Clarity of Purpose is Critical in a Digitally Transparent World

Advisor relevance in a robo world is indelibly tied to a client centered purpose.

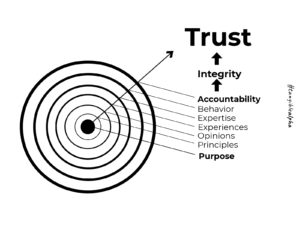

Your unique client centered purpose is the cornerstone of the foundation that empowers you to earn trust in a digitally transparent world.

Your purpose is more than a catchphrase or slogan.

Your purpose places you squarely on the side of your clients in every possible situation.

Your principles, values, beliefs, opinions, experiences, expertise, and promised behavior allow you to demonstrate in a tangible fashion exactly how relevant you are in the lives of your ideal audience.

The composition of this progression empowers you to ask for and expect reciprocal behavior from your clients.

In a robo world advisors must have trusted partners as clients this is the new age of financial services this is the era of collaboration.

Your foundation empowers you to do more than simply earn trust to gather net new clients it enables you to keep your current clients by engaging them in multiple platforms with content that is meaningful to both you and them.

Your foundation empowers you to focus on the value that you can control the most and it affords you the opportunity to promise that value in the form of your behavior.

Survival in the new digital age of financial services requires advisors to make their intangible value tangible.

This tangible, purpose-driven focus supports advisors by enabling them to publish content that leads to the solutions they control the most. This enables advisors to gather complete control over the perception of their value.

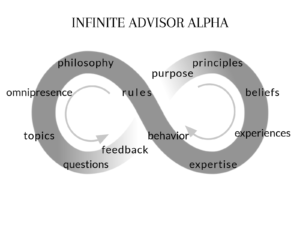

This progression of value design in which advisors are making their intangibles tangible also empowers advisers to ask better questions which leads to better critical feedback.

We call this progression of advisor value design infinite advisor alpha.

We call this progression of advisor value design infinite advisor alpha.

We make it available 24 hours a day on a 100% confidential platform that is completely free for financial advisors to take advantage of.

We are helping advisors around the world remain relevant in the new transparent digital ecosystem of financial services with models like this and micro–moments that develop real, tangible advisor value.

We exist to help advisors survive in a robo world.