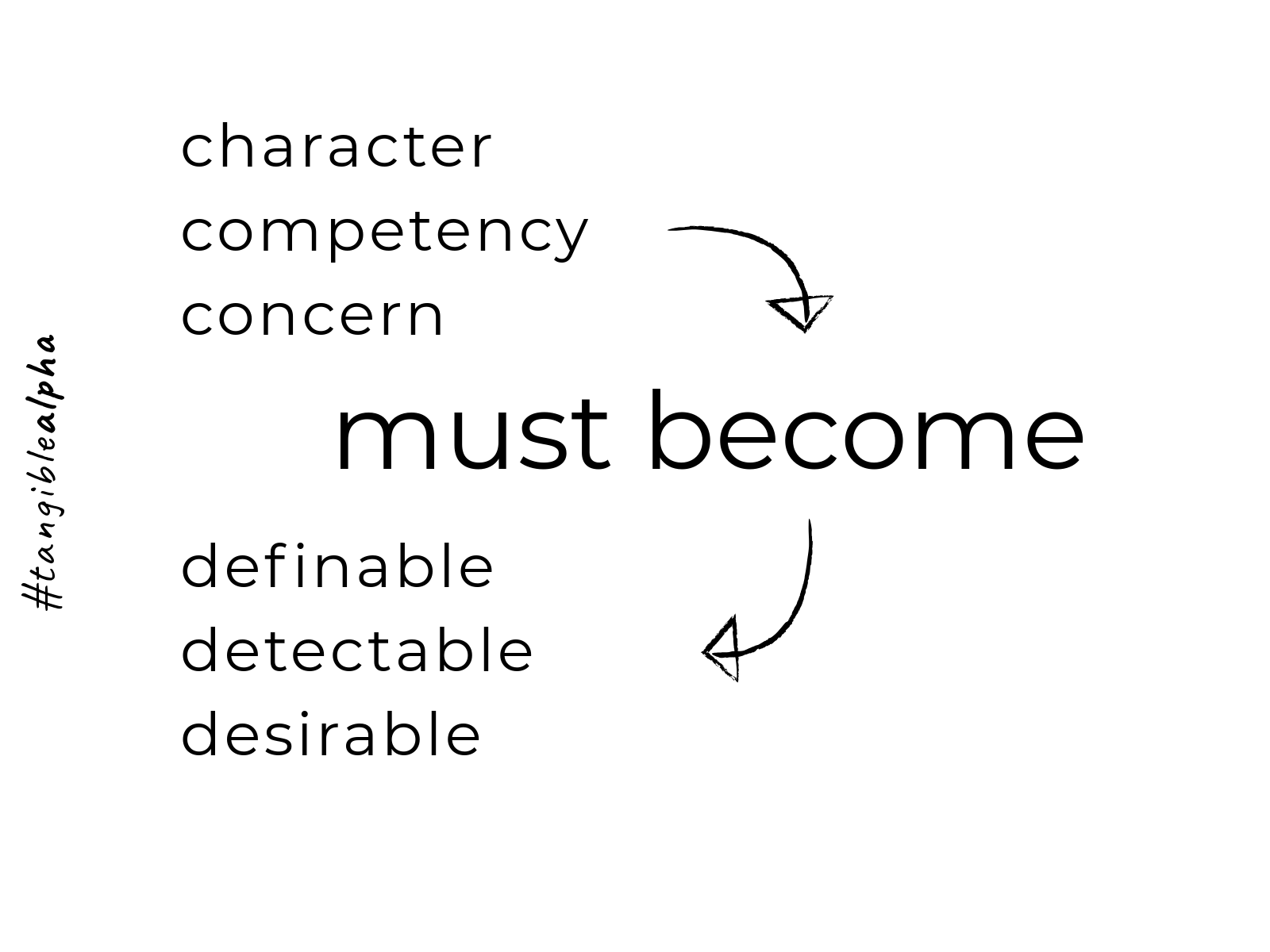

Your questions matter… To remain relevant as a trusted source of wisdom, your questions must lead to your unique value across multiple mediums 24/7.

-

Your advisor KPI must be updated to meet the parameters of transparency… The daily tasks required for success are not sales driven anymore.

-

Meaningful engagement must flow seamlessly… In person and digital communication must be focused on the behavior you can promise and not the elements of the business that you can’t.

-

Success is simple… The three pillars of success are like the three legs of a stool. Without all three, you will struggle to remain relevant in a robo world.

-

Fear is good… The natural enemy of success it would seem is fear… don’t let it be. Embrace fear to accomplish your dreams every day.

These posts have been brought to you in a simplified format that enables you to build your business on purpose in incremental steps. We are here for the sole purpose of helping advisors maximize their tangible value to remain relevant in the modern era of financial services. We accomplish this every day by making the complex simple. If you have already started to build your business on purpose with our program, these two minute audio files will help you gain more perspective on why and how you should continue to grow exponentially with these simplified incremental steps. If this is your first time… get going today because nobody can promise you a tomorrow.